If you have seen your property and casualty insurance premiums rise significantly over the past several years, you are not alone. Across the United States, coverage for homes, autos and valuable collections have increased at a double-digit pace.

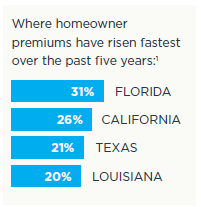

Unfortunately, few families can expect any moderation in the coming year, particularly those in higher risk “Cat-rated” areas. Affluent homeowners in Florida, California and several other states can expect to see premium increases of at least 20% and may also have to accept more restrictive coverage terms. Others may even have difficulty securing coverage at any price.1

Against that backdrop, here are some answers to questions you may have about the cost and availability of coverage to protect your family, your home and your possessions.

Presented here is an article by HUB International, republished by permission. Consult your insurance professional to discover why it’s happening, what to expect and how to minimize the impact.

The short answer is that premium rates reflect the risk of insured losses, and those payouts have increased steadily and substantially over the past decade. These losses are being driven by several factors:

Market forces within the insurance industry are also driving costs higher. To limit the potential payouts from catastrophic weather events, carriers turn to the reinsurance market. Demand for reinsurance capacity is outpacing the supply and reinsurers are adjusting to address those trends by limiting capacity, increasing their pricing, and restricting their terms and conditions. As a result, the cost of reinsurance rose by 25% to 40% in 2023 and will increase 10-15% in 2025.

Insurance is primarily regulated at the State level and varies considerably from one to the next. Charged with protecting consumers, these regulatory bodies institute measures designed to maintain a fair and orderly insurance market. Carriers that operate in compliance with their regulations, including caps on annual premium increases, are backed by State guarantees. If one of these “admitted” carriers becomes insolvent, the State covers the loss.

In States with the greatest risk of extreme events, notably California and Florida, well-meaning regulations are having unintentional consequences. Several large Private Client carriers have determined that the annual increases allowed do not justify the level of risk they are assuming. In California, several major carriers have filed for rate increases that are far higher than current regulatory limits,5 others have stopped writing new policies or are even exiting certain markets entirely. Several who remain will only write policies for Excess and Surplus (E&S) lines. In this non-admitted market, which operates outside State regulations and guarantees, premiums are higher and the terms less advantageous.

If you own a home in one of the more catastrophe-prone areas of the country like California, you may be able to retain admitted personal lines policies at a substantial increase in cost. If you are seeking a policy for a new, high-value home, or your carrier is dropping coverage in your neighborhood, the E&S market is likely to be your next best option. These policies cost far more than standard policies and typically cover far less than full replacement value.

According to Inside P&C magazine, lead carriers in the highest risk E&S markets will only insure 10% to 30% of replacement cost. Even then, demand for E&S coverage exceeds supply in some of the highest risk areas, leaving some high-net-worth homeowners with few options beyond self-insuring their homes.

Those who live outside of high-risk areas can also face difficulties securing coverage, particularly if their home is susceptible to water damage. This risk is particularly high in co-ops and condos, as water damage can easily spread across multiple units. So, if you live in a high-rise building, you may also face challenges in renewing your policy, and may also need to explore non-admitted solutions.

For homeowners who are unable to secure traditional insurance, or for those living in wildfire-prone areas, there is the California FAIR Plan. This plan was specifically designed to step in where the standard market falls short, but it’s important to understand what it offers—and what it doesn’t.

Here’s how it works:

The best way to control premium costs is to take proactive steps to decrease the potential for significant losses. Some of the more effective risk mitigation measures include:

Your family can also enhance insurability by reducing behavioral risks. Significant increases can be avoided by maintaining a clean driving record, particularly if you have young drivers on your policy. It’s also important to reduce liabilities by promoting generally prudent safety practices among your children and any of their friends who spend time at your home.

In this environment it’s particularly important to pay all your premiums on time, so your policy does not get canceled for non-payment. It will almost certainly be more expensive, and perhaps more difficult, to replace. You may also want to have your Risk Advisor explore opportunities to reduce premiums by consolidating policies at a single carrier.

The more complex your risk management challenges become, the more important it is to get expert advice. Your Private Client Risk Advisor is available to answer questions, address concerns and explore different strategies to help you protect your family, your home and your possessions. Whenever possible, seek out his or her advice proactively, prior to buying a new home or making major purchases that require insurance coverage. This will enable you to anticipate and address coverage issues and avoid unexpected concerns and expenses.

HUB International’s rate guidance comprises an analysis of proprietary national survey data and interviews with HUB personal insurance brokers and risk services consultants who specialize in serving personal lines business. On average, rates for middle- to upper-middle-market companies are experiencing rate increases for nearly all coverages as carriers need additional premium to support increased losses and expenses. Below are projections of rate increases that we anticipate in 2025. It’s important to discuss your unique exposure with your insurance broker and understand what to expect well in advance of your next renewal.

| Coverage | 2025 Private Client Rate Guide | Insights |

|---|---|---|

| Auto | +8% to 10% | The market is striving to achieve adequate rate levels within state regulations, a process that is anticipated to take several years. Rate increases for autos persist to counterbalance rising costs for labor, medical and replacement vehicles. The increased use of vehicle technology has also affected the value of replacement parts and influences the need for additional rate increase. Distracted driving is the main source of claims activity, an underwriting concern for both frequency and severity. The uptick in auto claims from natural disasters (flood, hail, etc.) compared to previous years remains a pain point. |

| Homeowners | +10% to 12% | Capacity continues to tighten in some regions, including the Midwest, prompting carriers to leave the market entirely rather than increase rates. Unprecedented challenges driven by natural catastrophes, such as wind, flood, earthquake and wildfire losses, continue to affect the homeowner’s market. State insurance funds can offer crucial property insurance where the private market might fall short, providing broader coverage access for owners in high-risk areas. Rates continue an upward trajectory due to increased labor costs and shortages, elevated claims activity and extended timelines for repairs and rebuilds. |

| Personal Umbrella | +10% to 15% | Social inflation remains a primary underwriting concern for umbrella policies, especially in jurisdictions with a history of high dollar verdicts. Expect increasing severity and frequency of auto claims to raise personal umbrella premiums. |

| Catastrophic Perils | +10% to 12% | Underwriters continue to grapple with the onslaught of extreme weather-related events — convective storms, wildfire and the Atlantic wind/hurricane season (June 1 to Nov. 30). Expect rising reinsurance costs to drive rate increases for catastrophic-exposed areas. Fewer traditional homeowner insurance companies are writing risks in CAT-prone areas. Many homeowners may need to tap into state insurance funds or the non-standard excess and surplus (E&S) markets for coverage, which is typically priced 30% to 40% above the standard market. |

| Specialty; Motorcycle, RVs, Watercraft | +5% to 12% | Much like the automobile market, specialty coverage lines will increase to offset losses driven by labor costs, vehicle replacement costs and medical expenses. |

Disclosures

Manchester Capital Management published this article with permission from: HUB International Insurance Services Inc. HUB International Services Inc, 818.257.7480 | max.gilman@hubinternational.com, its employees, and affiliates does not provide legal, tax or investment management services.

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements. As with any investment, there is the risk of loss.

It is once again that most joyous time of year where we step back to take time with our families, reflect on the accomplishments of the year that has...

For ultra high-net-worth (“UHNW”) families, integrating health into wealth planning isn’t optional — it’s essential for legacy,...

Can you invest in a way which is environmentally and socially conscientious while still producing solid returns? ESG—shorthand for Environmental,...