One of the strongest bull markets in recent memory appears to be waning. Since its low in March 2020, the S&P 500 Index has advanced more than 95%. The annualized trailing five-year rate of return exceeds 15%. So far this year, aggressive diversified portfolios are enjoying rates of return in the mid-teens while conservative balanced portfolios are achieving single digit returns. In many ways, a pause in the market’s advance is natural.

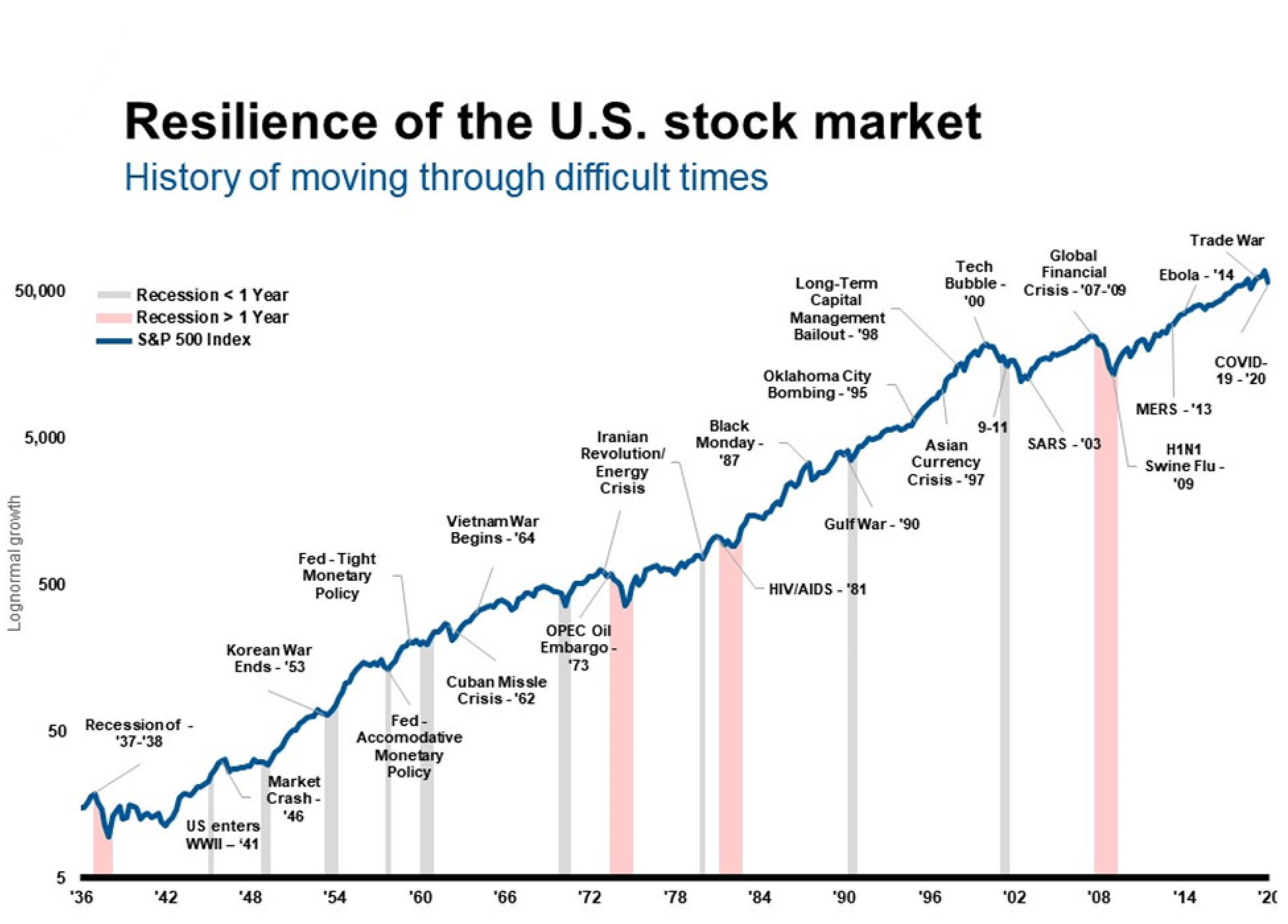

Historically, the U.S. stock market rarely achieves such growth without periodic declines of 10% or more. Occasional financial disruptions, like the mortgage debacle in 2008 or the dot-com bubble in 2001, trigger declines of 30% or more. But even these disturbing events have been followed by rebounds in the averages that, while they may take a while, often lead to new market highs. We suspect the September market retreat reflects the natural behavior of market forces and not a significant disruption to the market’s progress. For now, though, the momentum is to the downside.

Over the last year, the U.S. stock market has enjoyed notable advantages that help explain its robust performance. Interest rates have been at historic lows, held down by a supportive Federal Reserve and federal fiscal stimulus that has seen historic extremes in spending. Low interest rates have made bonds and debt instruments unattractive compared to equities. Low rates reduce the cost of mortgages, increasing demand for homes and pushing prices up, while also making commercial properties relatively attractive. Positive market momentum, and the fear of missing out, have encouraged equity investors.

Today, these tail winds are shifting, prompting a revaluation of equity pricing and their equity risk compared to the security and stability of government bonds. If fiscal stimulus from new Congressional spending becomes excessive, it could be detrimental rather than beneficial. If the monetary stimulus from the Federal Reserve that provided low interest rates creates inflationary pressures that drive interest rates higher, stock market values could be undermined.

Perhaps most importantly, Covid-related issues, especially the Delta variant, have created much of the market volatility. The Covid contagion threatens workers thereby exacerbating unemployment. Covid shutdowns have closed factories and businesses depleting inventories of everything from steel to computer chips to running shoes. Complex global supply chains have stalled so that even available goods are slow to reach the market. Container ships wait at anchor and there is lack of truck drivers to deliver product. Empty shelves with scarce workers result in business bankruptcies and disappointed consumers.

There is the uncertainty about other new virus strains. America has suffered more deaths from Covid than the entire population of the state of Vermont. The scale is frightening. Despite extensive vaccination efforts and significant natural immunity from Covid survivors, new Covid deaths remain high. Equity investors have good reason to pause until there is more clarity.

Throughout the September declines, we have remained positive on the economy, the stock market, and the future of America. More money has been lost trying to predict market declines and recessions than staying invested in a balanced portfolio during market corrections. Hedging a potential decline by holding cash or betting against the future is seldom successful.

You don’t have to be a sophisticated chart reader or market expert to decipher the message from the nearby chart. The American economy is a powerful wealth creator for the patient investor willing to accept the risk and stay invested for the long haul. The best path during market turmoil is to adjust at the margin while maintaining confidence that the markets will rebound over time. It is prudent to set aside funds to meet immediate cash needs and taxes, but longer-term assets should remain invested according to a well-constructed plan.

The recent news of a possible therapeutic from Merck that can reduce the severity of Covid infection is a great example of an unexpected game changer. The drug remains a promise without proof but is very welcome news. If the medicine is successful in mitigating the Covid impacts, it could help revive the economy and the markets. At the same time, the Delta variant appears to be moderating as we approach the winter when viruses spread more easily.

If Covid, and the terrible impacts it has caused, is contained, there is further reason to be confident. We should not expect the strong performance we have enjoyed since 2020 to continue, but the recent declines caused by Covid should subside. There are other challenges that pose uncertainty but there is also the potential for unexpected positive news.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...