There are few concepts more central to achieving long-term investing success than portfolio diversification. This idea, which at its core is simply not having all your eggs in one basket, has taken on added complexity in recent years thanks to the widespread adoption of so-called alternative investments.

The term has come to encompass an incredibly diverse range of strategies and approaches with a correspondingly wide range of potential outcomes for investors.

Alternative investments can provide important benefits to investors if approached carefully and according to a sensible investment plan, especially at times with significant market uncertainty such as we’ve experienced in recent years.

Alternative investments (also called alternatives, or alts), writ large, can be difficult to categorize. We consider them to be anything that is not a traditional stock or bond market investment. The range of alternative investment strategies includes:

An important feature of each of these categories of investment is that they are typically not liquid, meaning they can’t be sold (or liquidated into cash) as easily as public markets investments.

Adding alternatives to a traditional stock and bond portfolio may increase return potential or may reduce price volatility. Some hedging strategies provide uncorrelated returns, which provide portfolio diversification benefits.

Early stage investing (via angel investing, or managed venture capital and private equity funds) can give investors access to innovative ideas and early-stage growth opportunities not available on public equities markets.

Direct lending to companies that are too big to borrow from banks, but not yet big enough to access the public bond markets, may provide opportunities for higher-yielding credit opportunities than investors would have access to in the public bond markets.

Alternatives also provide investors with the opportunity to focus on high conviction areas of belief, or conversely, to broaden their portfolio diversification.

The biggest challenge is the liquidity issue already mentioned. If an investor decides to exit a strategy before its expected maturity, it may take months or even years to get out of it completely. If a cash need arises, alternatives are unlikely to be there to provide it. In a portfolio context, alternatives take long-term planning and careful management.

Even if not sold prematurely, funds may remain locked up for 12 years or even longer. This is not an appropriate time horizon for everyone. Investors should be prepared to hold alternative investments for extended periods of time.

Another challenge is the high dollar entry amount often required by alts. This may not be an issue for a single strategy that might come along but could become important if an investor is to build an overall portfolio that is properly diversified. Prudent private equity investors don’t typically just jump on one idea. It’s recommended to invest methodically, to build a portfolio over a period of years, and to seek diversification across managers and types of strategies and economic sectors.

Management of alternatives is something to consider as well. Funds often make capital calls over time, and later distribute money back to investors in chunks, over time. Managing each capital call, noting which distributions are return of principal vs capital gain, tracking performance and so on, are all ongoing requirements after the initial investment is made. Operational complexity of this nature is manageable, but one should be well prepared for it.

Some of the more speculative areas of alternative investing also carry a higher risk of investment failure than more traditional investments in stocks and bonds. There is an upside, potentially, but also a downside, potentially, in terms of both risk and return.

One positive side effect of the lack of liquidity of many alternative strategies is that they’re not priced daily. Like your residence, you may have a general idea what the actual value of it is at any given time, but you don’t see the price published online every day. The lack of liquidity provides an incentive to remain patient, focused on the long term, and makes it less appealing to impulsively sell when the markets are at a low point.

Investments in real estate, hedge funds and commodities may also provide investors with a different path of returns than they might see in public markets-traded stocks and bonds. Another benefit of investing in different asset classes, such as alternatives, is that they can smooth out the total return experience a portfolio provides over time. Not having everything go up and down simultaneously can really help investors ride out volatile markets with less choppiness.

Some alternatives are designed specifically to do well during a broad-based economic downturn, when other asset values are suffering. Distressed debt, for example, is an asset class predicated on the idea that savvy investors can find value in assets others are trying desperately to unwind.

Even within asset classes that are broadly turning down due to macroeconomic headwinds, some managers have proven adept at locating idiosyncratic opportunities that can be highly profitable if purchased with the correct timing. Alternatives can allow certain managers or strategies to thrive in such environments in ways that those focused strictly on the public markets are not able.

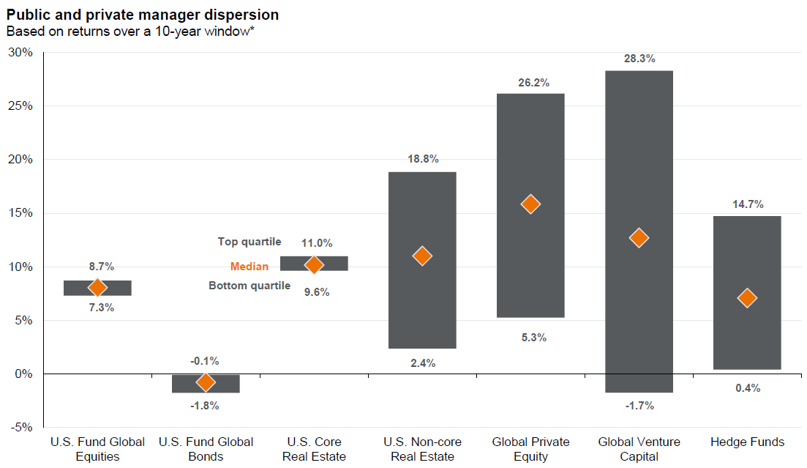

As investors have chased higher yields and stronger returns during strong market periods, there has been tremendous growth in the number and scope of strategies available. As a result, many less skilled managers have successfully raised assets to manage alongside the more skilled managers. The dispersion between top and bottom quartile managers can be of much greater magnitude than in public markets.

As the chart below shows, the dispersion in returns of the top and bottom quartile managers in alternative strategies is typically far greater than in public markets.

We would caution that it’s significantly more important to have strong due diligence and advisory support when considering alternatives than it is for traditional public markets investing. Manager selection can play a critical role in successful outcomes.

Careful consideration of current macroeconomic forces is also especially important at the outset of an alternatives investment portfolio construction process. Sub-asset classes can be expected to perform differently in the near and medium term, depending on the macroeconomic environment. The timing of what to begin with and how to build, as well as manager selection, will be important determinants of eventual investment success or failure.

Strategically spacing out the initiation year of different funds, also known as vintage year diversification, is an under-appreciated element of successful private equity investing. Today, the economic environment is very difficult for many young companies trying to raise capital. It may turn out to be a great time to be an investor, though, because entry prices may be lower, and one can be more selective.

Perhaps the biggest keys to successful alternative investing, though, are to invest according to a well-considered plan and to maintain a long-term investment perspective. Those guidelines hold true for public markets investing as well.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...