Trusts can play an important role in estate planning and particularly in intergenerational wealth transfer. They can be an effective estate planning tool to pass important family assets from one generation to the next. Trusts allow the grantor (i.e., person creating and/or funding a trust) not only to transfer assets but also to provide the terms that will guide and govern the use of the assets for the next generation and beyond. Creating a trust is often a complex undertaking with many details to consider. We have seen well-intentioned families create trusts that end up failing on execution or administration. At Manchester Capital, we work with families and their other advisers to set-up and manage trusts to help create the best opportunity for long-term success.

When setting up trusts, the discussion often starts with picking a trust situs – the state to use for administration, legal, and sometimes, tax jurisdiction. One state that might be considered is Delaware. Delaware has long been recognized as a leader in trust law with over 230 years’ experience enacting favorable trust laws to keep up with the constantly evolving and expanding needs of trust creators.

Delaware has a unique and sophisticated court, the Court of Chancery, specifically created to handle trust matters. The Court has a history of preserving, protecting, and supporting trust terms. Many of the highly effective and advantageous trust provisions used today, like the repeal of the rule against perpetuities, Decanting Statute, and the Directed Trust Statute, have been added over the last 40 years.

Another major advantage is Delaware does not impose a state tax on income or realized capital gains for non-resident beneficiaries, allowing greater after-tax growth of trust assets. Although, other states can impose tax on state-specific “source income”, like rental income from a real estate property in that state. Tax efficiency is an important factor in the long-term success of a trust so grantors should be mindful of important features in setting-up Delaware trusts to lessen the potential income tax liabilities from other states.

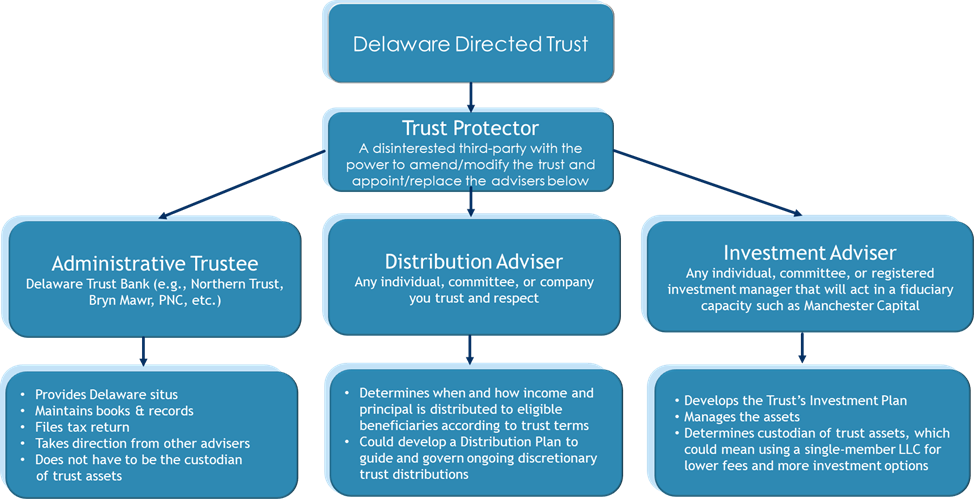

To take advantage of all Delaware has to offer, a trust simply has to name a Delaware trustee. This doesn’t mean you have to bestow all powers to the trustee though. You can use Delaware’s “directed” trust statute to appoint additional trusted advisers and/or family members to play important roles for the trust thereby limiting the Delaware trustee to a ministerial role. Properly structured “directed” Delaware trusts can result in the Delaware trustee acting as an “administrative trustee”, to administer the functions of the trust as outlined in the trust document, take direction from the other advisers, and file the annual tax return.

Trusted advisers can be appointed to fulfill the main functions of a trust: the Investment Adviser, to manage the assets of the trust; the Distribution Adviser, to make distribution decisions for the trust; and the Trust Protector, who can hold a wide range of powers and duties. Common powers held by a Trust Protector might include the power to amend or modify the trust, the power to change the jurisdiction, and the power to hire and fire other advisers. The Protector role is unique but also very important, so careful attention should be given to the appointment. In addition to these roles, other specialized advisers can also be appointed depending on the specific requirements of the trust and/or nature of the trust assets. For instance, a trust holding insurance policies might appoint a qualified insurance adviser.

An Example of a Directed Delaware Trust Design:

Delaware law also permits advisers to act in a non-fiduciary role for a trust. This is an important caveat when assigning family members and advisers who reside in other states. However, the Investment Adviser must act as a fiduciary. Manchester Capital has always operated as a fiduciary, so we can fill this role for our trust clients, if requested.

In some instances, grantors are concerned about starting trusts for younger family members due to requirements to disclose the trust and the assets. Delaware allows you to set-up “silent” trusts where there is no duty-to-notify the beneficiaries for a period of time. This can be especially helpful to keep children motivated and for other sensitive family situations.

Lastly, it’s important to note that you don’t necessarily have to keep the trust assets with the Delaware trustee. Many Delaware trustees allow you to keep trust assets at your preferred custodian by using an entity, such as an LLC, to hold the assets.

If you are interested in starting a Delaware Directed Trust, please consult with your Wealth Manager at Manchester Capital. We are happy to provide additional insight and recommend a Delaware attorney to make sure you’re taking full advantage of all that Delaware has to offer.

Manchester capital does not provide tax or legal advice. Please consult with your own tax and legal advisers before acting on any of the above.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...