For more than three years, the United States economy has been working through a massive set of disruptions related to the COVID pandemic, the subsequent policy responses, and the second-order effects of those responses including a spike in inflation, interest rate volatility, evolving living and working patterns, and accelerating technological innovation. These disruptions have touched nearly all aspects of our daily lives with significant reverberations throughout the real estate industry.

Real estate is inherently cyclical and highly dependent on capital markets and debt for liquidity. Commercial real estate in particular has seen tremendous impacts from these recent disruptive forces. Transaction volume initially dropped and subsequently skyrocketed during the pandemic as stimulus and historically low interest rates drove investors into any assets offering positive yields. As a result, valuations increased as investors drove pricing higher in auction processes. Rents, particularly in the apartment and industrial sectors, increased substantially due to strong demand from tenants.

More recently, the sharp rise in interest rates by the Federal Reserve in their fight to rein in inflation has reversed many of these trends. The same factors that drove the unsustainable trends of 2021 and 2022—namely low interest rates and ample liquidity—are now normalizing and bringing down transaction volumes and asset valuation.

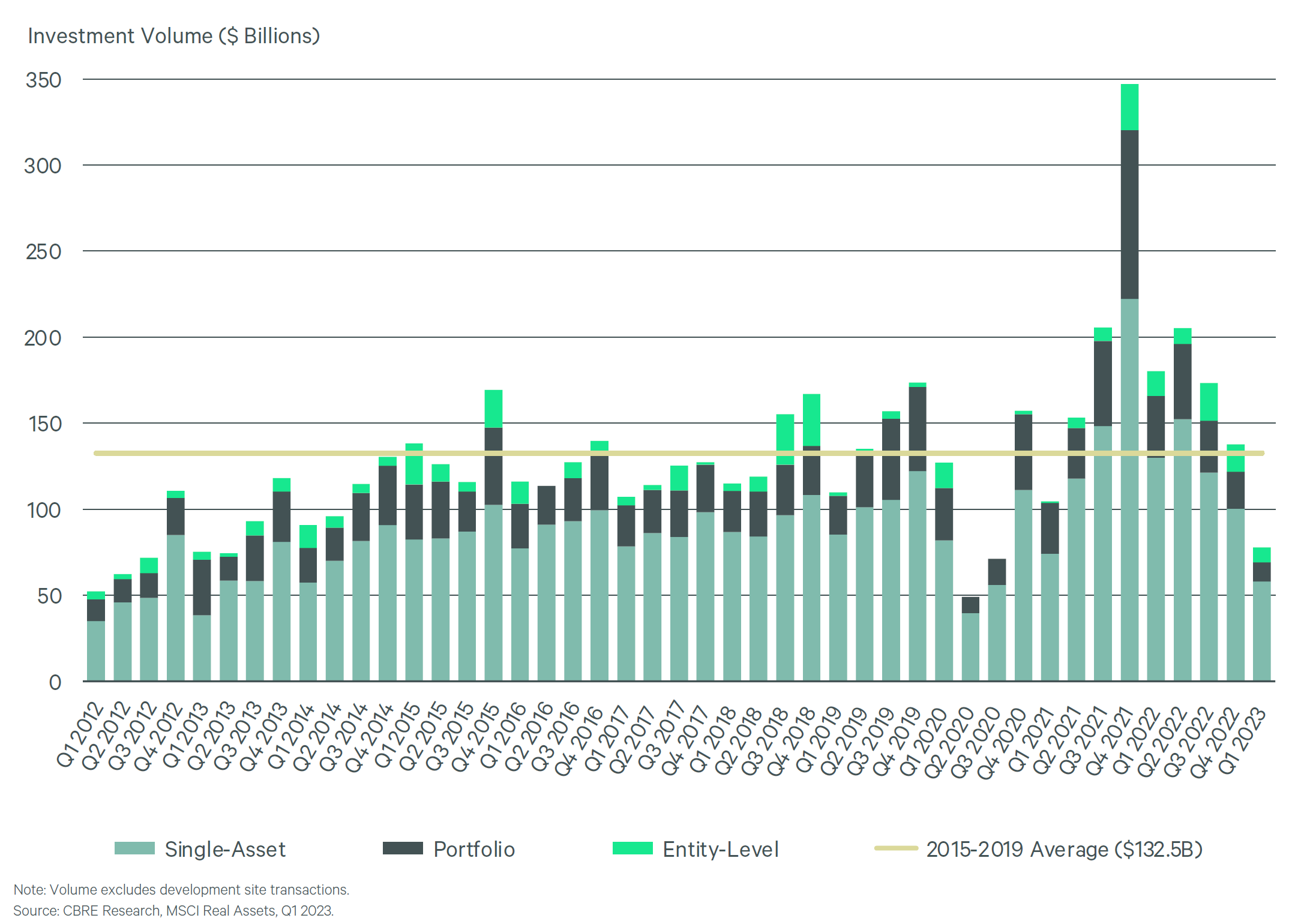

Following an unprecedented spike in transaction volume in the 4th Quarter of 2021, transaction volumes have dropped significantly, including a 57% year-over-year decline in the 1st Quarter of 20231. With many sellers anchored to the peak pricing of only a few years ago, and buyers expecting lower prices in the future, few transactions are getting done. We expect this bid-ask spread to narrow in the second half of 2023 and into 2024 as investors’ pricing expectations adjust to the current environment.

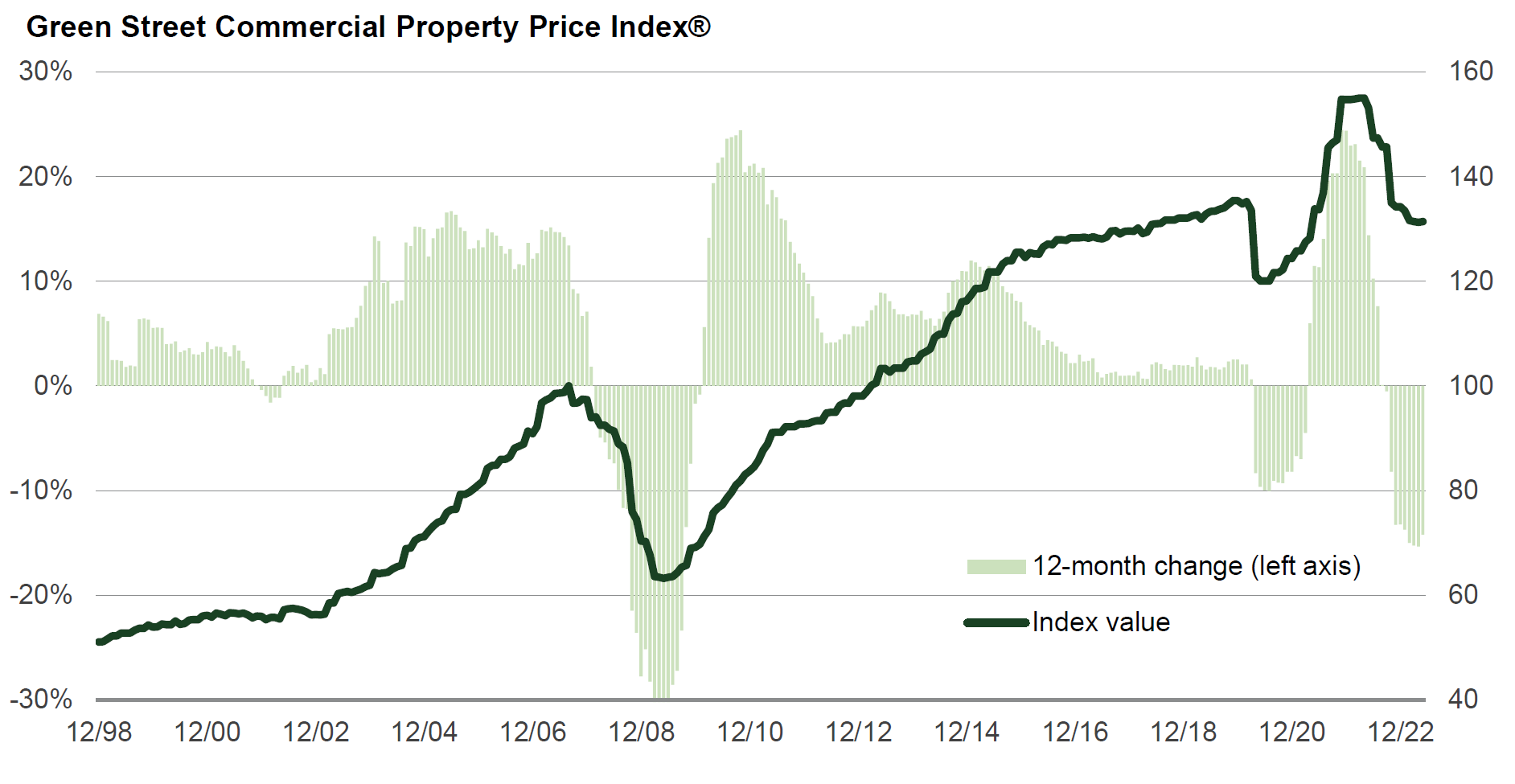

According to Green Street, a commercial real estate analytics provider, asset valuations have dropped approximately 15% from their peak in March of 20222. This followed a nearly 51% increase from the depths of the COVID market disruption. The chart above shows that the current market volatility is the highest it has been since the Great Recession in 2008.

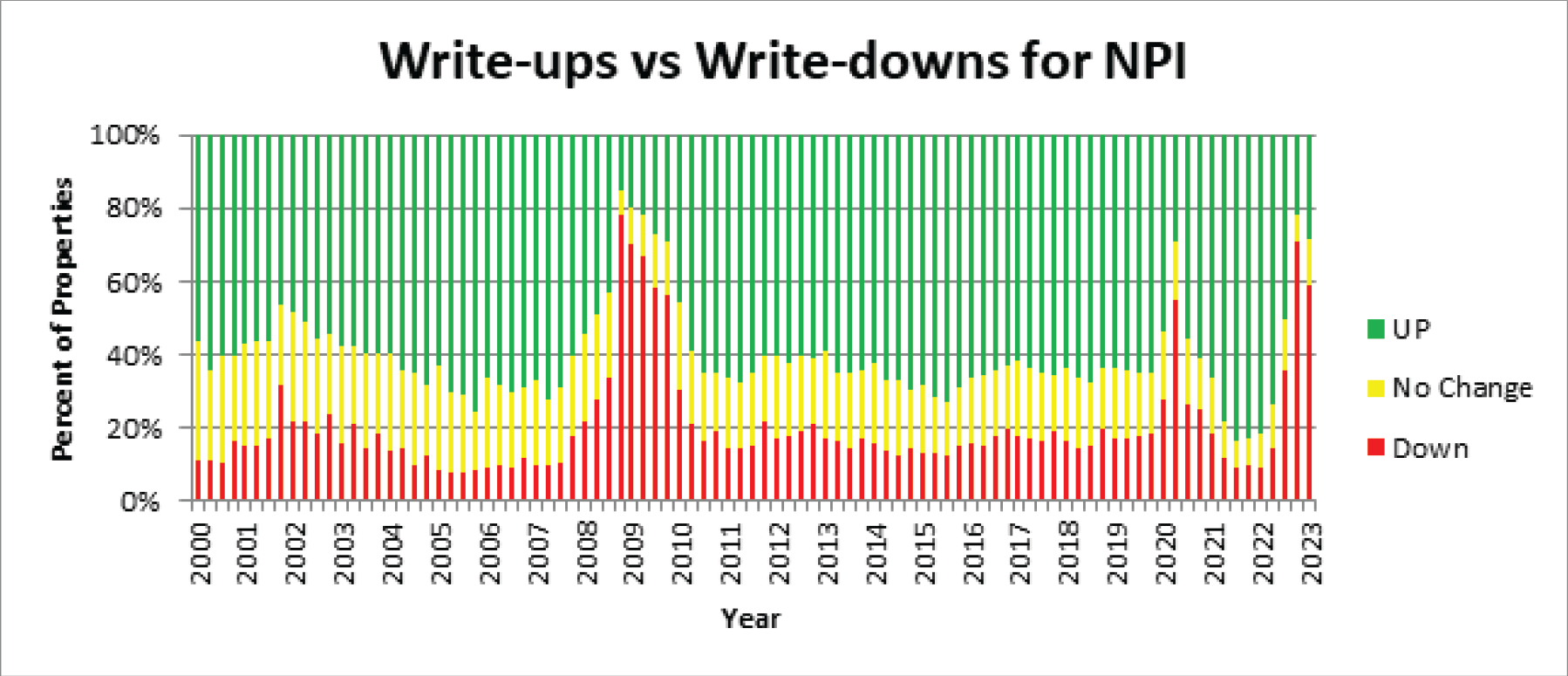

The NCREIF Property Index (“NPI”) tracks private real estate and is widely used in the industry for measuring various aspects of real estate performance. As the nearby chart illustrates, the NPI has seen a major uptick in the number of properties experiencing write downs with approximately 60% of property valuations being written down in the 1st Quarter3. This means that private valuations are adjusting, albeit at a slower pace than public REITS, to current conditions.

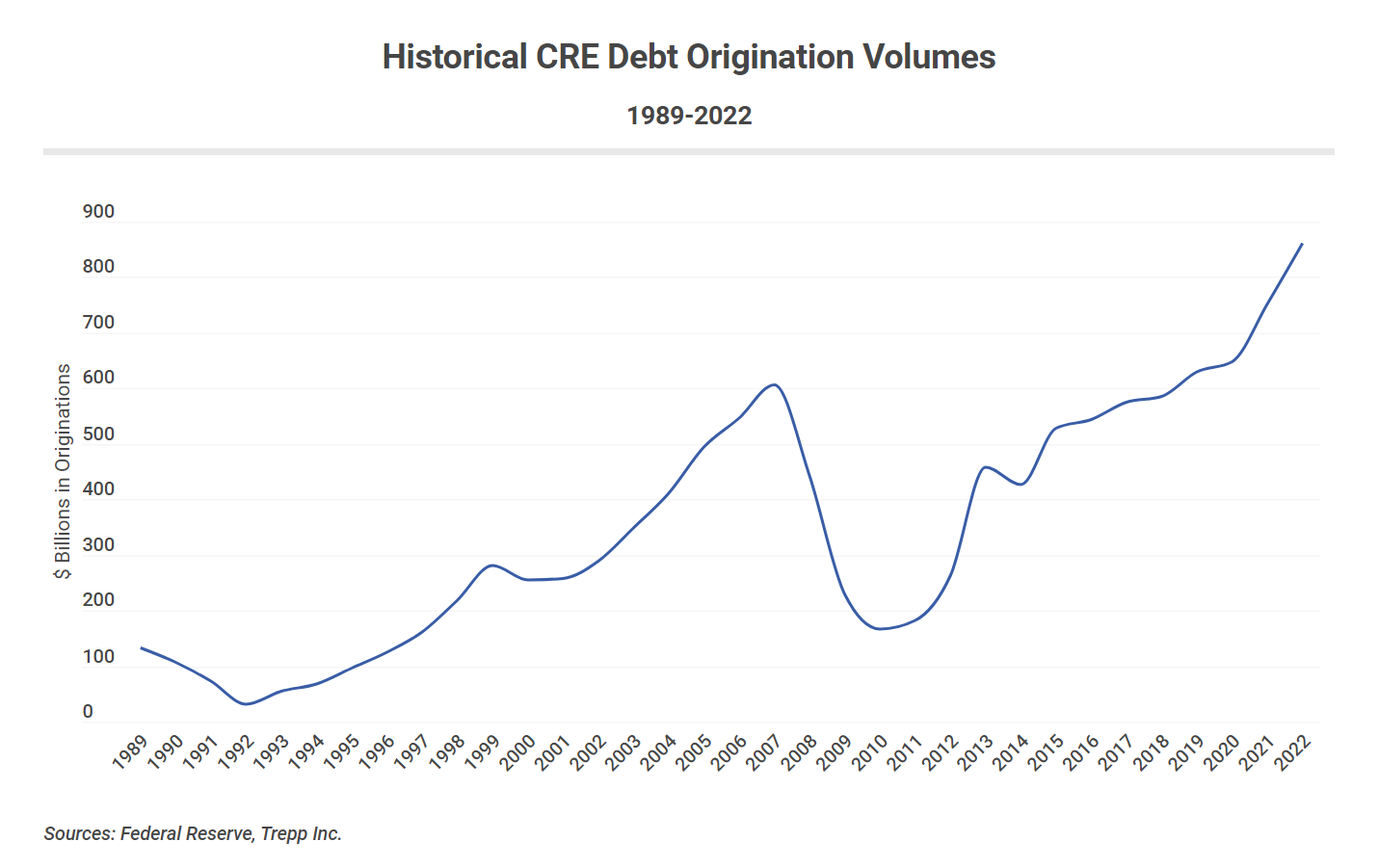

According to Trepp, a real estate finance data provider, the historical commercial real estate loan origination volume grew to $860 billion at the end of 20224. Anecdotally, lending has dropped significantly since then as banks have been forced to reassess their exposures following the failure of Silicon Valley Bank, and appetite from buyers has dried up in the face of increased interest rates. That said, in our discussions with originators debt remains available for core, stabilized properties with rates ranging from 5.5% to 7% – a stark difference from the rates of 3% – 4.5% available just two years ago. Office real estate is an outlier, with little to no appetite from the lending community for new loans.

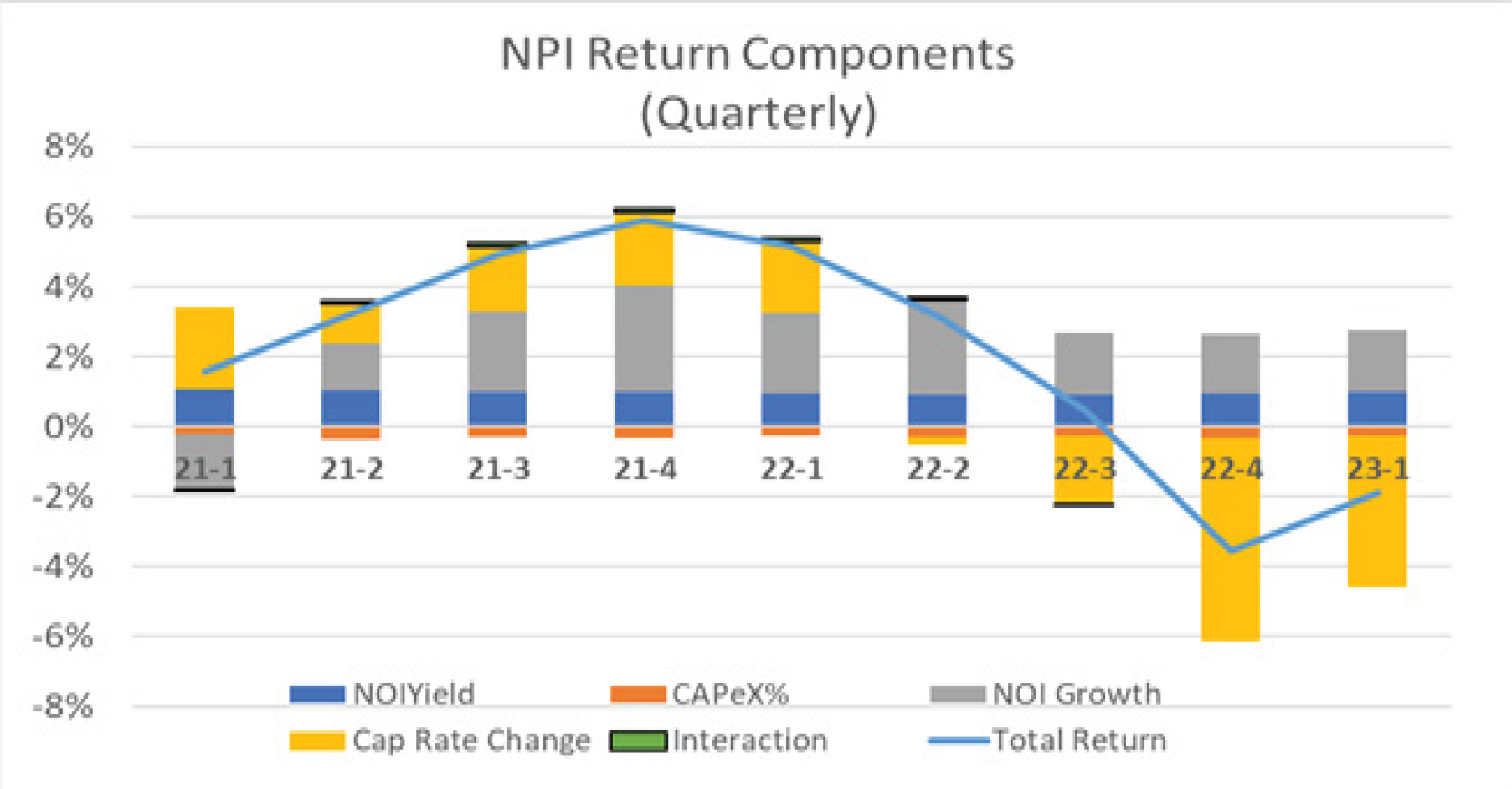

Outside of the office sector, property fundamentals remain relatively healthy with occupancy and rent growth both positive. Within the NCRIEF Property Index, income and growth returns are relatively stable with recent negative returns being driven by valuation factors3.

For as long as the debt markets remain unsettled, we would expect to see muted transaction volumes and continued uncertainty as investors work through the process of price discovery. Within our portfolios, we are focused on defensive leasing strategies, retrenching and shoring up liquidity where necessary, and looking to deploy capital opportunistically into new assets where pricing makes sense.

For more thoughts on investing across cycles, we encourage readers to revisit two prior Insight pieces: Investing Across Real Estate Cycles and Commercial Real Estate: Understanding What You Can and Can’t Control.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

It is once again that most joyous time of year where we step back to take time with our families, reflect on the accomplishments of the year that has...

For ultra high-net-worth (“UHNW”) families, integrating health into wealth planning isn’t optional — it’s essential for legacy,...

Can you invest in a way which is environmentally and socially conscientious while still producing solid returns? ESG—shorthand for Environmental,...