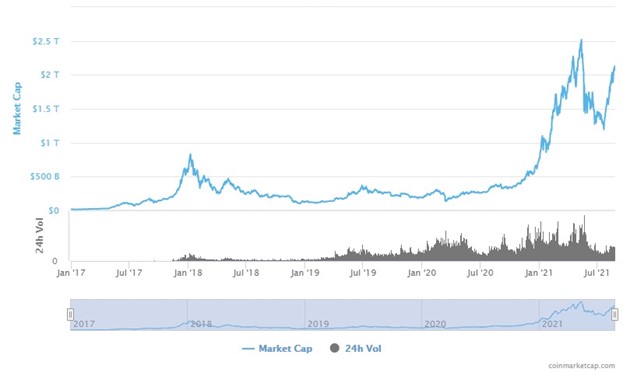

For anyone with even a passing interest in finance, investments, or technology (and increasingly anyone at all), stories about bitcoin, the blockchain, cryptocurrencies, and digital assets are nearly impossible to avoid. Many people likely first heard about bitcoin and blockchains around the Thanksgiving table in 2017 when the price of bitcoin spiked, and subsequently ignored them after the price crashed the following year. Today, cryptocurrencies and digital assets are front and center and have become exponentially more complex over the intervening four years. At the same time, the total market capitalization of cryptocurrencies increased from approximately $200 billion in late 2017 to more than $2 trillion today1.

This tremendous growth in market capitalization, the number of cryptocurrencies (from 2000 in 2017 to over 8,000 today2), and stories from your neighbor about diamond hands, laser eyes, and dogecoins has made it increasingly difficult to find the signal within the noise.

Manchester Capital has been following developments in the cryptocurrency space as the asset class has continued to mature. As digital assets and services become more mainstream and investment options proliferate, our team will continue to evaluate the risks and opportunities in order to best advise our clients.

In order to discuss the cryptocurrency/digital asset space, it helps to define certain terms.

Cryptocurrency – Digital assets or currencies, such as bitcoin, that are issued and transferred electronically as opposed to traditional government-issued currencies, such as dollars or euros, that exist in both physical and electronic form3.

Blockchain – The underlying technology behind Bitcoin and most digital assets. A Blockchain is a list of transactions that are grouped in blocks. As each group of transactions in a block is validated, it is added to the chain and locked cryptographically so that it cannot be altered in the future – creating a public, visible ledger of every transaction ever recorded. Importantly, since multiple copies of the blockchain are stored on independent systems around the world (known as nodes) and updated with every new transaction, blockchain technology allows for binding financial transactions to occur outside of the traditional banking system.

Bitcoin – Launched in 2009, Bitcoin (capital B) is a decentralized digital asset built on a blockchain. The virtual coins on the blockchain are bitcoins (lowercase b) and can be used to transfer or store value3. Bitcoins (small b) are earned by miners who use powerful computers (and staggering amounts of energy) to solve increasingly complex puzzles to validate and lock blocks of transactions into the Bitcoin blockchain, earning bitcoin for themselves in the process.

The supply of bitcoin is capped at 21 million coins, which is attractive to investors worried about inflation in traditional currencies. Given high transaction costs and volatility, bitcoin is rarely used for everyday transactions and is likened to “digital gold” as opposed to currency.

Ethereum4 – A blockchain that is programmable, allowing users to build applications that use the network to validate or secure transactions or payments for marketplaces, games, or other uses. If Bitcoin (capital B) is a spreadsheet (a ledger), Ethereum is Excel (programmable). ETH is the currency mined and used on this network and is the second-largest cryptocurrency by market capitalization.

Given its wider use potential and technical differences from bitcoin, ETH and other programmable coins have the possibility to be more widely used as currency than a strict store of value.

Investment Options

As the cryptocurrency market has grown, so too has the number of ways people can invest. For ultimate safety, one can own bitcoin and other cryptocurrencies directly on a drive that is not connected to the internet, known as cold storage1. Alternatively, there are multiple exchanges, such as Coinbase or BlockFi, where cryptocurrencies can be bought, sold, and stored. Moving forward, several Exchange Traded Funds are under review by the Securities and Exchange Commission that, if approved, would broaden ownership possibilities considerably. For an asset class premised on decentralization of finance (DeFi), further widespread adoption will increasingly rely on traditional finance and regulatory institutions.

Opportunities and Risks

There is no question that blockchain technology has the potential to significantly impact multiple aspects of the economy. In addition to the open, public blockchains like Bitcoin and Ethereum, private blockchains are already being used by traditional companies to improve operations, security, and efficiency. Walmart, for example, uses blockchain technology to track food products through their supply chain to maintain safety standards, and hospitals have used blockchains to keep track of COVID-19 vaccines2.

With respect to cryptocurrencies themselves, the uses are more speculative. Bitcoin proponents speak to its capped supply and decentralized governance as defenses against inflation and central bank intervention. Yet its extreme volatility negates its usefulness as a store of value and unit of exchange. Bitcoin’s volatility over the past 12 months was 65% versus a dollar-weighted basket of developed-market currencies at 5.5%2. Furthermore, high costs and limited ability to process large numbers of transactions make everyday purchases unwieldy. Newer technologies like ETH and Solana promise to cut costs, energy usage, and transaction times significantly and perhaps will solve some of these problems4.

Other risks include regulatory crackdowns, ESG concerns, technological obsolescence, theft, hacking, ransomware, and manipulation in a 24-hour global market with minimal transparency. While there is no denying the fortunes made by many early investors, the risks are substantial. And while it is certainly possible that cryptocurrency values may rise in the event of mainstream and institutional adoption, the lack of cash flow generated by cryptocurrencies forces their prices to be determined by sentiment rather than value. As such, we currently consider them to be highly speculative trading instruments rather than true investments and treated as such within the context of an overall investment plan.

While many of us at Manchester Capital have watched the gyrations of bitcoin and other cryptocurrencies with skepticism, we pride ourselves on being open-minded. It is impossible to ignore the growth of the industry and continued evolution and adoption of the technology. We are reminded of the early days of the internet, which was greeted with similar skepticism, investor mania, and wild volatility but eventually became ingrained in every aspect of modern life, often in ways previously unanticipated. While we would not dare to predict a path for specific cryptocurrencies or blockchain applications, we are confident that winners and everyday uses will emerge as more and more resources are drawn to the industry.

Looking further into history, few gold miners made money in the San Francisco gold rush. It was those businesses that sold shovels and blue jeans to the miners that accumulated wealth. As such, in limited circumstances to date we have chosen to invest in the digital asset landscape via funds from top-tier venture capital firms focused on the technology and applications (a “picks and shovels” approach) versus individual cryptocurrencies given the volatility and risk associated with concentrated positions. As history has proven, the winners of tomorrow may not be the leaders of today.

End Notes

1coinmarketcap.com/charts

2Goldman Sachs, Digital Assets: Beauty is Not in the Eye of the Beholder, June 2021

3 fidelitydigitalassets.com/digital-assets-basics

4 notboring.co/p/own-the-internet

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...