At Manchester Capital Management, we have always believed that real estate can be an excellent long-term store of value —in today’s market, however, success increasingly depends on owning the right assets in the right places. The US commercial real estate landscape is in transition. Years of tightening monetary policy and price corrections have given way to a period of slow recovery, where discerning investors can find compelling opportunities in regions and property types supported by strong demographic and economic momentum. This is where we feel MCM excels — helping our clients cut through generalizations and find value where others may see only uncertainty. This month, we’re pleased to feature insights from Corbin Rich, Managing Director and Head of Real Estate, who offers a thoughtful update on the current state of commercial property markets and the key trends shaping future opportunities.

I often get this question about commercial real estate. Most recently it was asked by a client selling an investment property and wondering how likely it would be for them to complete a successful tax-deferred exchange. Commercial real estate is nuanced and varies significantly depending on the property type and market. Answering this question requires a macro analysis and then a deeper dive into how various property types and regions are performing.

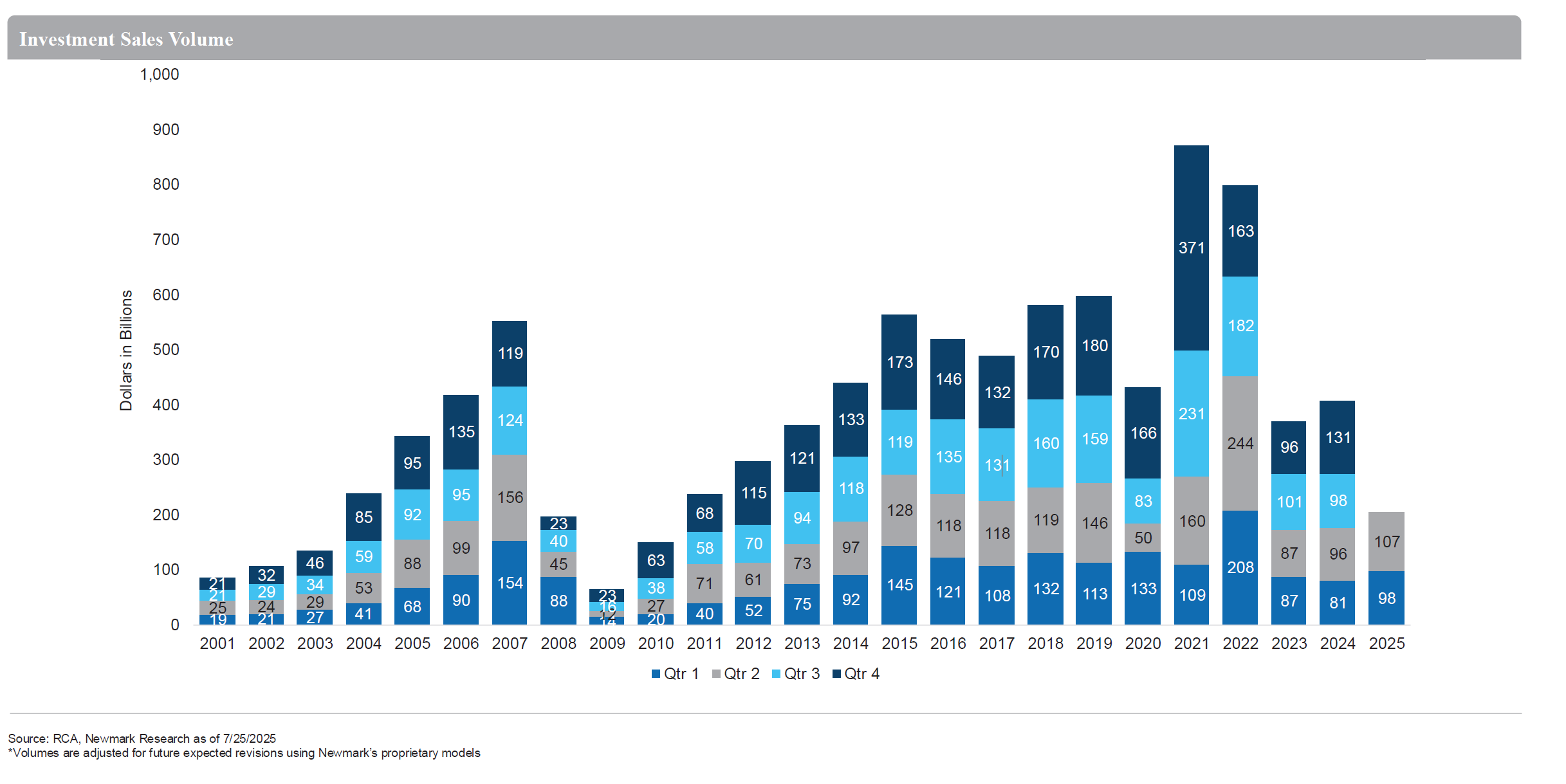

Commercial real estate investment sales volume set an all-time record in 2021, followed by a slight decline in 2022, and a significant decline in 2023. Transaction volume has been slowly recovering since and was up 16% year-over-year for the first half of 2025. Senior housing sale volume increased by 103% year-over-year, followed by a 63% increase for development sites and a 26% increase for office sales. Apartments experienced the largest sales volume – $65 billion through midyear, followed by $40 billion for industrial properties.

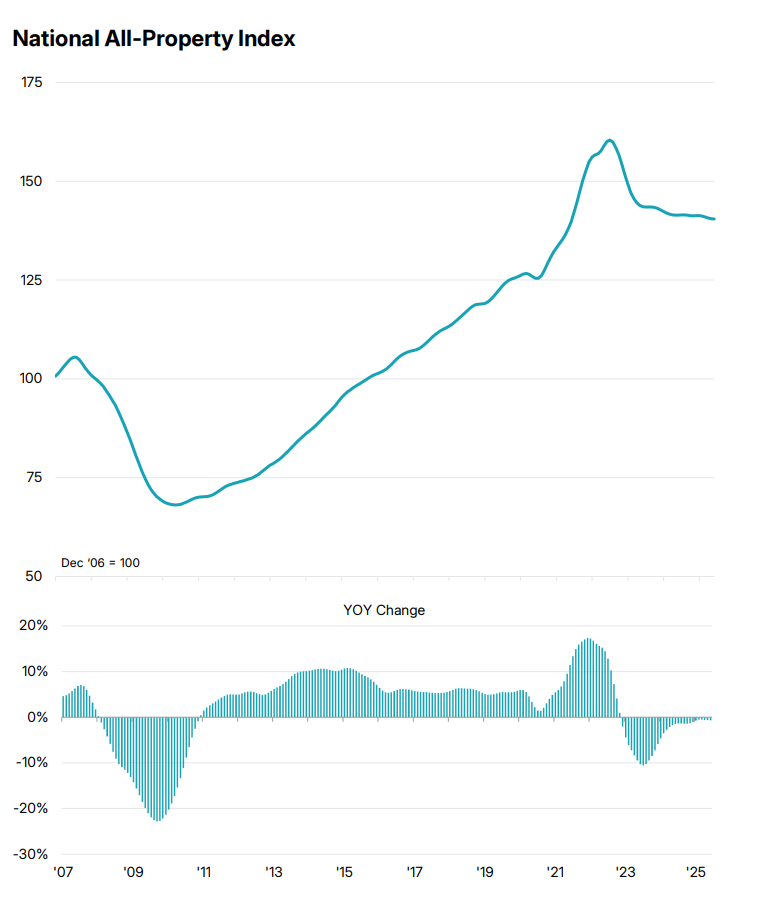

Average pricing across the four main commercial property types is down 12.2% since the summer of 2022. During this time, office, multifamily, and retail properties have seen declines of 25%, 19%, and 6%, respectively. Industrial properties, on the other hand, are priced 8% higher than three years ago. Improving costs of capital have also led to higher sales volume. Since peaking at the end of 2023, interest rates have been slowly declining.

Since 2016, office, retail and industrial investment have all moved South. Sunbelt markets like Dallas, Houston, Phoenix, and Miami have gained market share over the last 10 years, and Sunbelt transaction volume share increased from 35% in 2016 to 47% in the second quarter of 2025.

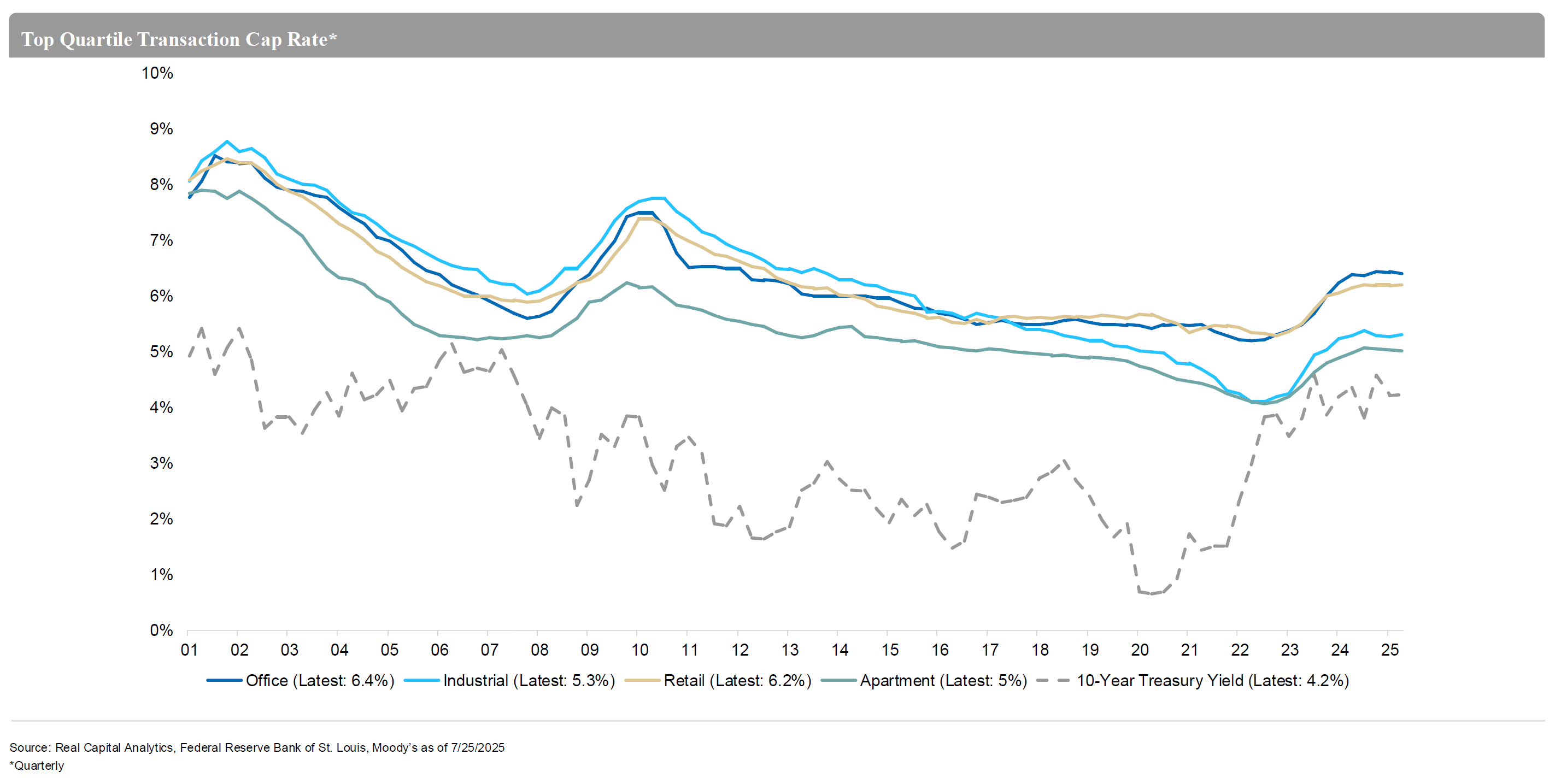

Average capitalization rates (“cap rates”)* steadily declined across all property types from 2008 to 2022. Cap rates then increased by roughly 100 basis points from 2022 to 2024 and have since flattened out. High-quality apartment and industrial properties are transacting around 5.0% cap rates. Class A retail and office are generally around 6.0% and 6.5-7.0% cap rates, respectively. Of course, these are very broad generalizations, and the cap rates vary further by market and property specifics.

Generally speaking, the market seems to be slowly recovering from a period of tumultuous monetary policy. Year-over-year price declines have flattened out, and sales and debt origination volume are increasing. We believe that commercial real estate remains an excellent long-term store of value, but it has become increasingly important to hold assets with sound use cases in markets with foreseeable tailwinds.

*Capitalization Rate – A capitalization rate (cap rate) is a financial metric used to estimate the potential return on investment for an income-producing property, assuming no financing is utilized. The cap rate is calculated by dividing the property’s net operating income (NOI) by the purchase price or market value.

Sources

Newmark

Morgan Stanely Capital International

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements. As with any investment, there is the risk of loss.

For ultra high-net-worth (“UHNW”) families, integrating health into wealth planning isn’t optional — it’s essential for legacy,...

Can you invest in a way which is environmentally and socially conscientious while still producing solid returns? ESG—shorthand for Environmental,...

At Manchester Capital Management, we have always believed that real estate can be an excellent long-term store of value —in today’s market,...