It is a challenging time for both stock and bond investors. The week ending May 27th marked the first positive week for the S&P 500 Index since March. The index was down for seven straight weeks, the longest decline since 2011. Bond investors are also enduring unusual losses. The Bloomberg Barclays US Aggregate Bond Index was down as much as 9.5% marking the worst drawdown ever for the index. As of this Insight, the S&P 500 is down 14% year-to-date while the U.S. Aggregate Bond Index is down 9%. The last time both U.S. stocks and bonds ended the year with losses was in 1969. Interesting times.

The markets are reacting to a rapidly changing investment landscape. The U.S. economy was humming along at a heady clip with GDP growing 6.9% in the fourth quarter to end the year with a strong 5.7% gain. Then, the economy abruptly changed course and posted an unexpected decline of 1.4% for the first quarter of 2022. Consumer spending slowed as prices continued to rise from ongoing supply constraints, labor shortages, pandemic stimulus, and sanctions on Russia.

The Fed was poised to raise interest rates incrementally and telegraph a longer-term approach to right-sizing interest rates. This process would provide some clarity for the markets as they slowly tightened the money supply and cooled the economy. However, the stubbornly high inflation rate is forcing the Fed to change course and implement a more aggressive monetary policy. With U.S. unemployment low and millions of unfilled jobs, the Fed has a green light to be more aggressive in rate increases. The Fed may even risk an economic slowdown to get inflation under control. A persistently elevated inflation rate could certainly throw the economy into a recession or elongated economic downturn.

The market is also in the process of correcting some excesses. As a result of the pandemic, trillions of dollars of fiscal and monetary stimulus were injected into the economy. Although this helped induce a rapid U.S. recovery, it also caused bubbles in some sectors of the market. Perhaps the largest bubble was in technologies supporting the work-from-home economy. These technology stocks advanced rapidly, many over 200% over a short period of time (e.g., Zoom, Docusign, Roku, etc.). Analysts stoked the flames and aided in the euphoria. They were quick to provide extraordinary growth forecasts and justify frothy market valuations, eerily similar to the dot.com bubble of 1999. Then, Initial Public Offerings (IPOs) of similar or related companies became highly sought-after as many saw their stock prices double or even triple shortly after going public (e.g., Airbnb, DoorDash, Snowflake, etc.). The IPO frenzy gave rise to Special Purpose Acquisition Companies, affectionately known as SPACs, as a way to circumvent the IPO process and take advantage of a seemingly insatiable appetite for these new work-from-anywhere enabling technologies. Indeed, the zero-interest rate policy exacerbated the bubble as it kindled leverage and excessive risk-taking in the market.

A posterchild for this particular stock rally was Cathie Wood at ARK Investment Funds. Cathie rose to prominence by her actively managed Exchange Traded Funds (ETFs) that solely invested in these types of stocks. Her flagship fund, the ARK Innovation ETF, gained 157% in 2020. However, these funds were not diversified, had concentrated positions, and may not have relied on fundamental company research in selecting investments. The main criteria for inclusion were that the companies were innovative and involved in the next generation of technology. The ARK Innovation ETF, and many of the stay-at-home pandemic winners, have since fallen more than 75% from their highs. Indeed, interesting times.

We have been studying the market and this correction closely. Although the interim losses hurt, we do not see any structural, systematic, or fundamental problems with the markets or the economy. Rather, investors are struggling to revalue securities to factor in higher interest rates, slower growth rates, reduced Federal stimulus, increased input costs, and uncertainty in eastern Europe. Investor sentiment has decidedly turned negative and analyst’s revenue forecasts have come down considerably (except for energy companies). Overall, expectations are being recalibrated. We don’t know how long this will last or how deep the correction will be —this process takes time.

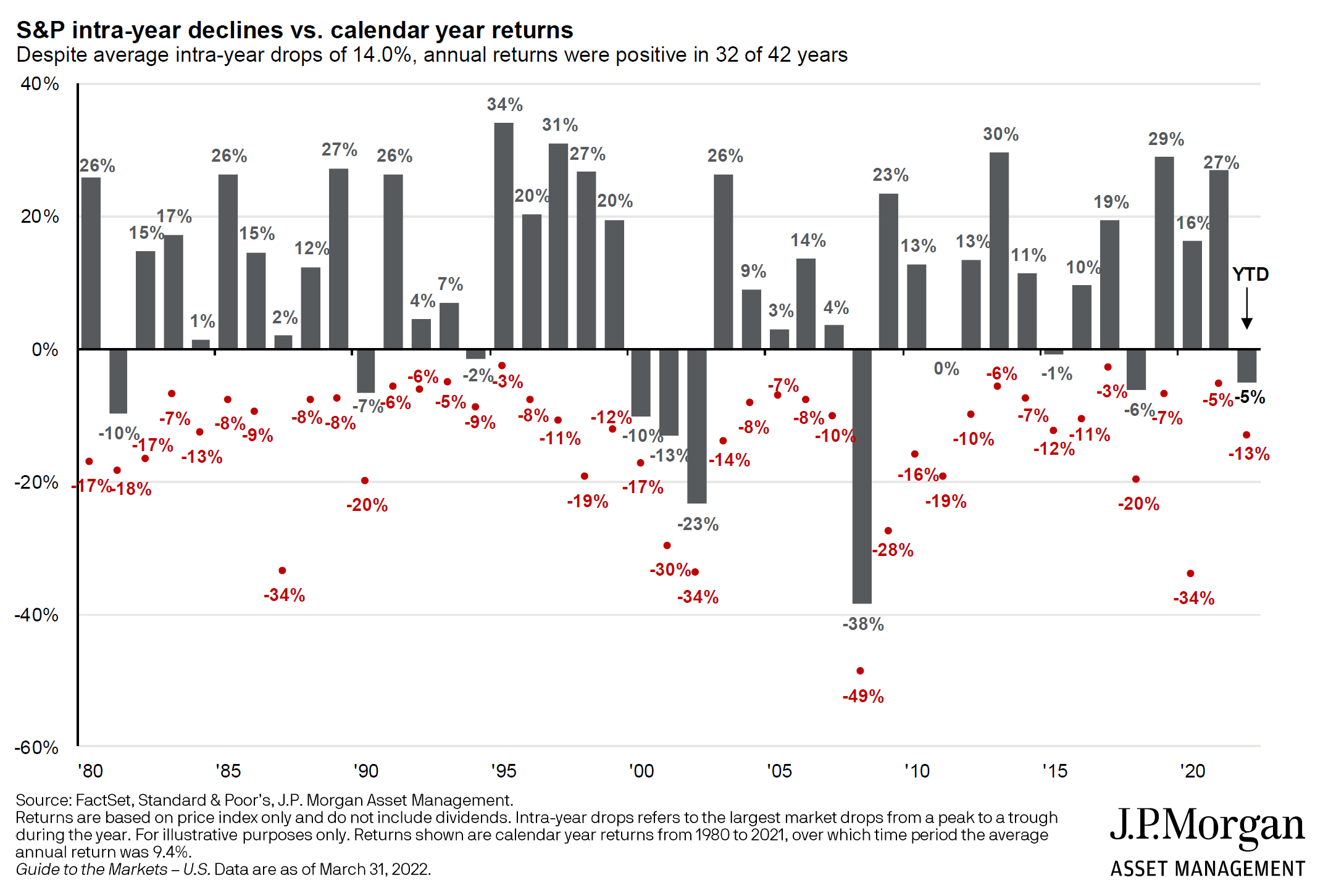

Long-term investors recognize they need to wade through these periods. It is part of investing through uncertain economic cycles. As seen in the chart below, the market has interim declines, some corrections (decline from high > 10%) and some are bear markets (decline from high > 20%). The average annual intra-year decline is 14% over the last 42 years while the average annual return was 11.9% with a positive return in 32 of the 42 years. Although the current market correction is unsettling for investors, it is important to remember it will inevitably rebound and reward investors with a long-term viewpoint. Interesting times for sure.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...