The Manchester Capital team enjoys educating the next generation to prepare them to be stewards of family wealth. Just as a parent would not allow their child to drive the family car without proper driving lessons, passing wealth to the next generation is less hazardous with education and training. Sometimes these lessons are better learned from an objective outsider rather than from mom or dad.

Education about wealth can encompass many financial topics, which we customize toward each family’s interests and the age of the audience. A teen who has earned income should know how to balance a checkbook and understand the benefits of a Roth IRA. A college student should know about the importance of credit scores and how to start on the path of building a strong credit score, which will be important for obtaining a credit card or renting an apartment. A person who is starting to take more personal financial responsibility should understand how to create a budget, how to evaluate renting versus buying, and how to obtain insurance. Depending on the situation, a review of basic estate planning may be appropriate.

When it comes to investing, we like to start with the basic mathematical concept of compounding. “What? I can earn money while I sleep? And the earlier I start a saving and investment plan, the more money I will have when I really want to buy cool stuff?” These can be inspiring concepts to get a young person started.

We then like to discuss different ways to invest and the different types of investments. Covering the basics of the way in which a company might raise capital to finance growth is a helpful way to distinguish between debt and equity investing.

In our experience, most young people don’t have much interest in being a lender. They want to be owners! Manchester Capital’s general view is that it is difficult to be a stock picker who regularly outperforms benchmarks, especially when there is an abundance of publicly available information about companies, especially for large U.S. companies. However, having someone young present a case for why one company is likely to be a good investment can be a wonderful way to encourage thinking about business, innovation, and the future. “I like this company because its products are better.” “Its products are also less expensive.” “It is the only company that makes something like this.” “Their customer service is amazing.” “Everyone uses their product.” “They give 1% of their profits to charity.” Recognition of attributes like these can easily be converted into an investment case covering the concepts of competitive advantage, profit margins, market share, and corporate responsibility in the future.

Having a family’s younger generation manage a small portfolio for the family is one effective and engaging method to gain hands-on investment experience. Following an educational seminar for several younger family members that covered a variety of financial topics, we worked with the parents to fund a brokerage account with a modest amount of capital. Each member of this younger generation recommended five stocks for the portfolio. They first had to present the investment case for each stock to their Manchester Capital wealth advisor, who would then make the final investment decision. We scheduled semi-annual update calls to review markets and the investment case as well as discuss whether each stock should remain in the portfolio. We allowed individual stocks with good fundamental theses to be added to the portfolio without restrictions based on diversification and portfolio characteristics. However, during the initial and semi-annual reviews, we talked about the concepts of risk management through diversification, correlation of returns, income from dividends versus capital appreciation, portfolio volatility, and more. This basket did not outperform the S&P 500 index over a two-year period, but it was close!

Becoming financially responsible is a multi-faceted and life-long process. If you are not sure how to get started with your children, please contact your Manchester Capital team.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

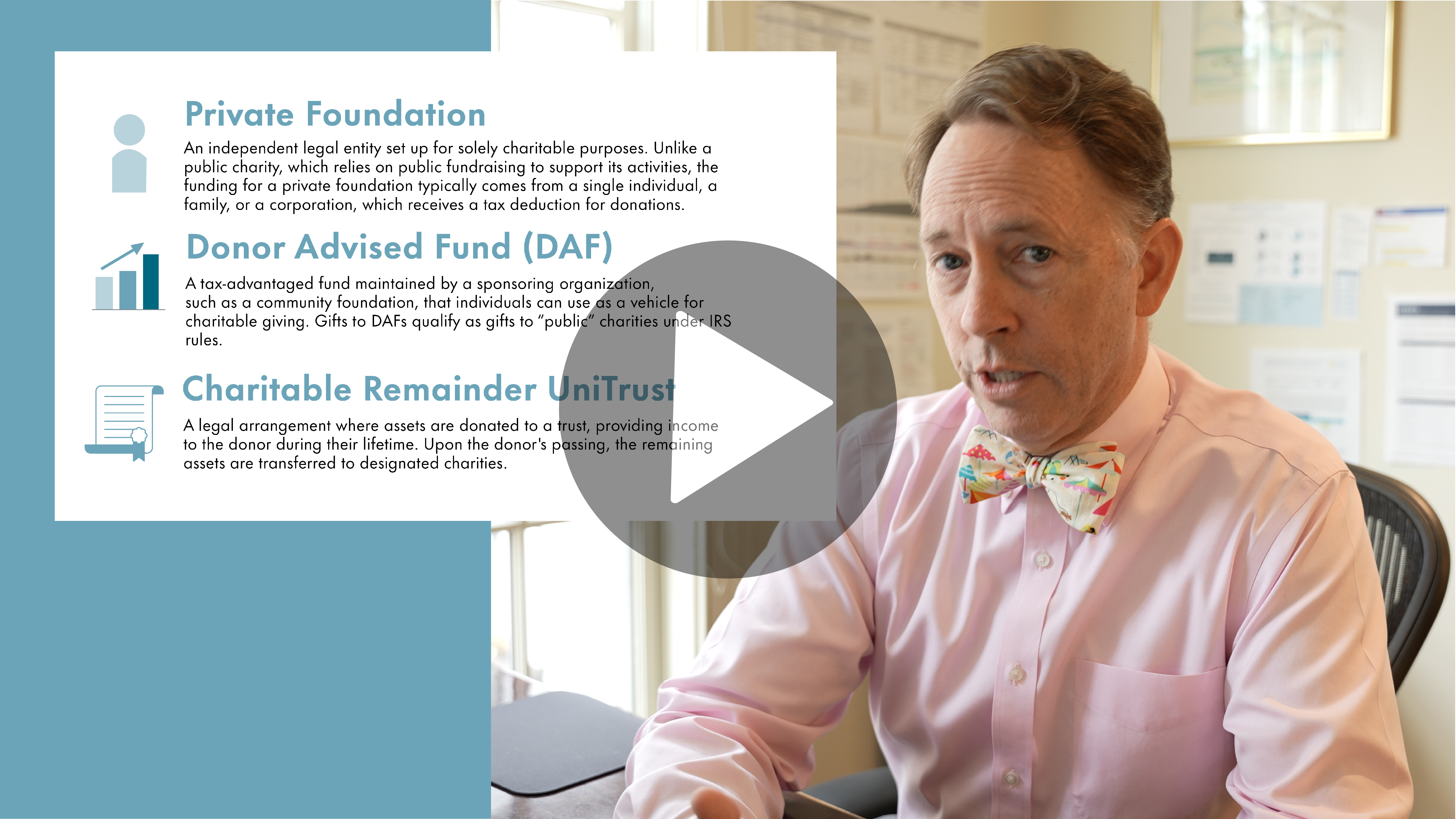

Manchester Capital Management's Senior Wealth Managers, Brian Vogel and Morgan Roberts discuss how they help wealthy families make informed decisions...

Intuitively, it seems that Presidential elections must affect markets. After all, markets prefer stability and predictability, and Presidential...

The Federal Reserve finished their latest Federal Open Market Committee (FOMC) meeting on June 12th and as expected, held the benchmark interest rate...