Mid-term elections are typically characterized as a referendum on the current Presidential administration and often elicit strong feelings from voters on all sides. “The economy” is usually expressed as a top concern of the electorate. Capital market returns pre and post election are by no means predictable but tend to follow certain patterns.

President Biden’s approval ratings have hovered in the low 40% range for most of 2022. Since 1936, only six Presidents have had approval ratings this low headed into the midterms. In all six cases, there were no instances of post-election seat gains in Congress for the President’s party. Could results be different this time? U.S. elections are a snapshot in time capturing voter sentiment on the first Tuesday in November of every even year. The confluence of distinctive present-day concerns (geopolitical, economic, policy, etc.) make each election cycle unique.

According to an August 2022 Wall Street Journal poll, those polled rated “The Economy” the most critical issue for the upcoming election. “Abortion” and Inflation” ranked second and third, respectively. Ninety percent of respondents also said they would “definitely” vote in the November election. This looks to be a tight race combining a highly polarized electorate with many contentious issues in play.

The current inflation rate of 8.2% is the second highest ever during a mid-term election (1974’s 11% was the highest). The Federal Reserve is raising short-term interest rates to fight persistently high inflation. We expect rate hikes to continue through the end of 2022 and possibly into 2023. Rate hikes are designed to cool the economy and could cause a near term recession. High inflation, rising rates, and a cooling economy could dampen the Democrats prospects. Although, the strong labor market could provide a lift for Democrats.

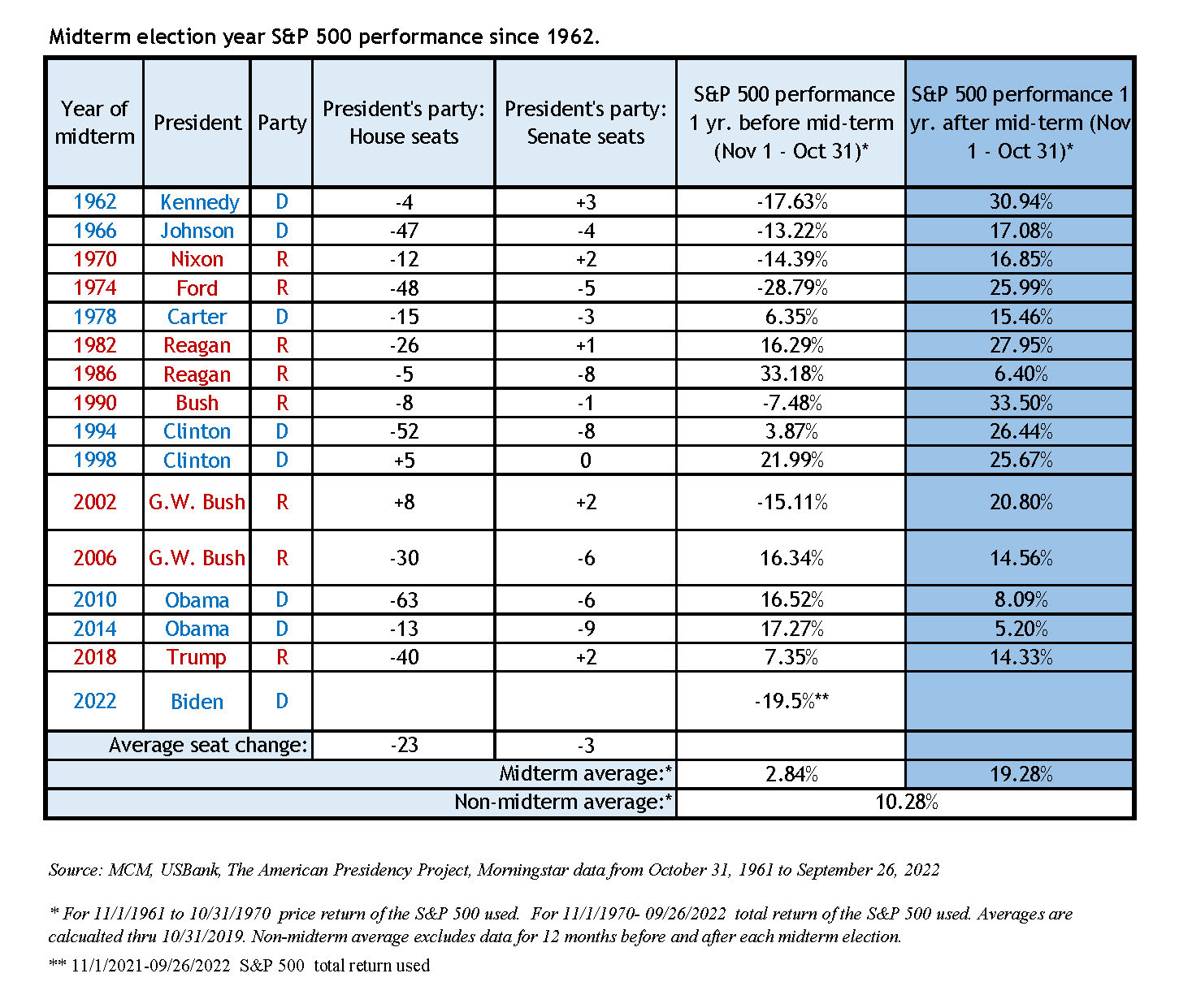

Market returns (using the S&P 500 index as a proxy) are historically volatile in the 12-month run-up to a mid-term election and typically strong in the 12 months following a mid-term election. Since 1962, the 12 months preceding a mid-term election have generated an average annual return of 2.84% with a range of -28.79% to +33.18%. Every 12-month period following a mid-term election (since 1962), the S&P 500 has generated positive performance, averaging 19.28%. This result is interesting but certainly not predictive of future returns. This positive performance occurred regardless of which party controlled the House, Senate, or the Presidency. As can be seen in the table below, neither party can claim to be “better” for capital market returns.

Control of the House of Representatives, the Senate, or both changed from one party to the other during every mid-term election since 2006. This is noteworthy because it only happened in two other mid-terms (from 1962 to 2004). Interestingly, the S&P 500 return has been positive in every year leading up to a mid-term election from 2006 to 2018, averaging 14.37%/yr. It is also counterintuitive that average market returns have been higher in years where party control flipped in one or both houses of Congress. Increased political volatility does not equate to negative market performance.

Elections and candidates often elicit strong feelings on both sides. Consider the two previous administrations of Obama and Trump. These candidates differed sharply in their politics and approach to policy. However, returns on the S&P 500 were above average during both Presidencies with compound annual returns (during time in office) of 14.45% (Obama 2009-2016) and 16.05% (Trump 2017-2020).

So, what does all this mean? First, the economy is always at or near the top of the average voter’s agenda (unless there is a major war going on). This year is no different with the S&P 500 in bear-market territory, with persistently high inflation, and with the Federal Reserve’s inflation reduction program potentially pushing the economy into recession. Second, capital markets have done well (and poorly) under both parties and under all combinations of party control in Congress. Rational capital allocators (business owners and managers) can adjust to any market situation if they understand government policy (i.e., “the rules”). When it’s unclear what the rules will be in the near term, uncertainty increases. Third, long-term investors should avoid letting personal feelings about one candidate or party guide investment decision making. Quoting the legendary investor Warren Buffett, “If you mix politics with your investment decisions, you are making a big mistake. Each generation of Americans has been, and will continue to be, better off than the previous generation.”

We will publish another piece detailing our post-election strategic thoughts. As always, please feel free to contact your wealth manager to discuss any questions you have.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...