…otherwise it wouldn’t end.

This is the final of three Insight newsletters exploring the topic of our national debt. In part one, we examined the factors that have contributed to our current debt level. In part two, we explained why the national debt did not have to be repaid. In this, part three, we consider the economic and market effects of the debt’s current trajectory and how Manchester Capital is positioning client assets to steward them through the times ahead.

There are myriad consequences of the rising national debt. Here, we will focus on six issues: inflation, dollar devaluation, rising interest rates, crowding out of other spending, equity expansion, and social bifurcation.

American economist Milton Friedman famously said that inflation is always and everywhere a monetary phenomenon—too much money chasing too few goods, conditions that currently prevail. Easy money, the result of an accommodative monetary policy driven by low interest rates, is chasing goods that are constrained by supply issues caused by COVID-19 business closures, work-from-home requirements, sticky unemployment, and little safety inventory due to just-in-time manufacturing practices. These conditions are causing inflation to spike—the Consumer Price Index rose 5.4% last month, well above the Federal Reserve’s 2% target. Fed Chairman, Jerome Powell, insists current inflation is temporary— that as the pandemic recedes, supply constraints will wane, and inflation will dwindle. Powell may be correct, but not if the Fed continues its easy money policy, which it is likely to do for reasons mentioned below.

Perpetually increasing debt and accommodative monetary policy should lead to the devaluation of the dollar. They are partly responsible for the rise of cryptocurrencies like Bitcoin. As more dollars are printed, each dollar’s value should decline. One appeal of Bitcoin is that there will be a finite number of coins created. Whether the dollar actually depreciates against other currencies depends on what other countries are doing with their currencies. If other countries pursue easy monetary policies, the dollar can strengthen against other currencies while still depreciating against hard assets like precious metals, real estate, and even food.

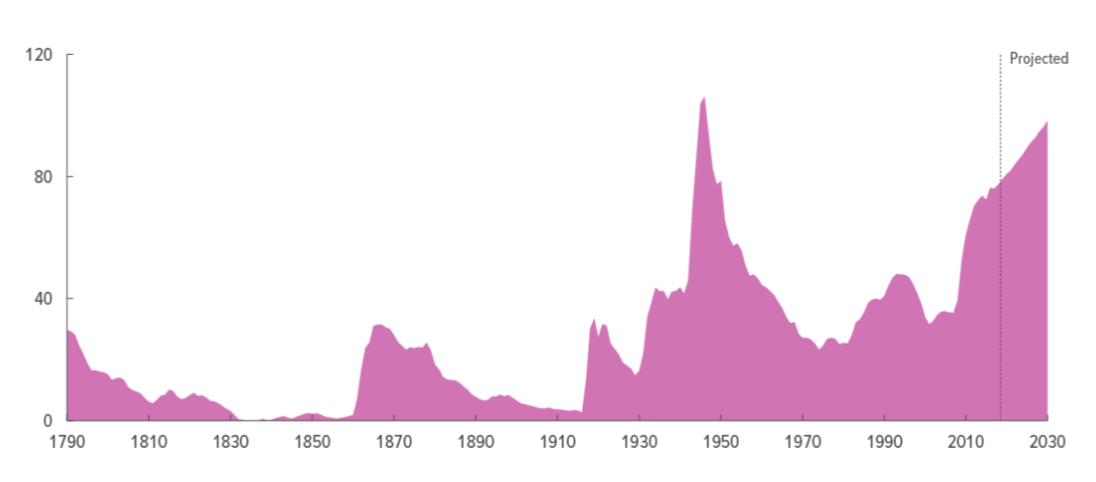

As national debt increases, the likelihood of repayment decreases. This decline in credit quality typically means that higher interest rates must be offered to entice other countries to continue to purchase our debt. More debt and rising rates mean greater debt-service (interest) payments, which will likely be funded by the issuance of even more debt. While the pressure on rates should be mounting, and rates should be rising, the Federal Reserve appears willing to purchase debt to continue to finance U.S. spending and keep rates low. So while rates should rise, they may not—at least not to any free-market level, and we are left to wonder if there is a limit to the amount of debt the Fed can absorb to keep rates low.

In a balanced-budget world, increasing interest payments would mean less money available for national defense, infrastructure, or programs such as social security and Medicare, but the U.S. has not had a balanced budget since 2001. Instead of making difficult decisions to balance spending and revenues, since 2001 politicians have chosen to have their cake and eat it, too, financing greater levels of spending with debt issuance and no crowding out.

TINA (There Is No Other Alternative) is an investment term that currently applies to equities. With conditions rife for inflation, dollar devaluation, and rising interest rates, savings and fixed income investments face potential significant headwinds. Additionally risk-taking is encouraged as the Federal Reserve and Federal Government use bailouts to prevent markets and industries from collapsing. Add in easy access to low-cost borrowing and it is not difficult to understand why too much money chasing equities has resulted in the S&P 500 reaching new highs.

The implications laid out here lead to growing wealth inequality. Debt issuance and a rising stock market benefit corporations and investors, particularly owners of equities, real estate, and hard assets. Those with small investment portfolios, and those culturally disposed to rent rather than own assets— benefit less from rising asset values but feel the sting of inflating prices. Today’s younger generation, a group that saw their parents harmed by the housing crisis, rent rather than invest in assets: cars are leased, music is subscribed to (Spotify), movies are rented (Netflix), cellphones are leased, apartments are rented. This creates a growing chasm between the owners of those assets and those paying for their use.

These conditions create class envy and ultimately social unrest. We do not know when this will end, only that it cannot continue forever—no individual or country ever spent its way to prosperity. Even if enough politicians gathered the fortitude to flatten the debt curve, by Japan’s example, the result is decades of stagnation.

So MCM seeks to protect its clients. We advocate short-duration fixed income against potentially rising rates. We seek alternatives to traditional fixed income and search for uncorrelated yield. We recommend real estate exposure and diversified equities holdings to capture the equity expansion trend. We monitor Washington’s policies, to help clients preserve wealth. Finally, we are acutely aware of risk, of what each of the aforementioned elements could do to the markets. This outcome is not inevitable. Whether through innovation or the American willingness to do the right thing after exhausting all other possibilities, it can still be avoided. We hope that is the case. We are prepared for it not to be.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...