Timing the market, even with a slower-moving asset class like privately-held real estate, is tricky business. It is easy to look back and regret not buying at this time or selling at that time, but pinpointing market shifts while they are happening is easier said than done. Real estate can be particularly tricky since it most frequently involves large, illiquid investments with significant transactional friction on the purchase and sale. Recent developments, specifically the collision of declining supplies and shifting demand in an environment of changing interest rates, create an interesting opportunity.

According to Morgan Stanley and Real Capital Analytics, U.S. commercial property prices stopped declining in June 2024, increasing 0.6% after a year and a half of valuation losses.1 Per the chart below, the last time real estate prices fell this much for this long was during the Great Financial Crisis (GFC). Prices bottomed at the beginning of 2010 and then increased through their recent peak in 2022. We may be witnessing an inflection point that rarely occurs with commercial real estate and that provides an attractive entry point for long-term investors.

NATIONAL ALL-PROPERTY INDEX

Before the previous bull market in 2010, the “typical” real estate cycle lasted seven years, perplexing many market participants when this convention failed. Considering this historical disruption to the cycle, investors may find greater insight in following the Fed’s monetary policy and management of interest rates. During the GFC, the federal funds rate went from 4.5% at the end of 2007 to 0-0.25% by the end of 2008.2 Similarly, but less dramatically, markets are now projecting three rate cuts in 2024, taking the federal funds rate to 4.5-4.75% by the end of the year, followed by a further four rate cuts in 2025, taking the rate down to 3.5-3.75%.3 ). If the federal funds rate levels off higher than the zero-interest rate policy that existed from 2008 to 2022, commercial real estate valuations should rise steadily, albeit more slowly.

FEDERAL FUNDS EFFECTIVE RATE

In addition to the prevailing cost of debt, different property types are feeling the effects of this market correction in various ways. Downtown offices, for example, took a huge hit, with values down 45% over the last five years.4 This has been the result of an oversupply of new buildings and the seismic shift that has occurred due to remote and hybrid work. Average multifamily property values have also dropped about 20% since their recent peak in 2022. While this sector’s long-term use case is more convincing, apartments also had historically high construction levels in recent years and experienced a steeper runup in values.

NATIONAL INDEX BY PROPERTY TYPE

On the supply side, the construction pipeline is slowing across the board, particularly for office, multifamily, and industrial properties. New office deliveries in the U.S. are projected to be the lowest since 2014, at 55 to 60 million square feet, and future years look even tighter.5 By 2026 new deliveries are estimated to be only 20 million square feet. New apartments delivered this year are projected to drop by 4% from the record high seen in 2023 and by nearly 40% next year. Temporarily bucking this trend, industrial deliveries will remain elevated through the end of this year or early next year before hitting 10-year lows by late 2025.

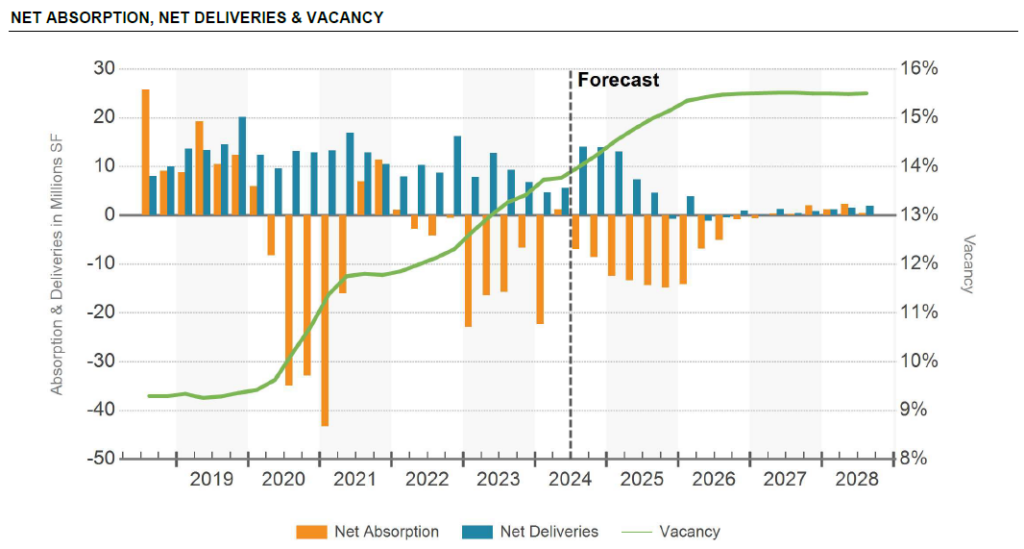

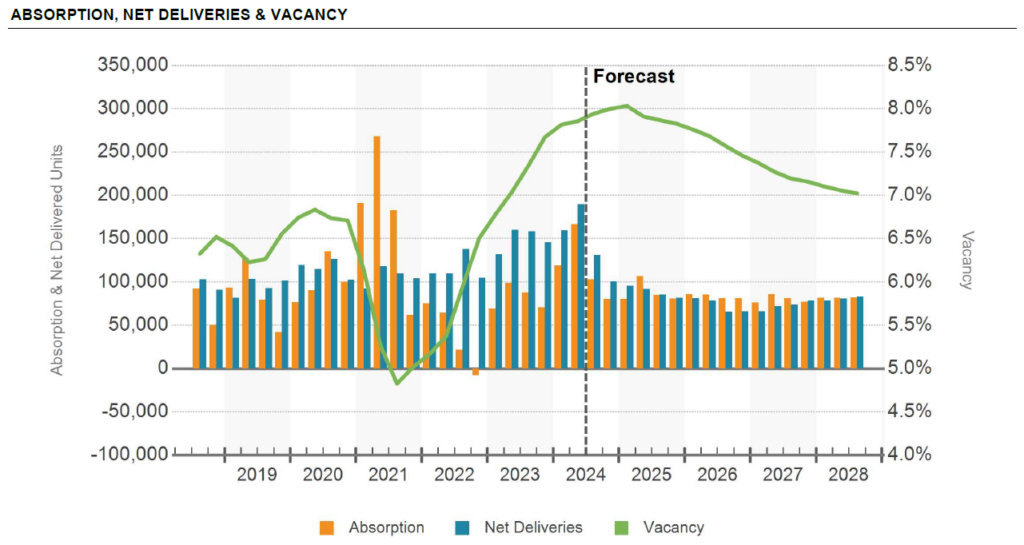

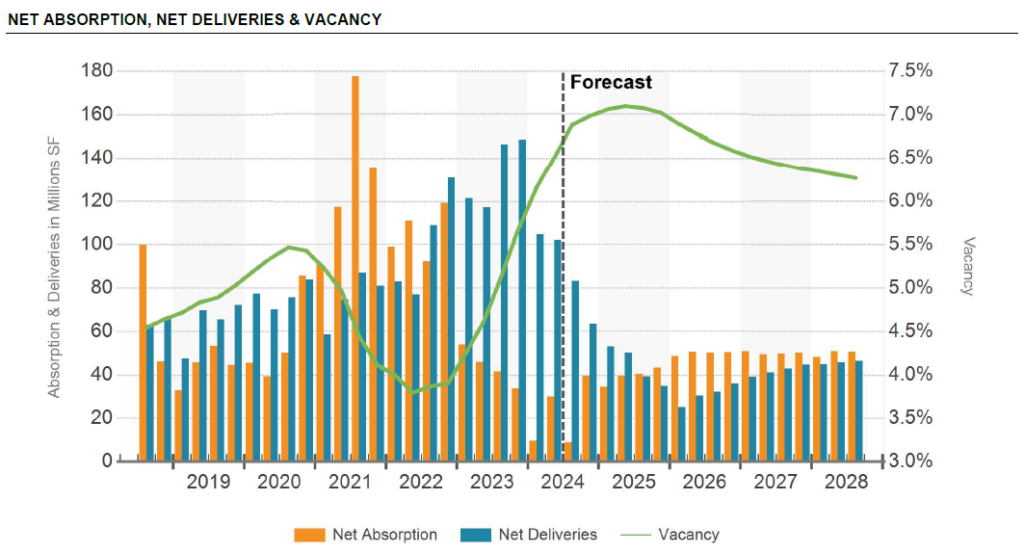

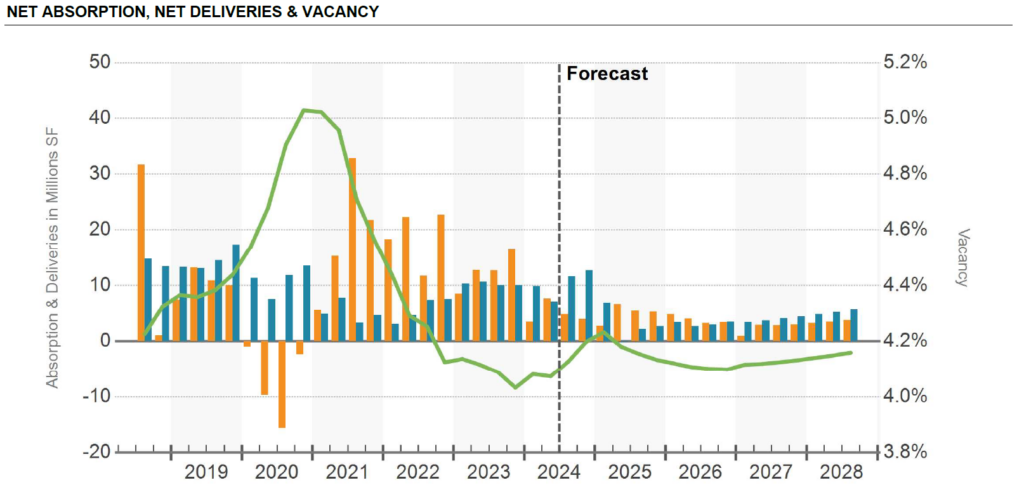

The graphs below show three key statistics—absorption, net deliveries, and vacancy—for each of the major property types—office space, apartments, industrial, and retail. Each has its own nuances, with apartments and industrial being the most similar. The office chart looks the most concerning but current price discounts reflect the sector’s perceived risk.

US OFFICE STATS

US APARTMENT STATS

US INDUSTRIAL STATS

US RETAIL STATS

So, where does that leave us? If you are looking to invest in commercial real estate, with rate cuts quickly approaching and supply pipelines falling off in the next 12-18 months, now might be a great window to acquire high-quality properties in markets with strong long-term demand. Don’t wait for the perfect moment—it rarely comes. Instead, focus on the fundamentals, stay informed, and reach out to your wealth manager if you would like to discuss the best approach for your family.

References

Additional Sources

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements. As with any investment, there is the risk of loss.

For ultra high-net-worth (“UHNW”) families, integrating health into wealth planning isn’t optional — it’s essential for legacy,...

Can you invest in a way which is environmentally and socially conscientious while still producing solid returns? ESG—shorthand for Environmental,...

At Manchester Capital Management, we have always believed that real estate can be an excellent long-term store of value —in today’s market,...