Can you invest in a way which is environmentally and socially conscientious while still producing solid returns? ESG—shorthand for Environmental, Social, and Governance—was a modern response to that challenge. A framework, not a fixed destination, ESG aimed to bring a broader perspective to investment analysis, incorporating long-term systemic risks and opportunities alongside traditional financial metrics.

But over the past few years, ESG moved from innovative insight to political football. Once one of the financial industry’s boldest growth areas, it has now become a flashpoint of both regulatory scrutiny and ideological debate. The story of ESG is not one of failure, but of evolution—a maturing concept being recalibrated for a more complex, more informed investment landscape.

This article explores ESG’s path: how it rose so rapidly, why it faced backlash, and where thoughtful investors go from here. Most importantly, it outlines how ESG principles can still serve as powerful tools within sophisticated wealth strategies—far beyond the headlines.

Modern ESG owes its roots to “Socially Responsible Investing” (SRI), a values-based approach largely focused on screening out companies involved in controversial sectors such as tobacco, weapons, or fossil fuels. ESG, by contrast, evolved into a broader analytical lens—one that evaluates how environmental, social, and governance risks and opportunities might impact long-term financial outcomes.

Today, ESG frameworks commonly assess:

For institutional investors, ESG became less about moral alignment and more about performance. Global asset managers and pension funds began using it to identify underappreciated risks—such as regulatory change or climate liability—and uncover structural tailwinds in areas like clean energy or inclusive economic development.

ESG didn’t emerge from a Silicon Valley garage or a university lab. It evolved from decades of investors grappling with a fundamental question: How do we make money while not destroying the world our grandchildren will inherit?

The movement gained serious momentum in the 2010s, turbocharged by three converging forces:

The Climate Wake-Up Call: Hurricane Sandy. The Australian bushfires. Texas freezing over. Suddenly, “climate risk” wasn’t some abstract concept—it was hitting balance sheets.

The Data Revolution: For the first time, investors could actually measure a company’s carbon footprint, diversity metrics, and governance practices with something approaching scientific rigor.

The Millennial Money Wave: A generation raised on recycling and social media was inheriting wealth—and they wanted their investments to reflect their values.

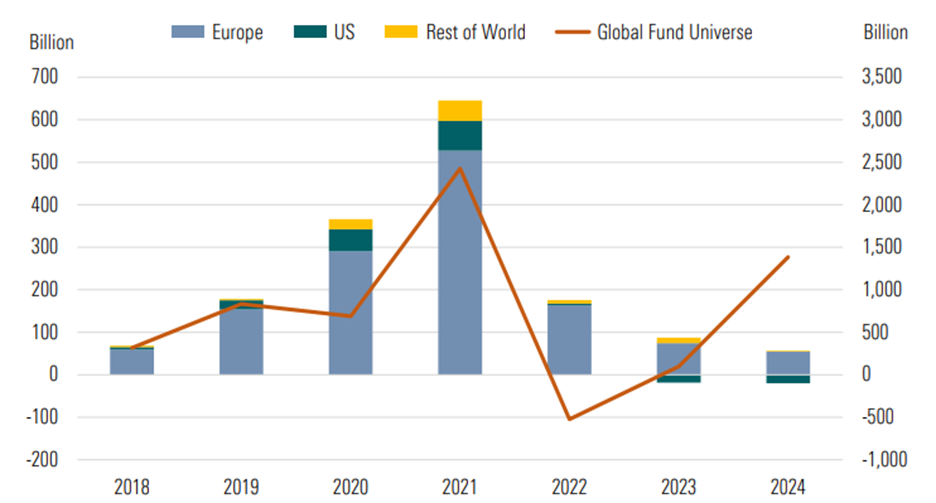

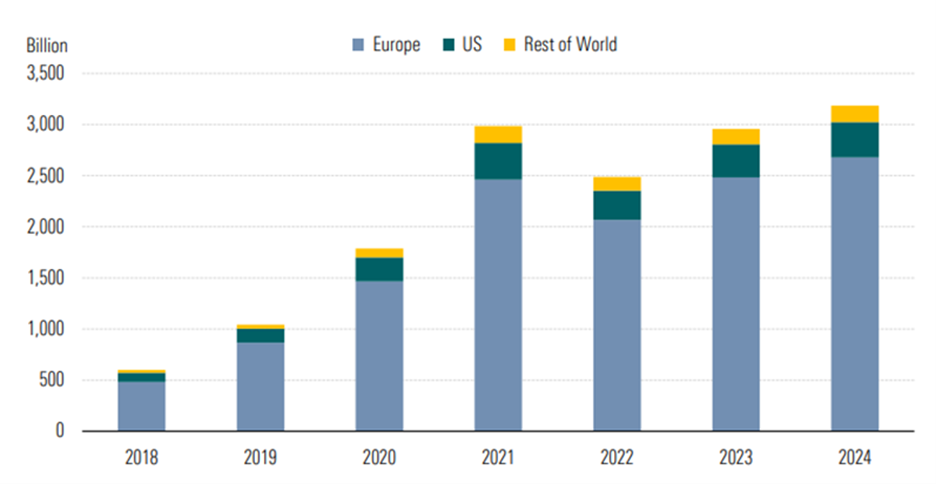

The COVID-19 pandemic amplified this trend. As health, equity, and systemic fragility became daily headlines, fund flows into ESG strategies surged globally. Large asset managers launched and marketed ESG products aggressively. ESG ratings became a common feature in investment fact sheets.

The backlash didn’t happen overnight. It was a conflation of political opportunism, market timing, and legitimate concerns about overpromising.

The Texas Two-Step: When Texas Comptroller Glenn Hegar published a list of financial firms allegedly “boycotting” fossil fuels, it wasn’t just political theater—it was a $19 billion warning shot. Suddenly, ESG wasn’t just about returns; it was about whether you could do business in America’s second-largest state.

The Performance Problem: 2023 was brutal for many ESG funds. Rising interest rates hammered growth stocks (including many clean-tech darlings), while oil and gas companies—often excluded from ESG portfolios—soared. Critics pounced: “See? ESG is just virtue signaling that costs you money.”

The Greenwashing Epidemic: As regulators dug deeper, they found funds labeled “sustainable” that owned tobacco companies, weapons manufacturers, and fossil fuel giants. The SEC started wielding the regulatory equivalent of a truth serum.

While ESG underperformance was a function of sector and style exposure—not the framework itself—it fueled criticism. Investors began asking whether ESG was truly additive, or just another “factor bet” with unpredictable payoff.

Here’s what the headlines missed: While politicians were busy turning ESG into a culture war battlefield, something fascinating was happening in the actual markets.

The Label Disappeared, But the Practice Evolved: Smart investors stopped using the toxic three-letter acronym but kept analyzing climate risks, supply chain vulnerabilities, and corporate governance. They just called it “risk management.”

The Numbers Don’t Lie: Despite political headwinds, private equity investment in clean energy is projected to grow from $463 billion in 2024 to over $560 billion by 2030, according to Pitchbook News. Electric vehicle adoption continues its relentless march upward. Solar and wind are now the cheapest forms of electricity in most markets.

The Institutional Investors Never Left: While retail investors got spooked by the political noise, pension funds, sovereign wealth funds, and family offices quietly continued integrating ESG factors. They just stopped talking about it at cocktail parties.

ESG isn’t dead – it’s simply morphed into something more sophisticated and less politically charged. Investors today aren’t abandoning ESG—they’re understanding all the risks and opportunities – including the ones traditional financial models miss.

The smartest investors aren’t asking whether ESG is “dead” or “alive” . They’re asking: “How can we use all available information – including environmental, social, and governance data – to make better investment decisions?”

That’s not political. That’s not ideological. That’s just smart.

The future belongs to investors who can see beyond the headlines, integrate all relevant risks and opportunities and stay focused on what matters: building wealth that can last for generations in a rapidly changing world. Assessing material financial risks – whether we refer them by the ESG acronym or not – is part and parcel of that.

We believe that investing with intelligence and integrity means responding to the world as it is—and as it’s becoming. ESG is not a passing trend, nor a binary choice; it is an evolving set of tools for understanding the opportunities and risks shaping long-term family legacies.

We are committed to cutting through the noise and working to deliver clear, actionable advice that reflects each client family’s unique goals, beliefs, and investment time horizons. For some, that means weaving sustainability into every investment decision. For others, it’s about prudent, measured adoption of ESG insights where they can potentially add material financial value. In every case, our approach is pragmatic, disciplined, and rooted in rigorous analysis—not ideology.

As the conversation around ESG shifts and matures, so too do the strategies required to protect and grow wealth across generations. We focus on helping families stay ahead of enduring trends—like resource scarcity, technological change, and the global drive toward decarbonization—by crafting portfolios we feel are built for both resilience and opportunity. Through philanthropy, legacy planning, and customized investment policies, we believe your capital can advance the causes you care about and the future you envision, for your family and for generations to come.

Disclosures

As with any investment, there is a risk of loss. Client specific asset allocations are based upon the investment objectives and other information conveyed by the client to Manchester Capital. Specific strategies are chosen based on the client’s specific investment objectives. Before applying a particular asset allocation to your individual situation you should consider whether it is suitable for your particular circumstances. In considering an investment in hedge funds or other private investments, you should be aware that alternative investments are highly illiquid, not subject to the same regulatory requirements or oversight as mutual funds, are more suitable for sophisticated investors, and may impose significant fees. The material contained herein is for informational purposes only and does not purport to recommend any particular investment strategy.

It is once again that most joyous time of year where we step back to take time with our families, reflect on the accomplishments of the year that has...

For ultra high-net-worth (“UHNW”) families, integrating health into wealth planning isn’t optional — it’s essential for legacy,...

Can you invest in a way which is environmentally and socially conscientious while still producing solid returns? ESG—shorthand for Environmental,...