Intuitively, it seems that Presidential elections must affect markets. After all, markets prefer stability and predictability, and Presidential elections introduce the potential for significant change. What will be the policy focus for the next four years? What sectors of the economy will be promoted and supported and which will be targeted? How will the elected President interact with foreign leaders and how will that affect global stability, supply chains, and energy prices? All this uncertainty, particularly when elections are forecast to be close, should lead to greater market volatility.

In reality, economics and market performance affect Presidential elections. Consider recessions—of the 46 Presidents who have served, the six presidents who experienced recessions within two years before their re-election all lost. Twelve Presidents who experienced no recession in the two years before their re-election all won.1 Or consider market performance—since 1928, if the S&P 500 has a positive return in the three months leading up to a Presidential election, the incumbent party wins; if the S&P 500 has a negative return, the opposition party wins. This has been true 87% of the occurrences since 1928 and every time since 1984.2

Because economics and market performance affect Presidential elections, incumbent Presidents intentionally stimulate the economy leading into an election. Short-term methods for spurring the economy include tapping the Strategic Petroleum Reserve to lower gasoline prices, increasing government spending to provide jobs and incomes, and timing policies such as reducing taxes or increasing benefits, or even starting infrastructure projects so that the economic boost hits in the run-up to an election. The current cycle is a perfect example—the Biden administration has tapped the Strategic Petroleum Reserve to lower gas prices, forgiven student debt, is having the Treasury draw down the Treasury General Account (which increases overall monetary liquidity), and has directed spending on infrastructure, clean energy, and the CHIPs Act, to hit in the 2024 to 2026 period. It is also widely anticipated that the Federal Reserve will lower interest rates at their September meeting—a stimulative act in time for the November election.

Presidents typically make the largest policy changes in their first two years in office. In year three, the effect of those policies and any fiscal and monetary stimulus tend to be priced in by the market. The result is that year four typically has the smoothest quarterly returns of the four-year presidential cycle. In fact, between 1950 and 2018, year four returns have averaged 6.3% with the lowest quarterly return volatility.3

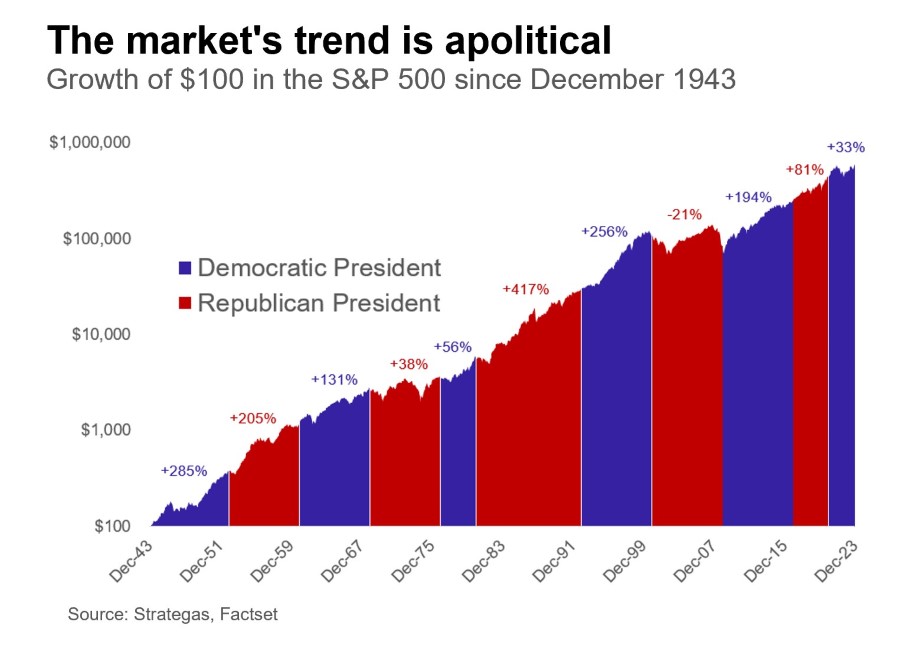

If Presidential elections do not affect markets, what does matter? The combination of the President and the Congressional makeup. As the nearby chart, “The market’s trend is apolitical” suggests, the overall march of the market continues under both Democrat and Republican presidents.

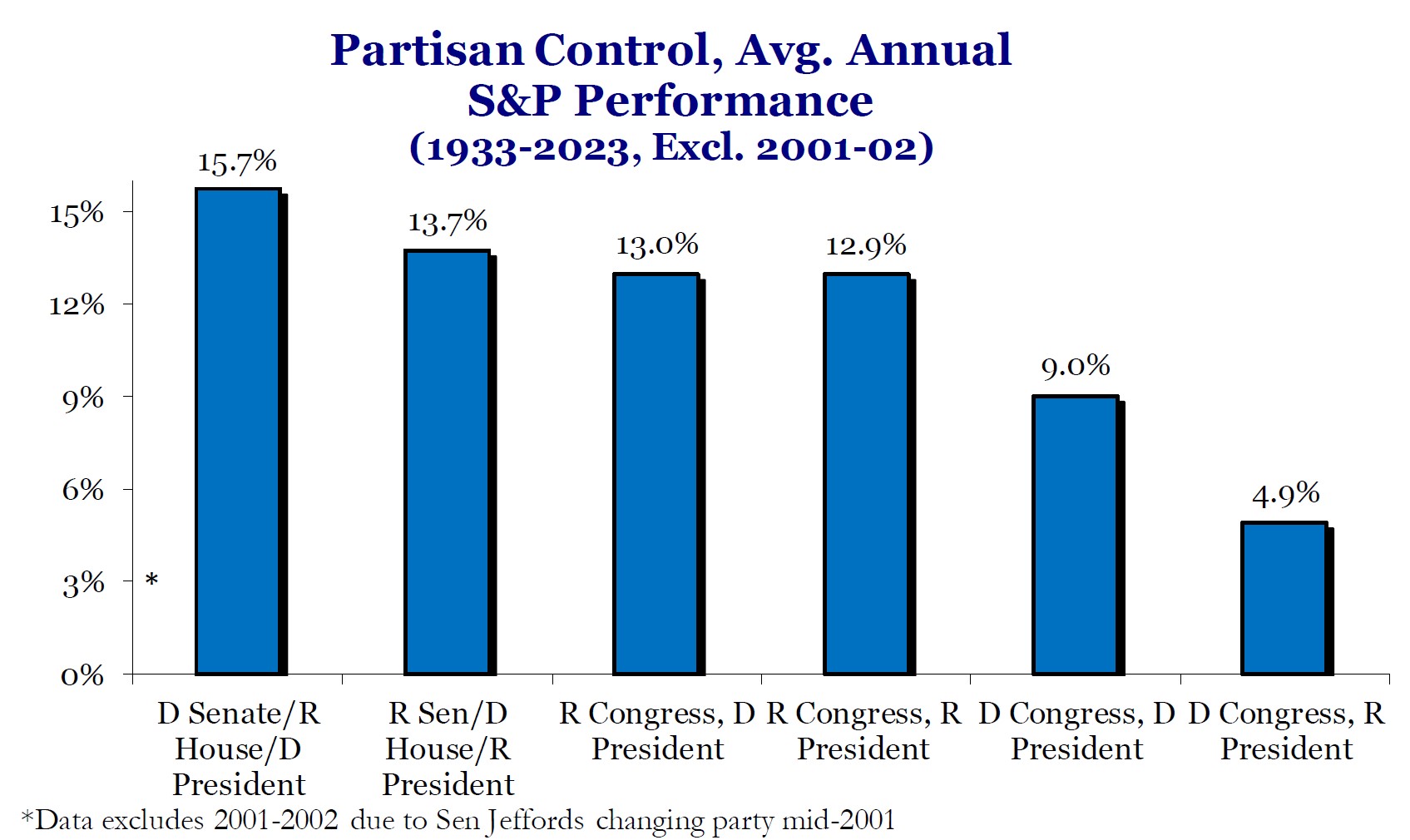

The strength of that progress, however, varies considerably depending on the composition of the three branches with divided government resulting in the strongest performance.

Remember, intuitively markets prefer stability and predictability. Divided government, with the opposition party controlling the House (thereby the “purse”) results in the best returns. One suspects the opposition party does not want to fund the majority’s priorities, so gridlock ensues. Single-party rule, whether Democrat or Republican, tends to lead to major policy changes, greater uncertainty, and lower market returns.

Whatever the composition of the White House and Congress after November’s elections, the new government will face significant challenges. Two wars (Russia-Ukraine and Hamas-Israel), a surging national debt ($35 trillion and rising), debt interest payments that now exceed $1T/year at an average interest rate of 3.27% (below the entire current yield curve), and a fiscal cliff with the expiration in 2025 of the Tax Cuts and Jobs Act reduction in personal and corporate income tax rates. Fortunately, corporate earnings estimates are forecast to grow 14% next year, which should be supportive of at least modest market growth while the market calculates what the new government is likely to change over the coming four years.

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking predictions or statements. As with any investment, there is the risk of loss.

For ultra high-net-worth (“UHNW”) families, integrating health into wealth planning isn’t optional — it’s essential for legacy,...

Can you invest in a way which is environmentally and socially conscientious while still producing solid returns? ESG—shorthand for Environmental,...

At Manchester Capital Management, we have always believed that real estate can be an excellent long-term store of value —in today’s market,...