Find the best commercial real estate deals, which often may be hidden

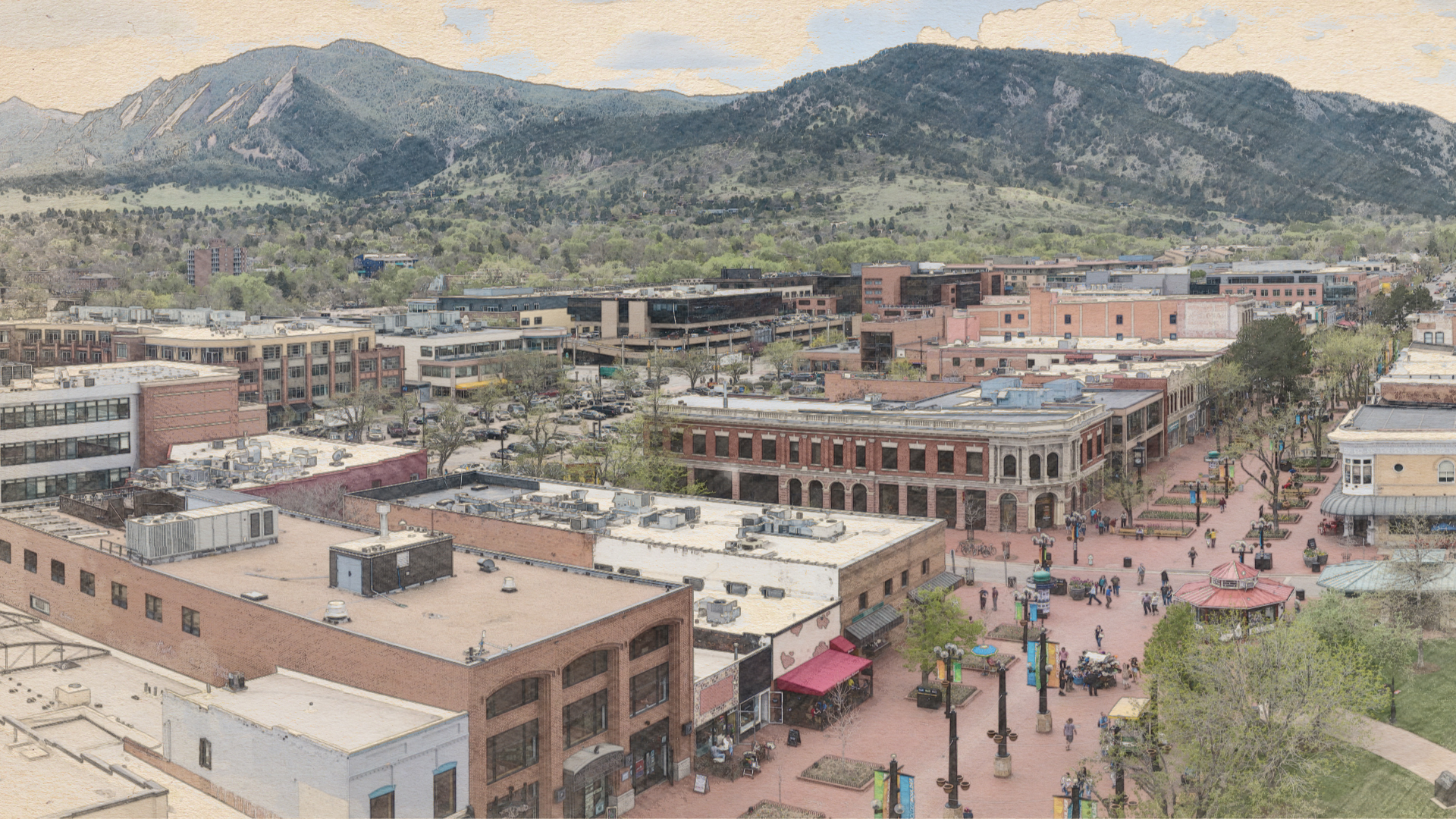

A client wished to expand and diversify his portfolio of direct commercial real estate investments. Through our existing network of real estate connections, we sourced an off-market opportunity in Boulder, Colorado, a market that has very strong fundamentals and promising future growth drivers. The ±153,000 square foot property was only 59% leased at the time and required patience and conviction to stabilize.

Within two years, the building reached 100% occupancy and was appraised for more than 77% above the purchase price. We secured 10-year interest-only financing at an attractive rate, and the property is well positioned to generate above-market returns for the foreseeable future.

DISCLOSURE

The case studies described herein are intended to illustrate Manchester Capital Management’s approach to developing personalized solutions to our clients’ unique investment management problems. These examples should not be considered to be recommendations for any particular client and are not intended to demonstrate a pattern of success or guarantee positive performance. Because our recommendations are individually tailored based on each client’s individual needs, there is no guarantee that our approach to managing any client’s account will share some or all of the characteristics as the situations depicted.

Nothing contained on this website constitutes investment, legal, tax or other advice and is not to be relied on in making an investment or other decision.

START YOUR EXPERIENCE TODAY

Contact Us