At Manchester Capital Management, we view wealth as more than a measure of current financial health — it’s also a foundation for building enduring legacies. This month, we’re pleased to feature an article tailored for the next generation of wealth stewards, written by one of our talented Gen Z team members, Portfolio Analyst Miroslava Martinez.

This article explores the fundamentals of compounding interest, one of the most powerful principles of long-term financial growth. It’s crafted to inspire younger family members to think longer term and to foster meaningful conversations among families about how small, consistent actions taken today can lead to extraordinary outcomes tomorrow.

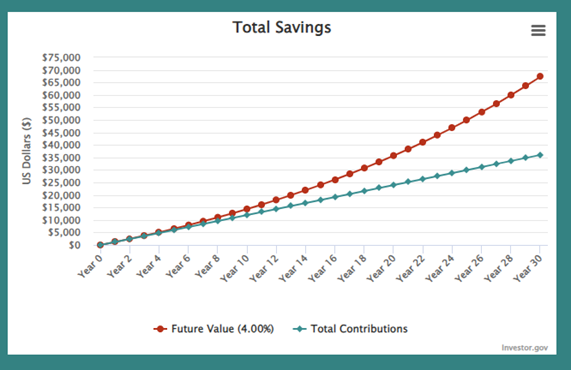

To understand compounding interest, it may be helpful to imagine hypothetical scenarios with two friends, Olivia and Liam. In these scenarios, Olivia began saving $50 a month at age 20, while Liam began saving $100 a month at age 30. When they’re both 60, who do you think ends up with more money? While Olivia started earlier and benefited from compounding over a longer period, Liam contributed more each month. As a result, Liam could end up with more money at age 60 due to his higher contributions, even though he started 10 years later. Some may think that Olivia’s earlier start gives her the advantage, but Liam’s larger monthly contributions could lead to a higher final amount. Both time contribution amounts, and growth rates influence the final balances.

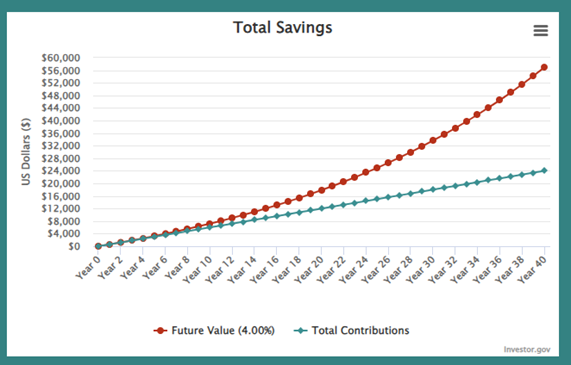

In finance, compounding interest means you earn interest on your contributions (in this example, savings) and on the interest your contributions generate. The compounding snowballs over time and can be powerful over longer time frames. When you put money into a high-yield savings account or into high-income investments, it can earn interest. The interest gets added to your total, and this new amount earns more interest, also growing in value. The cycle continues and your money grows faster the longer you leave it invested. To put it simply, compounding rewards patience and consistency.

The mathematical equation behind compound interest looks like this: x=y(1+r)t where x is the ending value, y is the starting amount, r is the interest rate, and t is time. All that means is that the longer you keep your money invested without withdrawing, the more it grows. It is a misconception that you need to start with a large sum of money to gain meaningful traction. Thankfully, even small, regular contributions can lead to significant results over time.

The secret behind compounding interest is time.

One of the safest ways to get started is with a high-yield savings account. Although returns on these accounts are usually modest, you will notice your balance steadily increasing. For those interested in receiving higher returns, investing in the stock market may be more suitable. A good rule to help accelerate growth is to reinvest any earned dividends instead of withdrawing them. It is more important, and frequently easier, to give your money time to grow than to make up ground later.

It’s important to remember that compounding also works in reverse. Credit card debt is a good example. Accrued interest can grow quickly when unpaid. To ensure debt does not spiral out of control, it’s a best practice to pay off debt as soon as possible. Let’s say you owe $1,000 at an annual interest rate of 26%. After 3 months, you will owe $1067 if you haven’t made any payments.

To leverage the power of compounding interest, save or invest money regularly, no matter how much. Consistency is key. From the words of Warren Buffet, “someone’s sitting in the shade today because someone planted a tree a long time ago.” For younger generations, this means to start “planting” with what you can. As your balance grows, leave your interest or investment returns in the account to keep growing. Compounding is most effective over many years, so try to avoid withdrawing funds prematurely.

Additionally, keep track of your financial progress and revisit your contributions periodically. As your goals change, adjustments can help you stay on track. Opening a savings account, contributing to a retirement fund, or exploring investment opportunities are all ways of getting started. Just like with Olivia’s and Liam’s story, remember that time is your most valuable resource. The longer your money compounds, the more you benefit.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements. As with any investment, there is the risk of loss.

It is once again that most joyous time of year where we step back to take time with our families, reflect on the accomplishments of the year that has...

For ultra high-net-worth (“UHNW”) families, integrating health into wealth planning isn’t optional — it’s essential for legacy,...

Can you invest in a way which is environmentally and socially conscientious while still producing solid returns? ESG—shorthand for Environmental,...