The unprecedented fiscal and monetary stimulus enacted during the last year, has sparked debate about the potential for rampant inflation in the future. As a result, investors are contemplating increased allocations to “harder” assets, such as commodities, real estate, and Bitcoin (à la Elon Musk). Commercial real estate, in particular, can be an effective inflation hedge.

The Fed’s balance sheet increased to more than $7 trillion last year and is projected to reach $10 trillion by the end of 2021 (Bloomberg). The Fed has vowed to continue its bond purchases and keep its key interest rate between 0% and 0.25% until the economy reaches full employment and inflation passes 2.0%. The breakeven inflation rate, a market-based measure of expected inflation, has risen from 0.5% in March of 2020 to 2.2% at the beginning of February 2021.

Economists and market prognosticators have their own predictions for future inflation levels, but if history is a guide, inflation levels will likely at least match those of the last 20 years. From 2000 to 2020, the personal consumption expenditure (CPE) index increased by 40%. This equates to average inflation of about 1.8% per year. During that same period, the housing portion of the CPE increased by 63.0%, or 3.1% per year (FRED Economic Data).

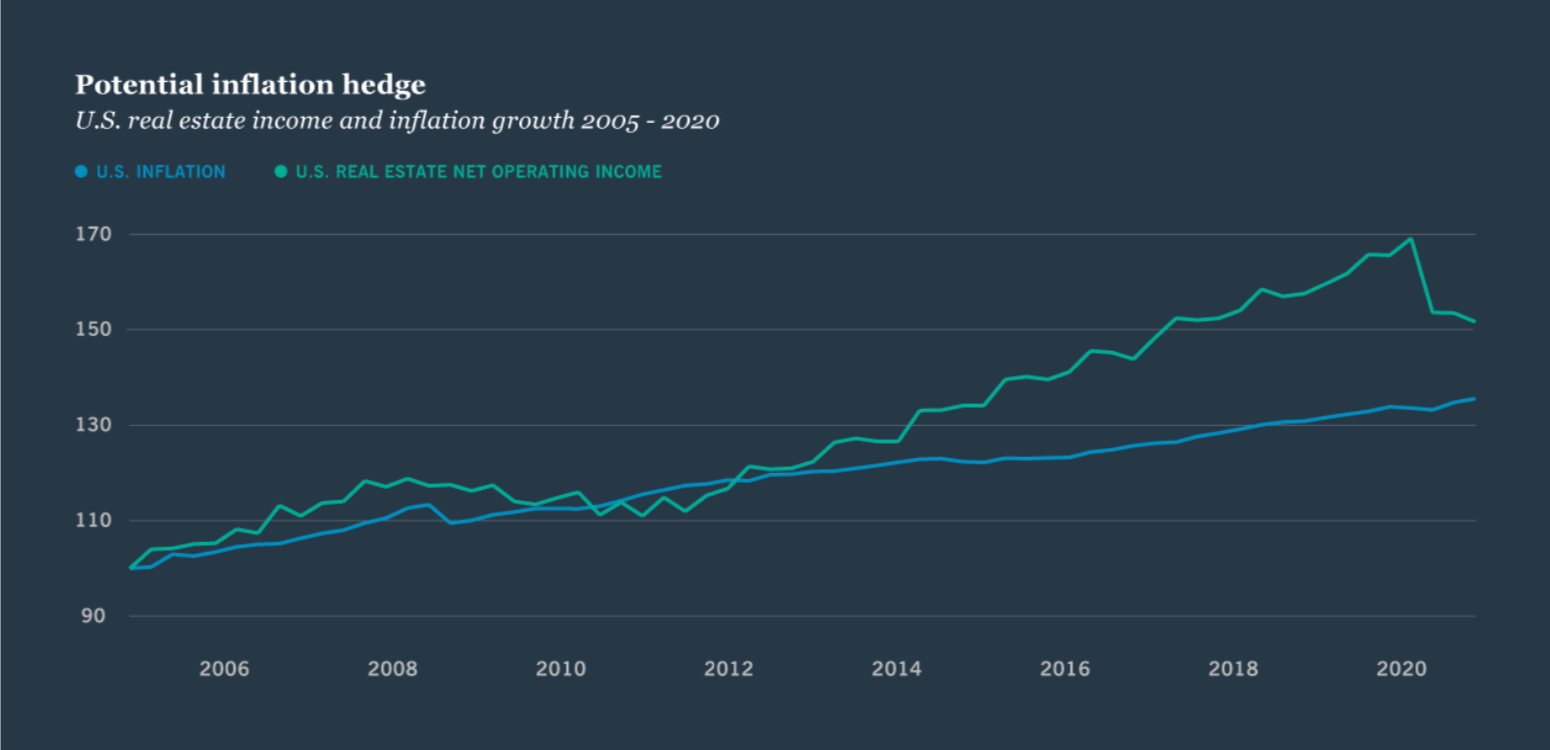

Conventional wisdom is that all investment real estate is an inflation hedge because it has limited supply, long-term fixed rate debt, and increasing cashflows due to the ability to raise rents over time. The chart below shows a comparison between the net operating income for core U.S. properties and U.S. inflation over a 15-year period beginning in 2004. In most years, increases in real estate cashflows met or exceeded inflation.

While investment real estate is generally an effective hedge against inflation, there are some caveats. First, increasing cashflow is predicated on rents increasing at least as quickly as operating expenses, which is not always the case. For instance, real estate tax reassessments can outpace rent increases, diminishing net operating income. This may be even more relevant going forward as many cities and states will target real estate taxes to offset budget shortfalls. Asset classes with shorter-term leases, such as apartments, storage, or industrial/flex, typically adjust rents more frequently than assets with longer term leases, such as industrial, retail, and office buildings.

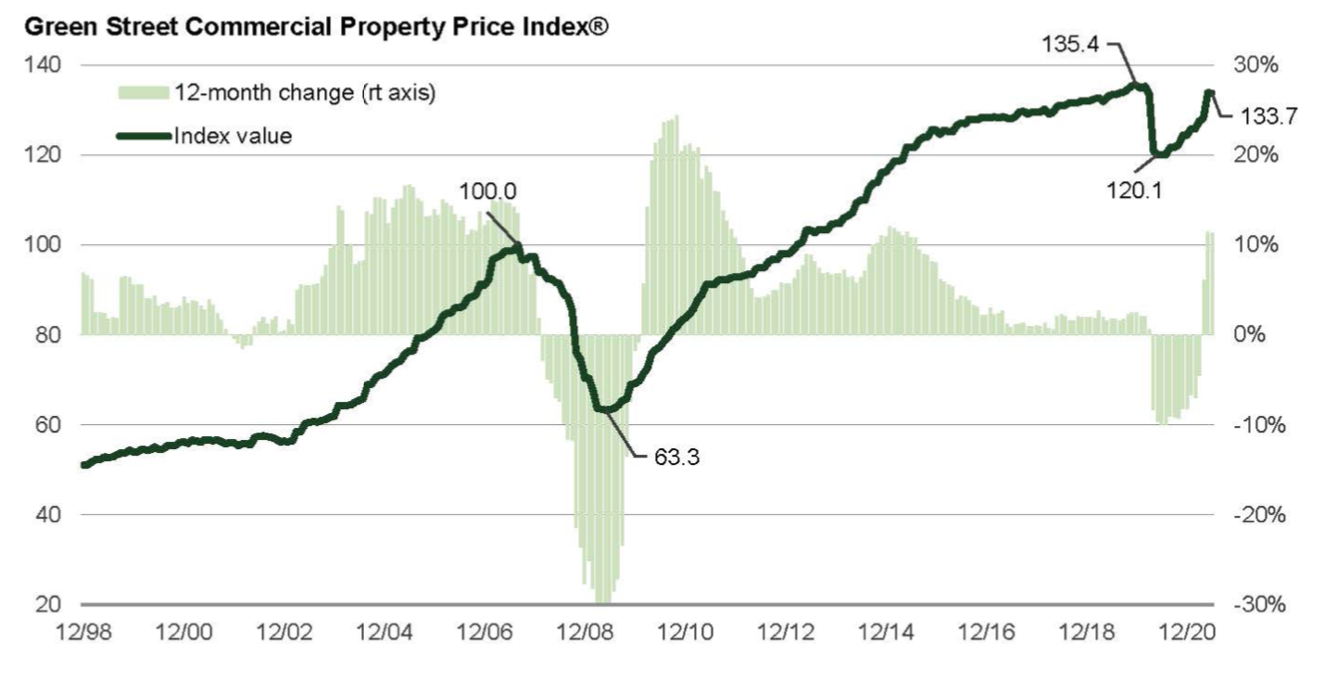

A second caveat is that for rents to increase over time, properties must maintain their usefulness. The chart below shows Green Street’s commercial real estate price index since 1998, which combines all major commercial property types. The index has increased over the last 20 years, but experienced sharp downturns after the Great Recession and the coronavirus pandemic. The pandemic accelerated trends that were already underway, such as a transition to more remote working amongst office users and e-commerce’s growth as a percentage of retail sales. Office and retail mall valuations are down 9% and 20% from pre-COVID pricing, respectively, while industrial is up 8%.

Opinions abound as to which of the real estate shifts are temporary and which are permanent. It seems likely that core downtown office markets will rebound as the virus recedes and workers and residents return, but average asking rents and seller price expectations do not yet reflect today’s impaired tenant demand. The enclosed malls of yesteryear, on the other hand, will not be returning to their previous glory, and instead may have a second life as industrial distribution sites or higher- density, mixed-use developments.

So while investment real estate can bean effective hedge against inflation, the effectiveness of the hedge depends significantly on a property’s cashflow increases and utility. It is, therefore, important to select real estate market segments that are aligned with future macro trends and will continue to have pricing power. Properties with more questionable near-term uses in markets with stagnating growth require careful underwriting or repositioning strategies to offset these risks and keep up with inflation. Contact your wealth manager to discuss how real estate investments might play a role in your portfolio.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...