The word recession has been thrown around a lot recently, causing jitters in the market. But recessions are just a part of an economic cycle, are to be expected, and as history shows, end with the economy growing again.

There is no official formula that defines a recession. A common rule of thumb is two consecutive quarters of negative gross domestic product. The actual determinants are more intricate. It is also almost impossible to perfectly predict a recession. As the old joke goes, economists have predicted nine of the last five recessions. But Monetary Policy and Fiscal Policy affect economic activity and can act as catalysts to cause and end recessions.

The Federal Reserve (“Fed”) guides U.S. Monetary Policy by trying to maintain stable prices (keep inflation low and steady) and support maximum employment. The Fed’s primary tool is the federal funds target interest rate (“Fed funds rate”). The Fed funds rate affects everything from the interest rate paid on savings accounts to mortgage interest rates. The Fed funds rate also sets the cost of money in the U.S. economy.

To paraphrase Milton Friedman, inflation occurs when there is too much money chasing too few goods. During periods of high inflation, the Fed raises the Fed funds rate to increase short-term borrowing costs, making loans more expensive and savings more attractive. This in turn discourages spending and encourages saving, slowing down economic activity, and reducing inflation. Conversely, in a recession, the Fed cuts the Fed funds rate, reducing short-term interest rates, and thereby making it cheaper to borrow and less attractive to save. This encourages spending and boosts economic activity.

Fiscal Policy, which is government’s spending and tax policy as decided by Congress, influences economic activity. During a recession, lower tax rates and/or increased government spending encourage demand and stimulate the economy. During COVID-19, approximately $4.5 Trillion [1] of fiscal stimulus was injected into the economy. This money boosted consumer and corporate spending, lifting the U.S. out of a recession quickly. Conversely, when the economy is booming, increased taxes and/or reduced government spending can help cool the economy.

Monetary Policy and Fiscal Policy both act with a lag — today’s actions will not be evident immediately and may not impact the economy for years. In addition, changes in Monetary Policy affect different parts of the economy at different times. Some sectors, such as housing, feel the effects of higher rates faster than other sectors, like the labor market. Monetary Policy and Fiscal Policy can also have opposing impacts, with one slowing the economy while the other accelerates the economy.

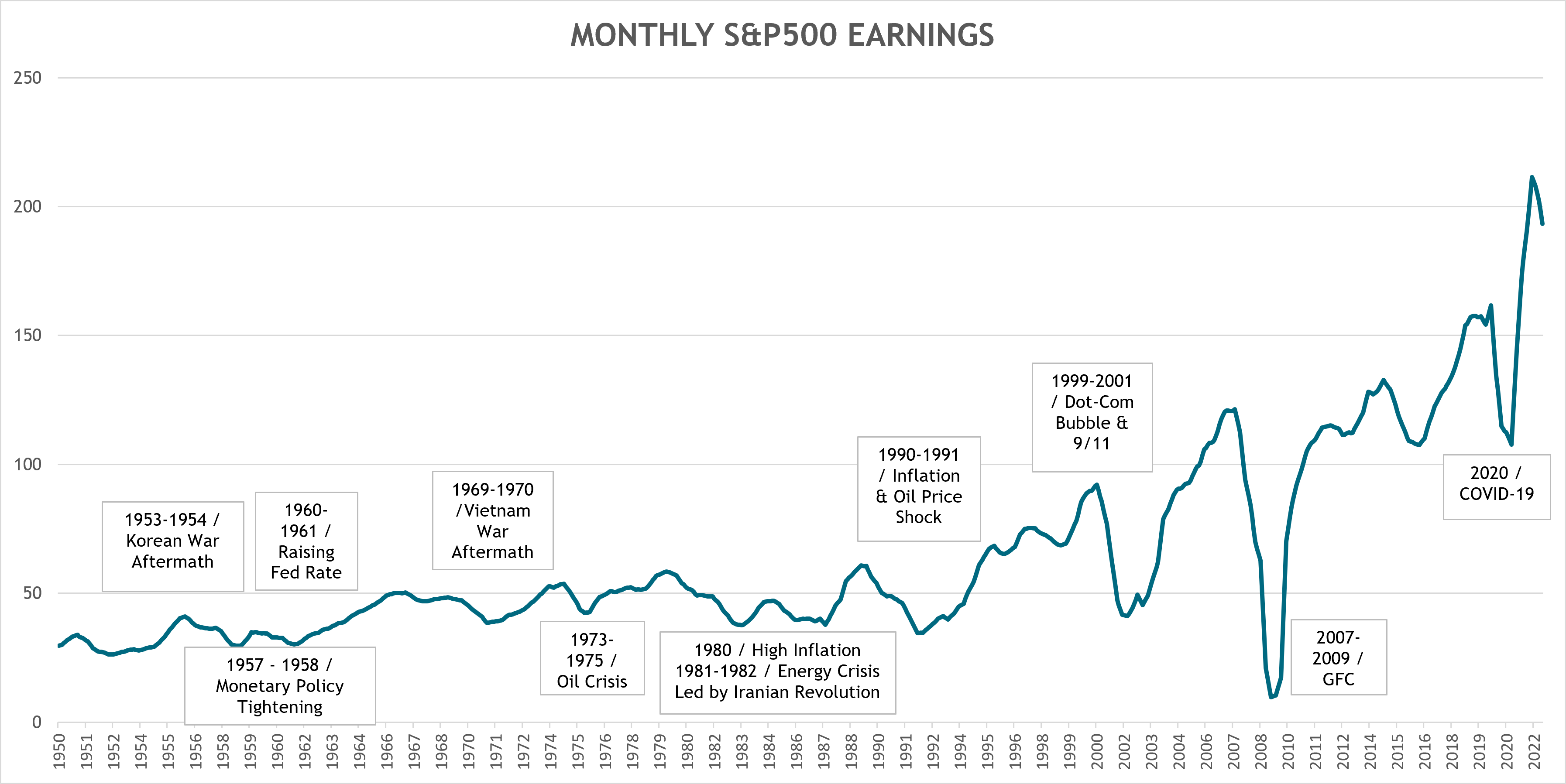

The amount of money flowing through an economy has a direct impact on corporate earnings. Corporate earnings are the main determinant of a company’s share price. Earnings expand when the economy is growing, and consumer spending drives up company profits. If consumer spending outpaces economic output, inflation results, pressuring the Fed and the government to tighten their policies and cool the economy down. When borrowing costs rise and goods and services become more expensive, corporate profit growth slows or retreats. The annual S&P 500 earnings (an indicator of the wellbeing of the U.S. economy) shown in the chart below demonstrates the relationship between earnings and recessions.

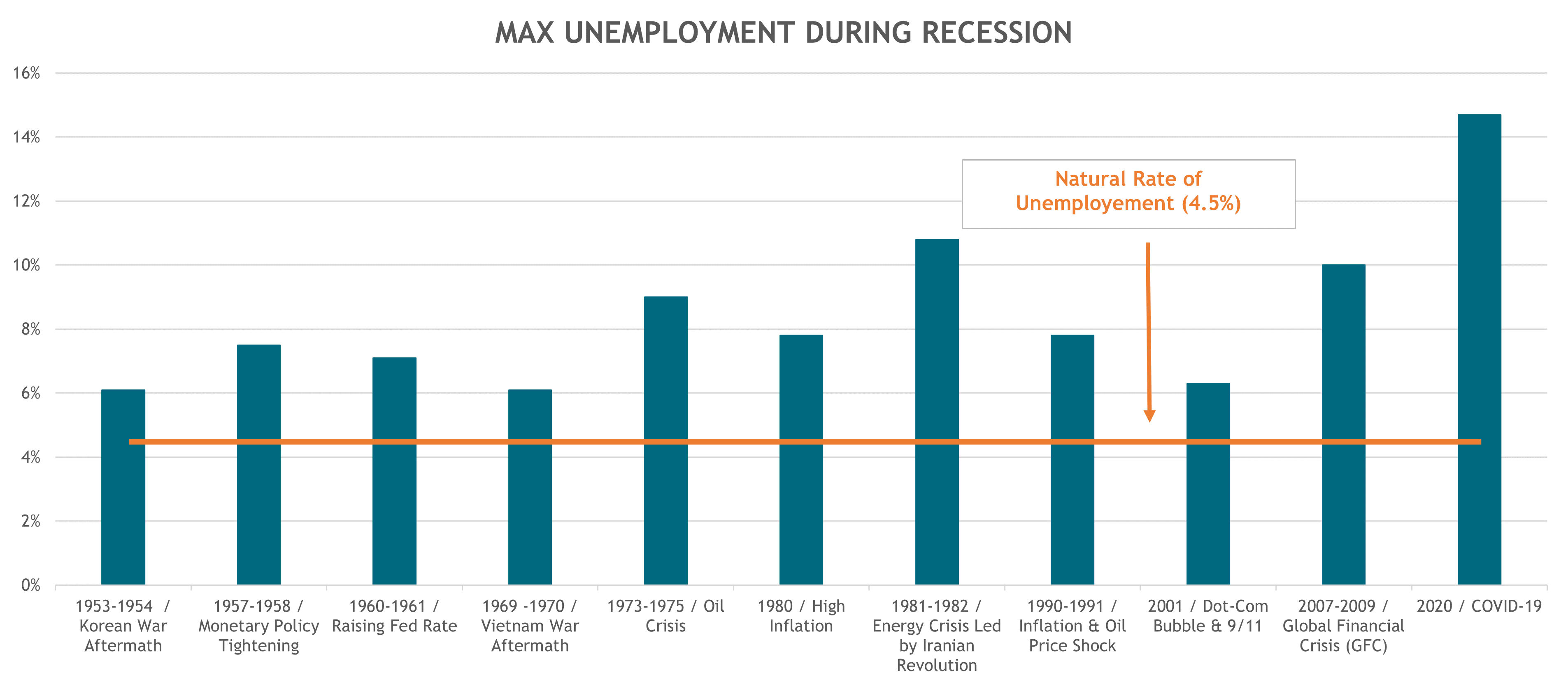

One likely response to falling earnings and profits are layoffs as companies seek to reduce spending. Since 1950, every recession has been accompanied by rising unemployment. The chart below shows the maximum unemployment rate during each recession since 1950. A 4.5% unemployment is considered full employment.

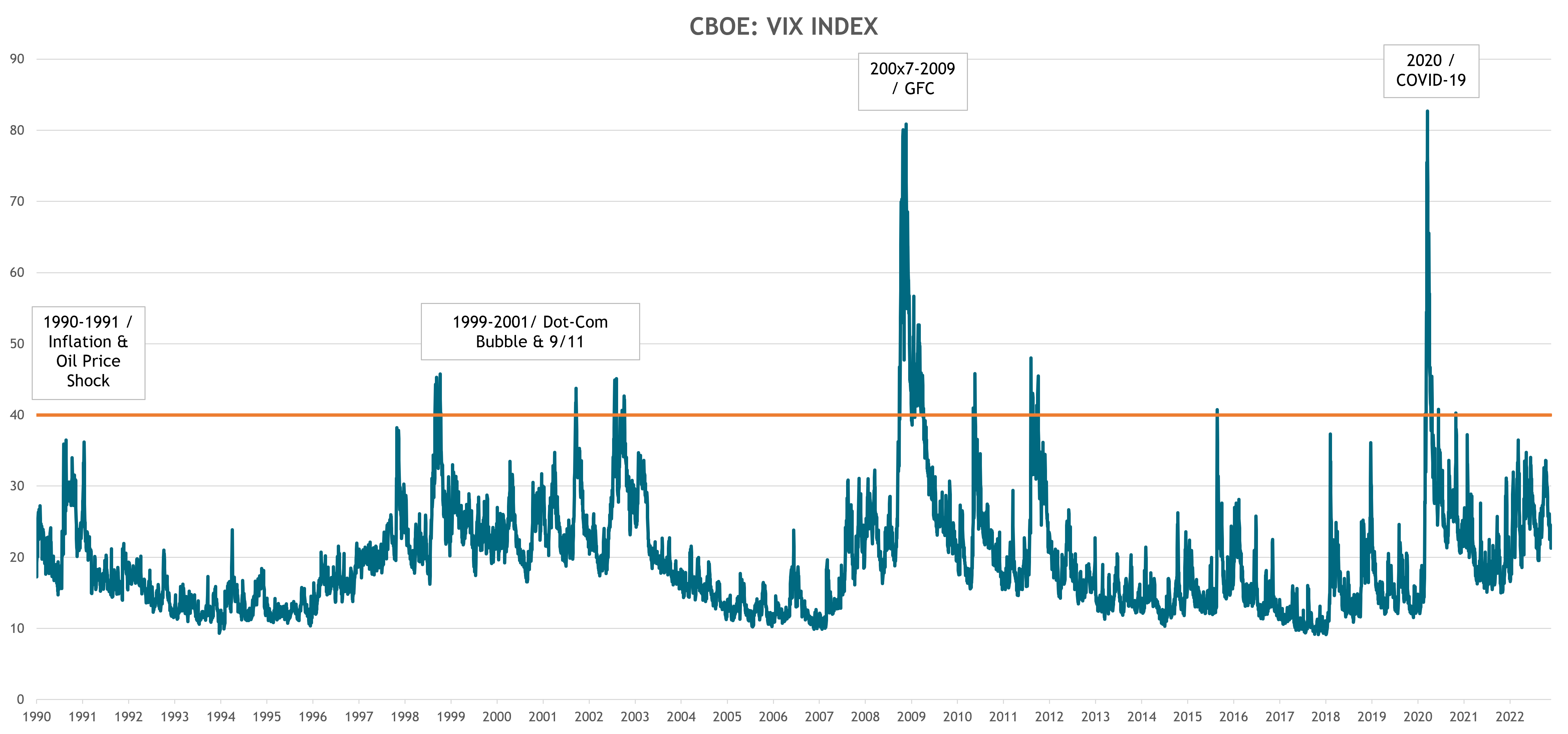

The volatility index (VIX) is a measure of how fast prices change and is designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market. It is commonly known as the fear index or fear gauge. The higher the VIX, the greater the level of fear and uncertainty in the market. Since the inception of the index, the VIX has spiked during recessions. In more recent years, that spike reached well over 40. When market participants become more optimistic (once the economy starts recovering), the VIX falls into the teens, reflective of a high level of confidence in the market’s future. Rising VIX levels can serve as an early indicator of a coming recession.

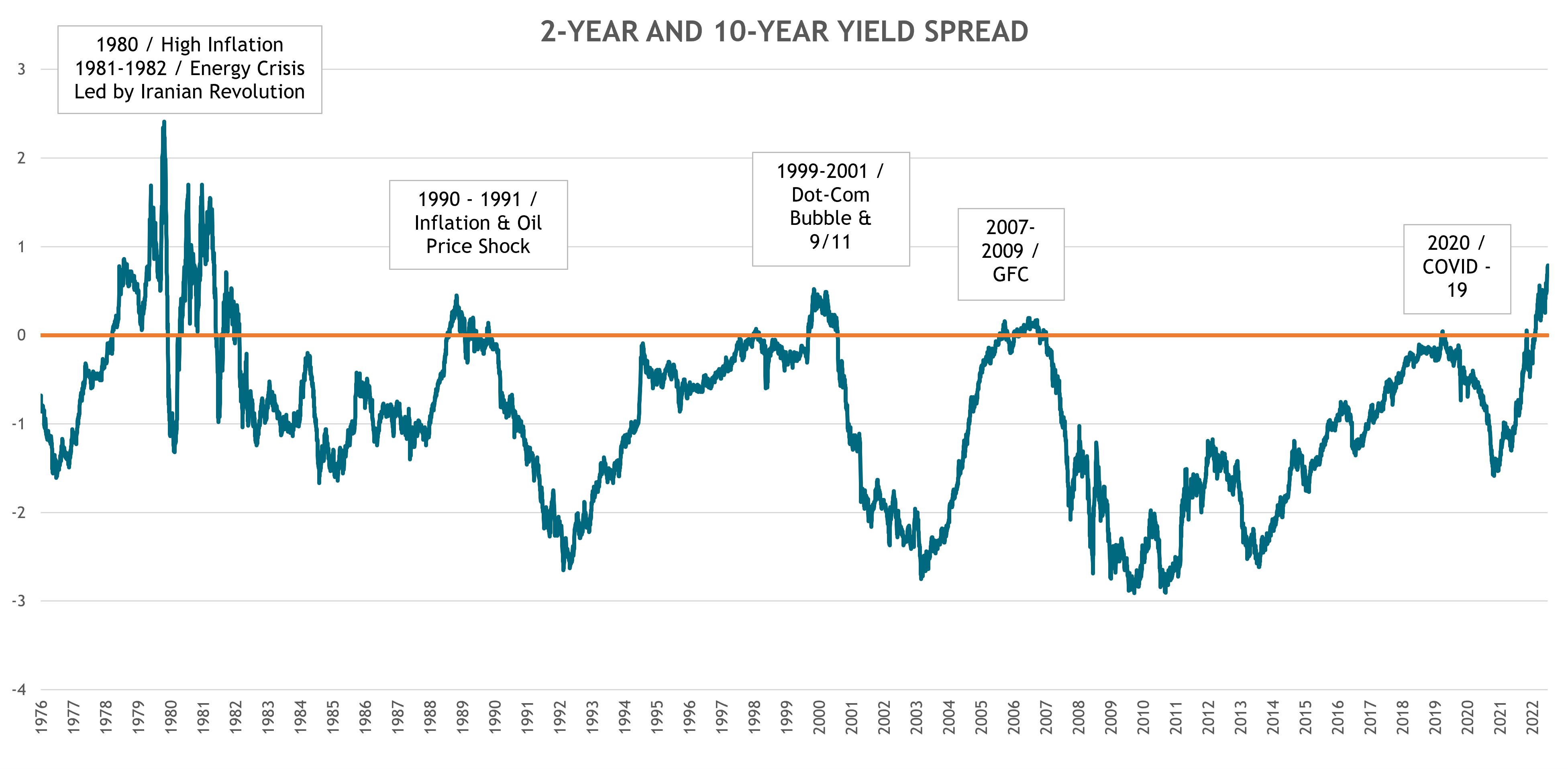

The yield curve has historically served as another indicator of a coming recession, specifically the spread between the 2-year and 10-year treasury bond yields. Normally, the longer the maturity of a bond, the higher the yield because investors demand greater compensation for taking more time-related risk. This means the 2-year yield should typically be lower than the 10-year yield.

However, when market participants suspect a recession is on the horizon, they sell short-term bonds to buy long-term bonds, driving down short-term bond prices and increasing short-term yields. Short-term yields can also rise because the Fed is acting to increase the federal funds rate, leading investors to sell short-term bonds and compound the increase in short-term yields. Thus, the 2-year yield can end up higher than 10-year yield when the market is in distress. The relationship between the 2-10 spread and recessions is shown below.

Currently, the U.S. is experiencing the highest inflation in the past 40 years, mainly caused by supply and demand imbalances. The goal of economic policies —to help balance supply and demand— has been difficult to achieve over the past three years due to the large global economic shocks of COVID-19 and Russia’s invasion of Ukraine. Today’s inflation has been a direct result of the stimulus policies enacted to counter the economic effects of the pandemic, along with the supply constraint caused by COVID-19. The Fed, addressing inflation, has acted aggressively raising interest rates, leading to increasing signs that the U.S. is heading into a recession:

The recession indicators are not universal:

Though it is difficult to conclude whether we are heading into a recession based on mixed signals from our indicators, given the tightening financial conditions, persistent high inflation and a hawkish Fed willing to risk a recession to quell inflation, we believe a recession will occur in the next 12-24 months. While history has taught us that recessions are largely unavoidable, a diversified portfolio can reduce the impact of a market drawdown.

[1] https://www.usaspending.gov/disaster/covid-19?publicLaw=all

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...