In our October 2021 Insight we wrote, “One of the strongest bull markets in recent memory appears to be waning. In many ways, a pause in the market’s advance is natural. We suspect the September market retreat reflects the natural behavior of market forces and not a significant disruption to the market’s progress.”

At the time, the S&P 500 had fallen 4.7% in September 2021. What followed was a rebound in the 4th quarter with the market rising 11%. That correction was not unprecedented, or even abnormal.

In January, we faced more significant declines in stock market indices. We have witnessed record highs, one after another followed by several weeks of multiple declines as investors focus on the new conditions presented by 2022. The omicron variant has proven more contagious than previous COVID variants, even if less virulent. Geopolitically, tensions with Russia and Ukraine have the potential to threaten the energy supply in Europe, where they are already dealing with soaring natural gas prices.

The U.S. economy remains strong and above historical trend but is still restricted by supply chain issues and a very tight labor market. There are more job openings than applicants. Corporate and consumer balance sheets are healthy with little leverage. Corporate earnings from companies with strong profits remain fairly valued.

Growth stocks, however, such as technology and communication services, are suffering. When interest rates increase, growth companies that have been valued on uncertain future earnings become less attractive.

Additionally, the most speculative parts of the market—including ARK funds, meme stocks, crypto assets, etc.—have recently shown pronounced weakness and given back much of their pandemic-era gains.

Indeed, inflation anxieties are high as the headline CPI inflation index reached 6.5% year-over-year. The Federal Reserve has finally admitted inflation is no longer “transitory”. They have indicated plans to reduce their policy of buying bonds and treasuries from the public markets that increase money supply and keep interest rates low. More importantly, the Fed has indicated their intent to start raising the Federal Funds rate, their principle monetary tool.

The Federal Funds rate is the base rate banks charge each other to borrow or lend their reserves overnight. This rate, which has been between 0% and 0.25% since the beginning of the pandemic, sets the foundation for all interest rates from home mortgages to corporate credit. The Federal Reserve is planning to increase rates incrementally over the coming months to quell inflation.

Increased rates make borrowing, growth, and speculation more expensive. The number of future interest rate increases is uncertain as the Federal Reserve continues to monitor inflation, other measures and economic progress. It is likely they will raise rates at least three times this year in increments of 0.25%, but the stock market declines suggest the market could be pricing in four or five rate increases. Indeed, many market participants are planning on five rate increases, taking the Fed Funds rate to 1.50% before the end of the year. The markets appear to us to have already adjusted to a future rate level that has not yet been implemented.

Over the intermediate to long-term these interest rate increases are positive—rampant inflation harms everyone—however it does cause short-term volatility as investors recalibrate to a new interest rate environment. Inflation also affects behavior on Capitol Hill. Concerns among politicians that too much fiscal spending was exacerbating inflation may have led to the demise of President Biden’s Build Back Better proposal.

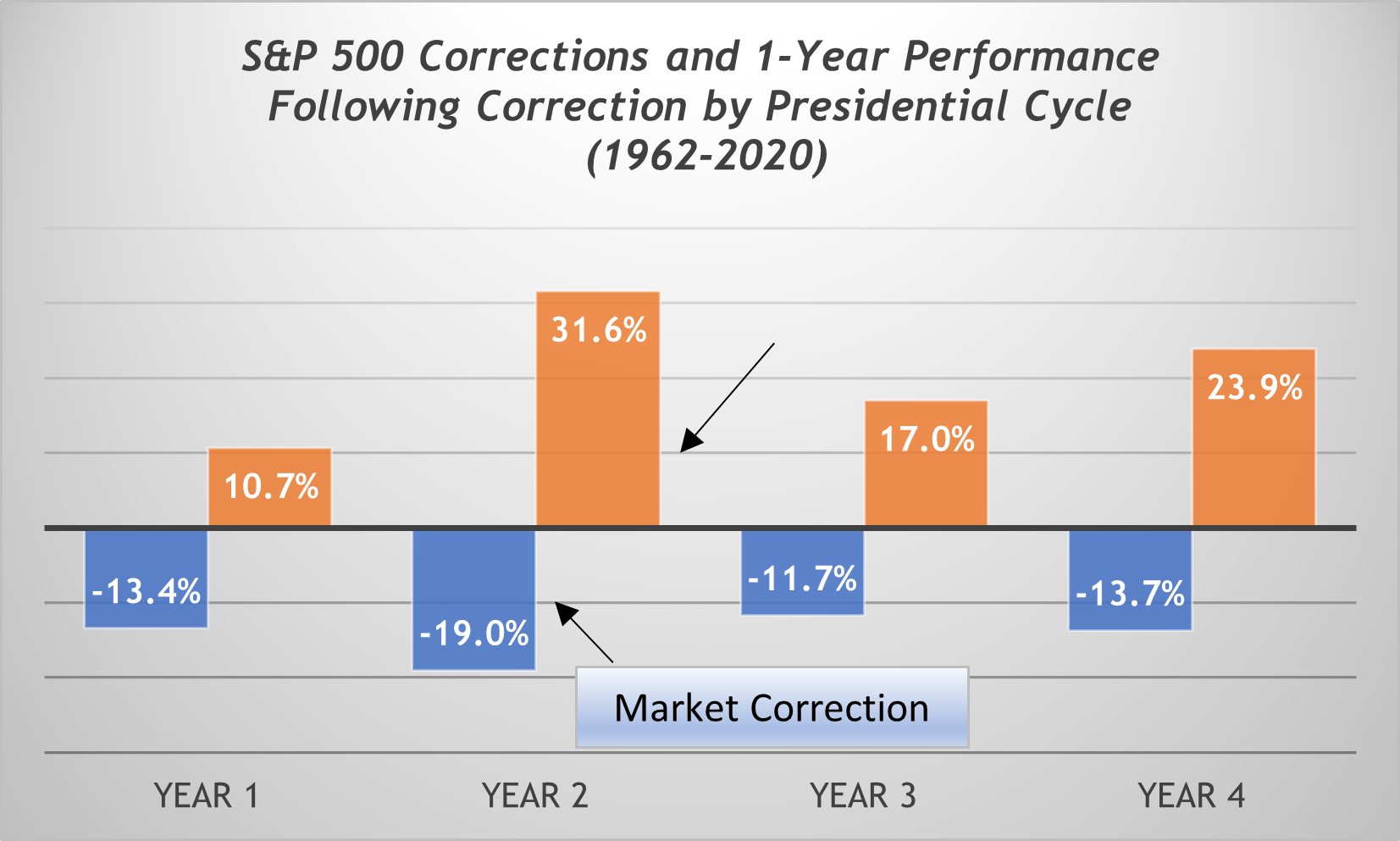

Historically, January’s market pullback is consistent with past years. According to investment research firm Strategas, stocks are more volatile in midterm election years. From 1962 to 2020, on average, stocks experienced a decline of 19% during the midterm year followed by 1-year gains averaging 32% after the decline — more than any other year in the presidential cycle.

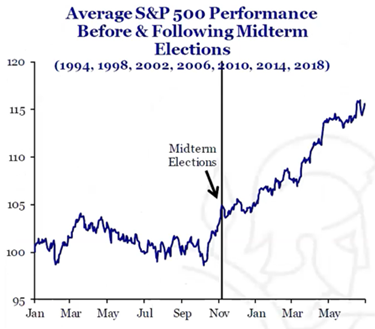

Since 1994, as shown in the chart below, the nine months following the midterm elections have been strongly positive. In fact, the S&P 500 has not declined in the 12 month period following a midterm election since 1946.

Source: Strategas

Political lens aside, it appears to us that the market is near an inflection point. With an apparent end to quantitative easing, we can expect higher interest rates and a tighter money supply. This stock market correction does appear different than others in the “Quantitative Easing Era”. This correction marks the first time in recent history when bond yields have gone up, not down. Value stocks, led by energy, have so far outperformed growth, an unusual occurrence in the last 13 years.

How much the market may correct this year is impossible to predict. The market is always willing to deal a lesson in humility to the overconfident. Our advice is to maintain a diversified portfolio and stick to a long-term plan. Time is the greatest advantage an investor has over the market.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...