Investing is more than a financial exercise. The most seasoned investor feels a twinge of fear and concern when volatile markets react negatively to sudden economic shocks. Those cool-headed decisions based on a sound investment policy offer little comfort when there are sudden declines. Why do we become prisoners of our emotions subject to making the wrong choices at the wrong time?

There are evolutionary reasons for our behavior. The science of “Behavioral Finance” has shown that we are the product of inherent emotional biases in our core genetic code. We fear losses significantly more than we value gains. A loss aversion bias likely developed during human evolution as a survival mechanism, deeply rooted in the way our ancestors needed to make decisions under conditions of uncertainty and scarcity.

Early humans faced an environment where resources such as food, shelter, and water were not only scarce but also crucial for survival. The consequences of losing these resources were often far more severe than the benefits of getting additional resources. If, as investors today, we were ruled by our emotions, we might choose to remain committed to a portfolio position despite its decline because the emotional pain associated with suffering a loss is often stronger than the rational evaluation of the future merits.

Investors share a similar confirmation bias that dates from our early evolution regarding making decisions efficiently and quickly in environments that were often uncertain and potentially dangerous. Early humans lived in small groups where social cohesion was important to survival. Sticking to strategies and beliefs that had previously worked enhanced survival. Agreeing with your tribe was more important to your survival than making an independent decision.

Modern investors sometimes seek out information that echoes their own beliefs, effectively putting blinders on to any contrary evidence. They fall prey to an overconfidence bias, especially if they have early success in a timely decision. They want to read news that agrees with their views and listen to pundits that ignore contradictory evidence. They fail to recognize that not all news is relevant information. Indeed, much news is more distracting than helpful. A tell-tale sign of overconfidence bias is excessive frequency checking news updates.

There are a host of other behavioral biases that provide rationales for our behavior but are often detrimental to our financial success. We must acknowledge that the price of successful investing is to be willing to accept market volatility. The risk of any plan should be calculated by the time frame for that plan. A long-term plan designed to produce returns greater than inflation requires accepting the risk of periodic downturns.

Knowledge and understanding are your allies in these efforts, helping you recognize your inherent shortcomings and giving you the perspective to stick with well-reasoned plans. When market pundits and sensational news stories threaten to distract you, remember to filter the noise, focusing on what truly aligns with your investment strategy and goals.

In the spirit of Charlie Munger, let’s not take ourselves too seriously. Investing requires discipline, blending numbers with emotions, and strategies with experience. We are, after all, human and prone to our own vulnerabilities. The key is to proceed with a dash of humility, and the wisdom to recognize that a rational process will lead us to the destination we seek.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements. As with any investment, there is the risk of loss.

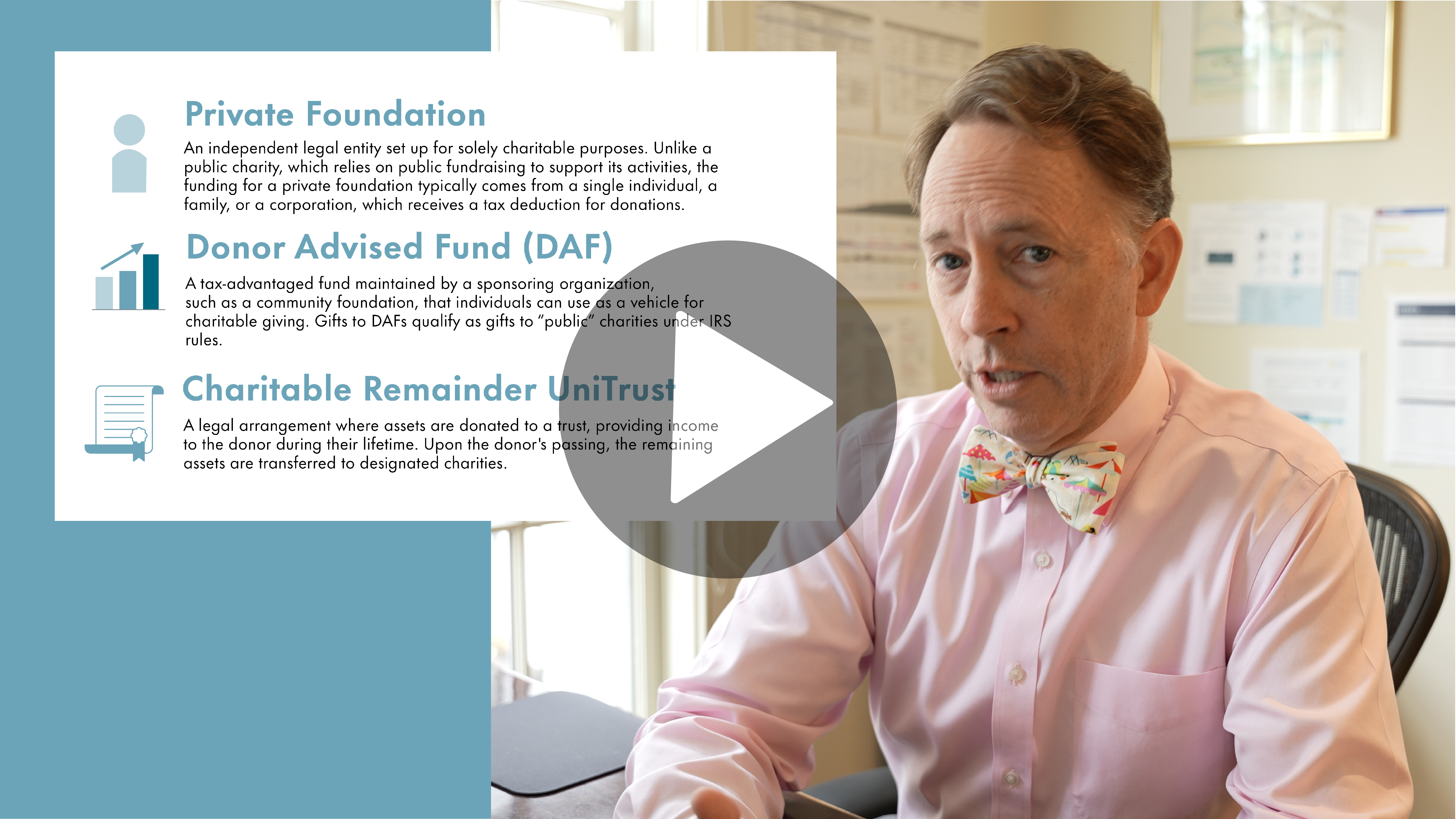

Manchester Capital Management's Senior Wealth Managers, Brian Vogel and Morgan Roberts discuss how they help wealthy families make informed decisions...

Intuitively, it seems that Presidential elections must affect markets. After all, markets prefer stability and predictability, and Presidential...

The Federal Reserve finished their latest Federal Open Market Committee (FOMC) meeting on June 12th and as expected, held the benchmark interest rate...