Frequently misunderstood elements of homeowners’ insurance and structural problems in the homeowners’ insurance industry can create problems for an unwary consumer. Several of the families we work with in California and Florida have received letters from their insurance providers informing them that the companies will no longer provide them with insurance. Additionally, in performing risk reviews for new client families, we often find gaps in coverage related to common misunderstandings. To illustrate how these insurance concerns might arise we dive into the fictional tales of woe of siblings John and Jane Doe, both of whom received such non-renewal letters.

John Doe lives in California, the golden state and land of wildfires, mudslides, and earthquakes. John paid high homeowners’ insurance premiums to protect him from these risks and even understood that earthquakes were excluded from most policies and required separate coverage. John had learned that lesson the hard way, having moved to California from Washington, D.C. after the 2011 D.C. earthquake.

Thinking both that earthquakes never happen outside of California, and that his D.C. homeowners’ policy would cover an unlikely earthquake, John was forced to pay for his property damage himself and vowed never to make that mistake again.

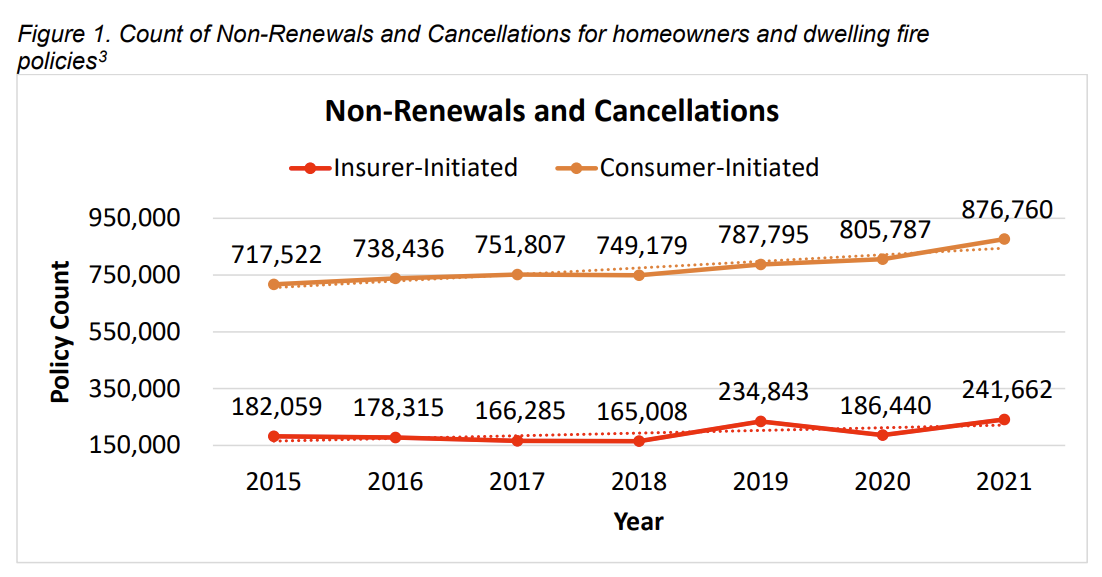

All was well for John in California until his sewer drain backed up, flooding the first floor of his house. Flood coverage, like earthquake coverage, is excluded from most policies and typically must be purchased separately. While a burst pipe will likely be covered, sewer backups, mudslides, overwhelmed sump pumps, and other flood-related issues are usually not. Then, in 2021, John received his non-renewal letter. According to Evan Greenberg, the CEO of Chubb (a high-end insurance provider), Chubb would end coverage in many key California areas because Chubb could not “charge an adequate price for the risk.”

In California, regulations require home insurance premiums to be based on historic loss data rather than projections for future losses that can be determined by catastrophe modeling. These models reflect detailed, location-specific data that can be vital to proper underwriting—for example, a wildfire has destroyed the natural vegetation that is used to prevent mudslides in a community. Rather than risk underpricing insurance, some insurers are walking away, leaving homeowners with few, and possibly less financially secure, insurance companies as their only option.

John’s sister, Jane, a Florida resident, faced her own insurance difficulties. Before Jane received her non-renewal letter, she faced two insurance challenges. The first related to the loss of a valuable heirloom piece of jewelry that had been in the Doe family for generations. When Jane submitted a $20K claim for the item, she was shocked to learn that her homeowners’ policy, like most policies, came with low coverage limits for jewelry—in her case $5K. Her agent informed her that, going forward, if she wanted to cover valuable individual pieces, including art, wine, and antique furniture, those would have to be listed individually on a schedule.

Shortly thereafter, a census taker slipped on a dog-toy walking up to Jane’s door, broke a hip, and ended up suing her for an amount that exceeded Jane’s policy coverage. After the event, Jane’s ever-helpful insurance agent explained that, going forward, she could purchase relatively inexpensive liability insurance that would provide coverage beyond standard coverage limits. The agent advised umbrella or excess liability was very well worth the minimal additional cost.

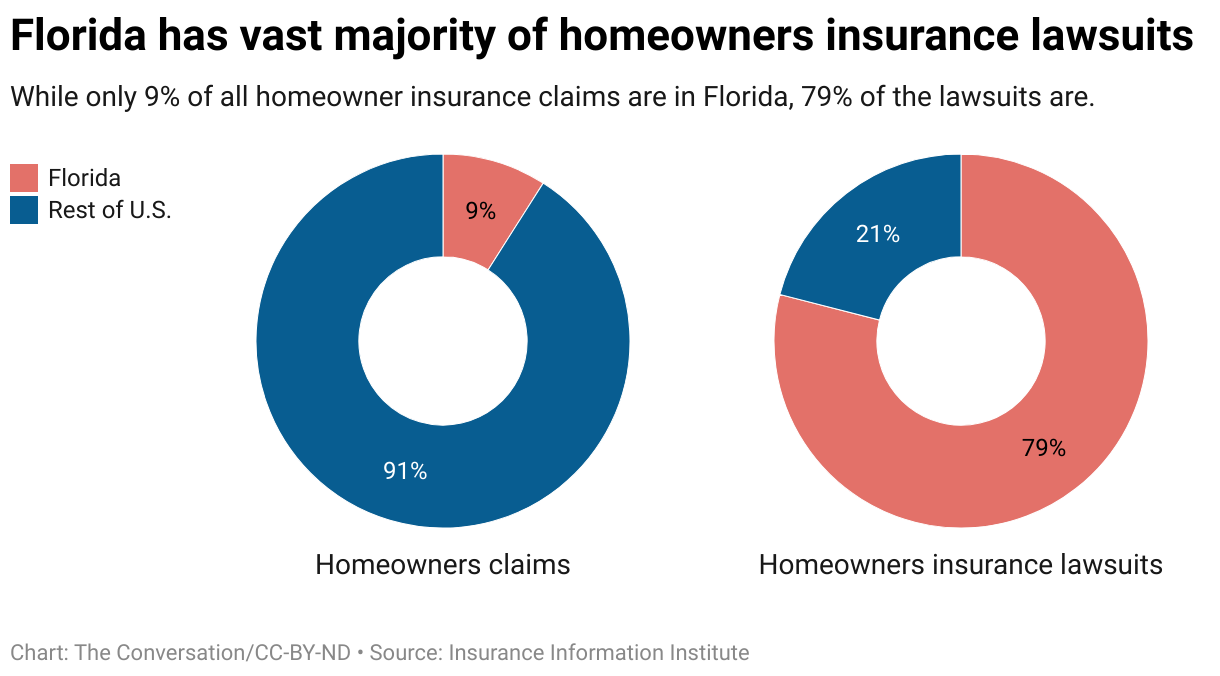

While these issues were expensive irritations, it was hurricane Ian that shed light on a serious problem in the Florida homeowners’ insurance market. Following the storm, a contractor offered to replace Jane’s roof (a $50K job), which was aging but had only suffered minimal damage ($10K), at no cost to her—she simply needed to sign over an “assignment of benefits,” which would allow the contractor to collect directly from Jane’s insurance company. The contractor completed the work, and without Jane’s knowledge or consent, billed the insurance company $60K for the job. This put the insurance company in a bind—either they pay the exorbitant bill, or deny the claim, force the contractor to sue, and fight the expensive battle in court.

Jane received her non-renewal notice—her insurance company was pulling out of Florida. When Jane asked her agent why, the agent explained that although only 9% of homeowners’ insurance claims originated in Florida, 79% of all lawsuits related to homeowners’ insurance claims were filed there, many due to assignment or benefits issues. In 2019 alone, Florida insurance companies spent $3B fighting lawsuits, and despite charging premiums that were almost triple the national average, many insurers couldn’t turn a profit between claims and lawsuits.

While California and Florida clearly have homeowners’ insurance issues unique to each state, policy nuances like flood and earthquake coverage, umbrella policies, and specific item coverages are not unique. These risks should be assessed for each individual homeowner, particularly those with wealth and property to protect. Understanding risk, potential exposure, and ability to absorb losses are very important elements in deciding whether to pay for or decline, any of these coverages.

Please, do not be like our fictional siblings—reach out to us if you would like our assistance in reviewing your individual situation and to consult with your insurance adviser.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

A consistent request from almost all families Manchester has served over the last thirty years is for guidance on how to talk about money. Both...

Manchester Capital's Managing Director, Christine Kaming Tomas recently sat down with Rabbi Yechezkel "Zeke" Moskowitz, a third-generation business...

Investing is more than a financial exercise. The most seasoned investor feels a twinge of fear and concern when volatile markets react negatively to...