What do you call it if it looks like a duck, walks like a duck, but doesn’t quack like a duck? Inflation is soaring, economic growth is slowing, and global markets including stocks, bonds, and commodities are falling. It looks and feels like a recession to many market watchers. Yet unemployment remains at historic lows (3.5%) with an additional ten million job openings in America. How can we have a recession with increasing employment? Will employers cut back in the face of declining demand?

These conflicting trends are resulting in conflicted investors. Markets are experiencing dramatic declines or increases from one day to the next. In fact, the S&P 500 has seen its most volatile year since the bear market of 2009. During the first nine months of this year, 88% of the trading days had an intraday range greater than 1%. Investors struggle to identify where there is value and where there is risk. Does it matter if we call it a recession? How does the intelligent investor find the value in these times?

The traditional method to determine value is the Dividend Discount Model (DDM). For a company stock, for example, the DDM estimates the value of future dividends and discounts the value of those dividends to the present day using prevailing interest rates. As interest rates fluctuate, so too does the present value of those future dividends. An increase in interest rates means an investor will be paid in inflated dollars in the future making the investor inclined to pay less for the stock today.

The DDM model requires more than just math. The model also requires an accurate forecast of future interest rates and future corporate dividends, a very difficult and time-consuming task, especially during a rapidly changing economic landscape like in 2022. Because the DDM is highly dependent on difficult-to-forecast inputs, it functions more as a theoretical model than a practical model for investors.

A more common valuation metric is the Price-to-Earnings (P/E) ratio. The P/E ratio is a more direct measure used by investors because it relies on actual data, not forecasts. The P/E ratio of the overall market is calculated by dividing the price of a market index, such as the S&P 500, by the weighted proportion of the annual earnings (per share) of all the underlying companies.

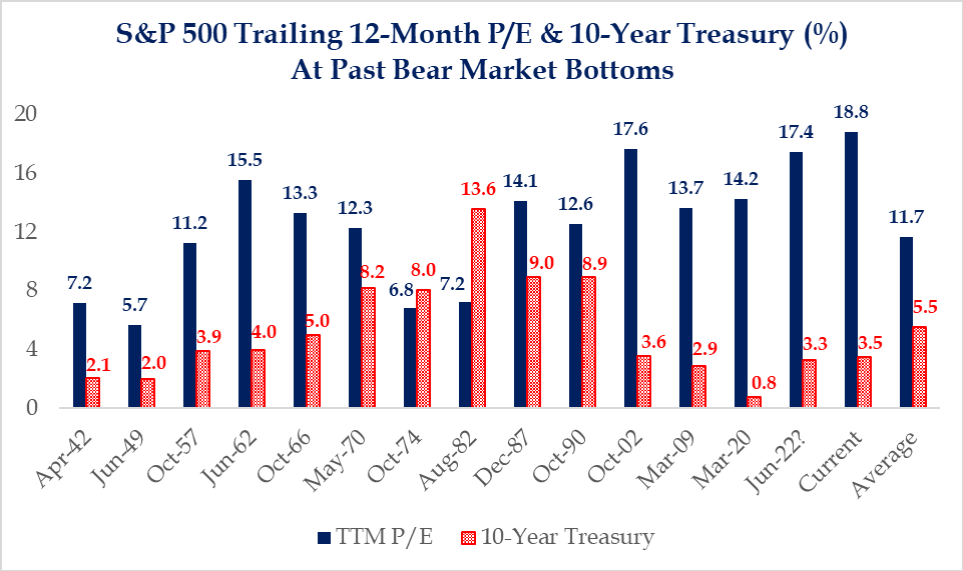

As of the end of September, the S&P 500’s price was $3,584 and the trailing 12-month earnings were $189, giving the market a P/E ratio of 18.8x. As you can see from the chart below, the market’s P/E is still relatively high when compared to previous bear market bottoms. The main difference between now and the last six bear markets is the inflation rate.

Inflation, interest rates, and the Federal Reserve are affecting both corporate earnings guidance and the market value (P/E) that investors are willing to pay for those earnings. The current inflation rate from September is 8.2% and the Cleveland Federal Reserve estimates that inflation for October will be 8.1%. Fed Chairman Powell has stated his intention to bring inflation down to a target 2%. If the Cleveland Fed’s projections are correct, Powell will have to continue to raise rates. Indeed, the surprising low unemployment number noted above is an important factor and makes us believe the Fed will not change course in the near-term.

We caution investors about the recent news that corporate earnings have increased. The S&P 500 earnings grew 10.5% for the first half of 2022 compared with the first half of 2021. However, many analysts are now projecting only 4.7% growth in corporate earnings over the coming four quarters, down from an estimated 9% growth projection earlier in the year. Early indications are that even these projections could be high.

Combined with high food and energy prices, these factors are likely to lead to reduced consumer spending and lower corporate earnings, which puts additional pressure on the markets. The Federal Reserve’s current path of interest rate hikes will likely slow the economy and bring inflation under control, which will be a great benefit to long-term investors.

Long-term investors understand that conditions such as we are experiencing today are storms that must be weathered. The Federal Reserve, after delaying for more than a year claiming inflation was “transitory,” has finally embarked on a serious course to bring inflation under control. Historically, that course of action results in market pain after which follows a recovery period of sustained prosperity. We encourage clients to ensure they have sufficient cash available to meet short-term needs and advise sticking to one’s long-term investment plan.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

It is once again that most joyous time of year where we step back to take time with our families, reflect on the accomplishments of the year that has...

For ultra high-net-worth (“UHNW”) families, integrating health into wealth planning isn’t optional — it’s essential for legacy,...

Can you invest in a way which is environmentally and socially conscientious while still producing solid returns? ESG—shorthand for Environmental,...