As we analyze the global situation in early 2024, a mosaic of complex geopolitical events unfolds, each with potential ramifications for the global economy and investors. Do these events rise to the level of “breaking the glass” and pulling the fire alarm?

The intensification of conflicts in the Middle East, notably the escalated attacks by Iran-backed Houthi rebels in the Red Sea and the Iranian Islamic Revolutionary Guard Corps’ operations in Iraq and Syria, pose a significant threat to regional stability. The recent death of three American soldiers in Jordan caused by a rebel drone raise the stakes of an expanding war in the Middle East. These actions, coupled with Israel’s countermeasures against Hamas and operations in Lebanon, illustrate the intricate dance of power and retaliation that is playing out.

Meanwhile, the political landscape in East Asia is equally turbulent. Taiwan’s election with a new pro-independence President contrast with an increasingly assertive China declaring the election a choice between war and peace. North Korea’s aggressive stance towards South Korea reveals deep-seated tensions that could have far-reaching consequences.

In Europe, the ongoing conflict in Ukraine, now approaching its second anniversary, and the escalating rhetoric from Russia towards the Baltic states, reminds us that geopolitical risk is a constant companion in investment decisions. The political rather than the usual business debate recently in Davos reflects global concerns about the United States’ geopolitical stance.

The current administration’s approach to international conflicts, particularly in the Middle East and Ukraine, has drawn criticism for perceived indecisiveness, which could be influencing the future landscape. The prospect of a change in U.S. leadership in the upcoming election adds another layer of uncertainty.

All these events, reminiscent of past calamities, paint a picture of a world teetering on the edge while the financial markets seem to ignore the developments. The S&P 500 is reaching record highs, and a general sense of optimism is prevailing among investors. Inflation is declining, employment is strong, consumers are spending.

This divergence between the economic sentiment and geopolitical realities is not unprecedented. History has shown us that markets can often remain buoyant even in the face of looming conflicts.

The U.S. stock markets, for example, recognize that there are more than eight trillion dollars parked in various cash instruments, ranging from bank savings accounts to short-term Treasuries. These positions have enjoyed high interest rates and offer notable security. But the Federal Reserve looks to begin reducing interest rates in the spring and will encourage these savers to turn back into stock market investors.

We should also mention that strong corporate earnings demonstrate the fundamental strength of the overall economy. The American consumer continues to spend, blessed with payments from myriad government programs aimed at stimulating the economy. Finally, there is considerable enthusiasm about the impact of Artificial Intelligence on corporate productivity. Every day brings another announcement about how A.I. will alter our world in ways comparable to the births of the internet, smart phones, and the construction of the interstate highway system.

Covid reminded us that there are always surprises, but we shouldn’t “break the glass” because of current events abroad and political concerns at home. Instead, resist the urge until events dictate a change in positioning and then act promptly when necessary.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements. As with any investment, there is the risk of loss.

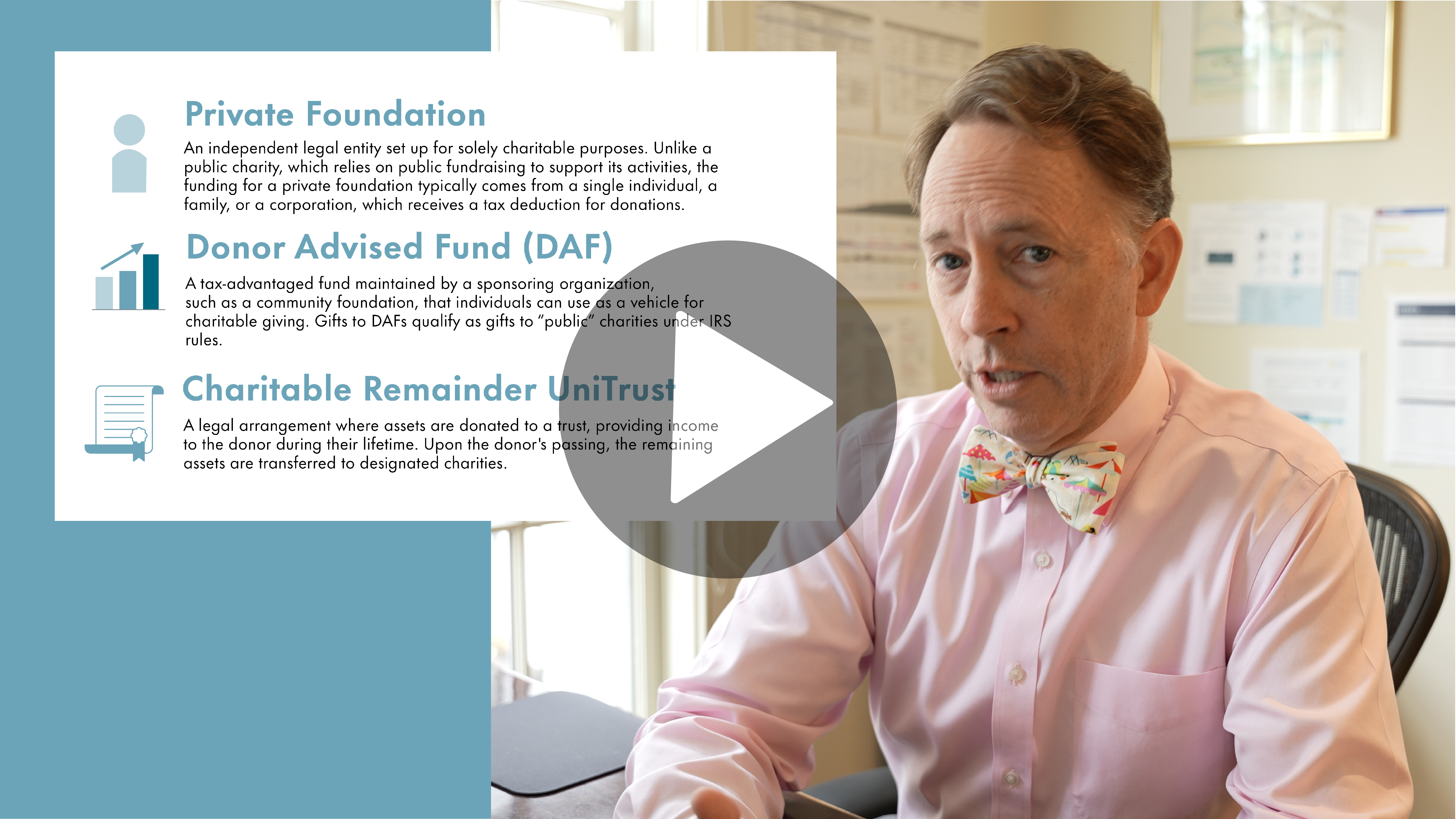

Manchester Capital Management's Senior Wealth Managers, Brian Vogel and Morgan Roberts discuss how they help wealthy families make informed decisions...

Intuitively, it seems that Presidential elections must affect markets. After all, markets prefer stability and predictability, and Presidential...

The Federal Reserve finished their latest Federal Open Market Committee (FOMC) meeting on June 12th and as expected, held the benchmark interest rate...