For the past several months as Russia has amassed troops on the Ukrainian border, we have asked ourselves the same questions that have occurred to many of our clients, “What does this mean for the market and how much is already baked into asset prices?” With Russia’s invasion, we found out—the U.S. stock market dropped at the open on Thursday because the eventuality of the invasion was not fully built into asset prices—but as the day progressed, the market recovered. This week, the market opened down on the news that Putin put Russia’s nuclear arsenal on heightened alert. This development seemed to catch investors by surprise; however, given the modest size of the market’s decline it appears investors do not believe nuclear weapons are a viable option. Regardless, it is a reminder that situations like these are fluid and the markets are continuously absorbing new information.

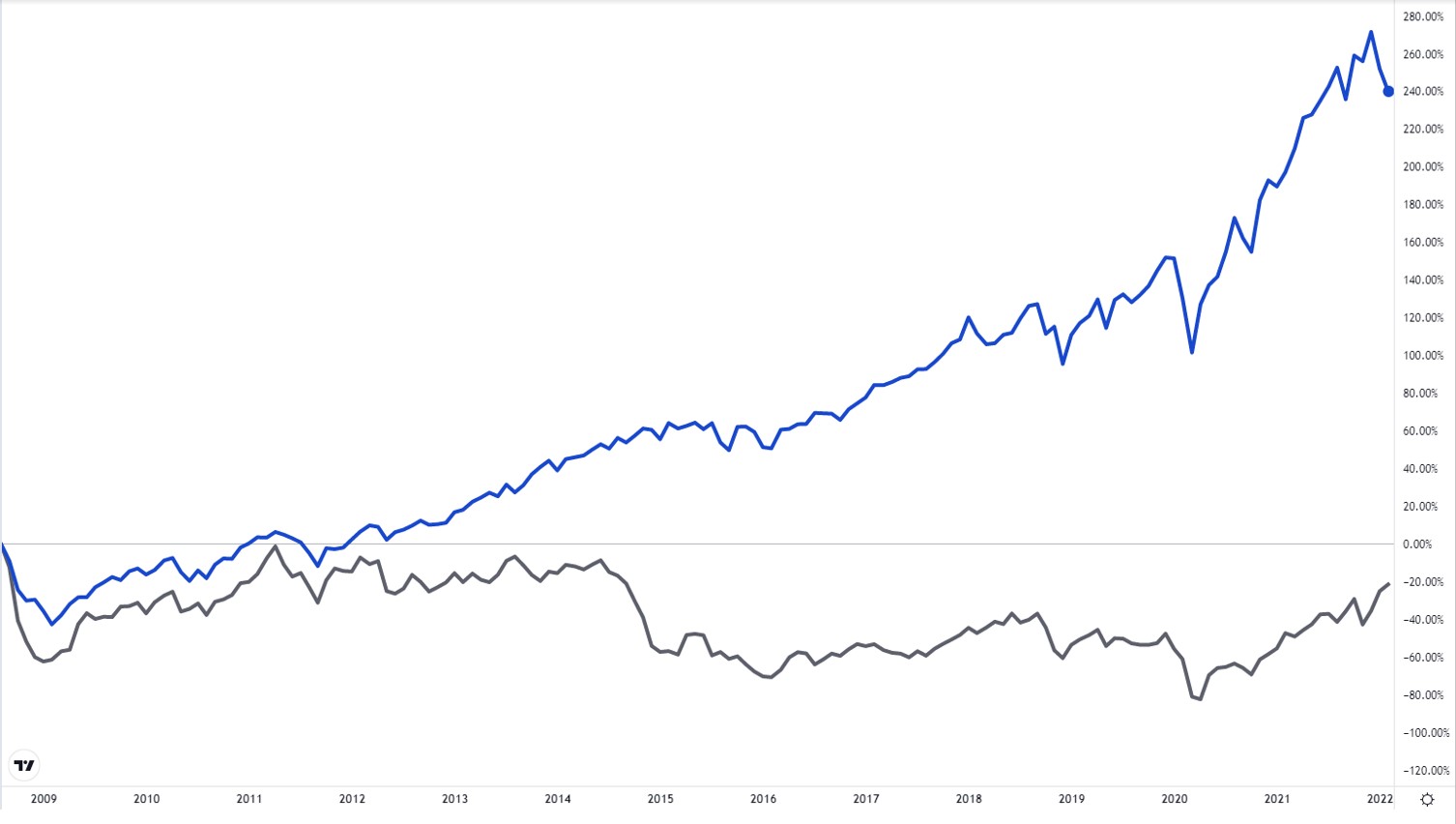

The most significant effect Americans and many Europeans will feel from Russia’s actions are rising energy prices. As we write this, crude oil stands at $92.68/barrel. The market has been here before—more than 10 times going back to October 2007. Peak oil occurred in July 2008 when the price of crude reached $145.29/barrel, a full 56% higher than where it stands today. Since then, the S&P 500 has risen 233%.

Source: Yahoo finance and tradingview.com

Given the warnings from Western politicians that Russia would face severe consequences and sanctions if it were to invade, we can expect some secondary effects as the Nord 2 pipeline is cancelled, shipments of technology to Russia are embargoed, Western companies are prohibited from dealing with Russia, and certain financial penalties are levied. While these will have an isolated impact on Western nations, of greater significance will be the overall effect on inflation in the U.S. and how that causes the Federal Reserve to react.

With inflation running at 40-year highs, Chairman Powell and the Federal Reserve are committed to raising interest rates, beginning in March, with Quantitative Tightening to follow later in the year. The market has been trying to determine how many interest rate increases the Fed will enact and how quickly. Estimates range from three to five rate hikes this year with the first one likely to be 0.50%.

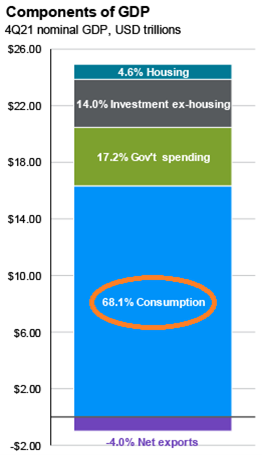

We entered 2022 with analysts forecasting S&P 500 earnings growth of approximately 9% for the year. Inflation and interest rate increases threaten to dampen that number. Aggressive action the Fed takes to curb inflation could depress U.S. economic activity, resulting in slower corporate earnings growth. If the Fed doesn’t react strongly enough, and inflation remains at a high level, consumers will likely reduce discretionary spending (there’s less left for discretionary spending when spending on food, gas, and utilities all costs more). A reduction in discretionary spending, which makes up 68% of GDP, also directly leads to reduced economic activity and therefore reduced corporate revenues. Combined with higher input costs, reduced revenues leads to reduced earnings.

At present, we do not foresee a recession on the horizon. What we do see are more volatile days ahead given increasing levels of uncertainty. How strongly will the West sanction Russia? Will China see Russia’s actions as a green-light to become more aggressive toward Hong Kong and Taiwan? Will smaller countries accelerate nuclear programs as a means of protection? What do the 2022 elections mean for the composition of Congress and the Biden agenda going forward? Will the Fed go too far in raising rates?

Throughout 2021, earnings growth outpaced market performance. This allowed valuations (Price-to-earnings ratios) to decline slightly even while market performance was strong. So far in 2022 the market has retreated approximately 10%, bringing valuations down aggressively and reflecting a more tepid outlook for future growth.

It is times like these, times when we are reminded that the world can be a dangerous place, that several investment principles come to mind: Have a long-term investment plan and stick to it; Maintain adequate liquidity to ride-out short-term periods of volatility; Stay diversified, even when you suspect certain asset classes may not be strong performers under present conditions; and finally, Volatility dampeners like hedge funds, which historically have under-performed in strong market years, can serve an important role in volatile years.

If you are concerned about your long-term plan, if you think your circumstances are changing and may affect how your assets are invested, or if you simply want to speak to your wealth manager about our outlook for these challenging times, please contact us. History may not repeat itself, but it does echo, and we have heard this tune before.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...