In my new role as Director of Impact Investing, I feel privileged to support our client families who have specific preferences regarding the way they steward their resources. This role is a wonderful opportunity for me to continue the work I have been engaged in for over 20 years as a student and practitioner in the field of sustainable and impact investing. Families with significant assets are uniquely positioned to leverage their investment portfolios for positive environmental or social impact, and in many cases without sacrifice to their expected financial return.

“Impact investing” is a modern term for a practice that can be traced as far back as the mid 1700’s, when the Religious Society of Friends (Quakers) refused to invest in the slave trade.1 The field started to gain momentum in the modern era following a push by investors to divest from companies doing business with the apartheid government in South Africa in the 1980’s.

Various names have covered the practice of values-aligned investing, including “socially responsible,” “sustainable,” and “ESG” (environmental, social and governance). Whatever the practice is called, the idea is to help investors incorporate an impact sensibility into their investment process to align their concern or care for the natural environment and/or social justice-related concerns for society at large.

Families often have well-considered and clearly expressed philanthropic goals. Those same goals can be reflected in their investment approach, though different tools and outcomes are to be expected when considering investments as opposed to grants or donations.

Families who have a carefully crafted investment policy statement (IPS) can codify their impact goals and incorporate specific processes to apply the family’s aspirations across their total portfolio.

The key idea is that all directed capital even with different risk and return expectations can play a role in making the world a better place. Three main sources of capital for addressing systemic risks are government, philanthropic, and private. By examining each specific family’s situation, Manchester Capital can help our clients identify the best type of capital to use (investment vs. philanthropic, equity vs. debt, liquid vs. patient) to achieve their goals.

Government has assumed a role in making society “better,” though what the role entails is often under intense debate. Government will nevertheless play a significant part in environmental and social justice outcomes through policy and regulation (or lack thereof). The U.N. Principles for Responsible Investment (PRI) has published a series of white papers describing what they call “The Inevitable Policy Response” to climate change.2 Investors, while able to vote or support campaigns or conduct public policy work, often have little to no control over specific publicly funded programs, especially outside their own communities.

Philanthropic capital is simply not plentiful enough to address the world’s need for investments to solve key issues like climate change, plastic pollution in the oceans, or disparities in opportunity for certain communities. According to the National Philanthropic Trust, Americans made grants of just over $471 billion in 2020.3 This figure pales in comparison to the estimated total U.S. stock market capitalization as of 9/30/2021 of over $48 trillion.4

We believe factors like pure efficiency and a closer alignment of dollars with objectives render private investment and private industry a significant and highly effective means to participate in solving the world’s most pressing challenges.

Every investor can play a part to move both invested (endowment) and granted (program-supported) philanthropic capital, as well as the vaster amounts of private invested capital, into thoughtful investing approaches that use the power of innovation to solve some of the world’s intractable issues. That is what impact investing really means: investing with purpose.

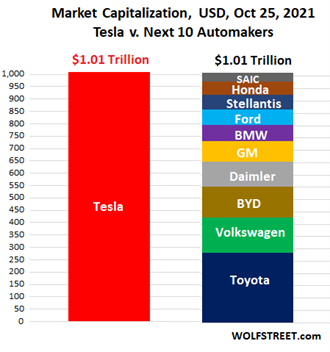

Interestingly, this is also where the notion that values-aligned investing underperforms traditional investing can be challenged. I believe that outsized returns in individual investments (and pooled strategies) can be achieved from companies that use sustainability themes as part of their business models. An example of this phenomenon is Tesla, which went from being a marginalized outlier in the automotive industry to capturing a market value equal to its 10 largest car company competitors combined in the space of only a few short years.5

I am not suggesting Tesla is a “perfect” company; it is not, even by ESG standards. The point is that innovation with sustainability as a driving force for financial performance can create real opportunities for investors, whether they are seeking to be values-aligned, profit-motivated, or both. The two concepts are not mutually exclusive.

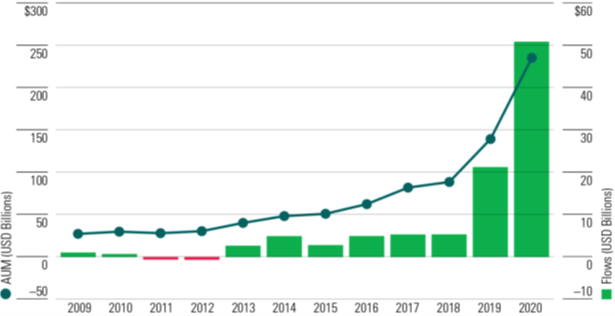

A key challenge for impact investors going forward will be to navigate the “gold rush” of players flooding the area for reasons having more to do with marketing than with making a positive difference in the world in any authentic fashion. This surge can be seen in the fund flows into ESG or sustainability-labeled funds. Statistics confirm that these flows have increased dramatically in recent years.6

Bloomberg’s ESG 2021 Midyear Outlook Report predicts continued and accelerating growth in ESG-focused assets going forward. 7

The ESG label can be easily manipulated, however, and we have noted that some asset managers have simply rebranded existing non-conforming funds with an “ESG” or “Sustainable” label as an excuse to rescue “out of favor” or “mediocre” funds while charging higher management fees than they otherwise could get away with.8

In this environment, investors will be challenged to identify these greenwashed, or otherwise inauthentic funds that would lead to misalignment with their actual goals.

The good news is that as the field of impact investing continues to scale up, more sophisticated evaluative and measurement tools are becoming available. At Manchester Capital Management, we aim to be the best in class for all the services we offer, including being able to help interested families integrate impactful thinking into their investment processes. We do this at the pace and scale appropriate to each family based on the issues they seek to address.

We believe that our fierce independence is a critical resource in doing this work. We look forward to facing our investment and impact challenges and opportunities head on, and I am grateful for the opportunity to be a part of the Manchester team in doing this work.

End Notes

6 Source: Morningstar. Data as of 12/31/2020. Includes funds that have been liquidated; does not include funds of funds

Disclosures

This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the author at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the author nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information.

Predictions, opinions, and other information contained in this article are subject to change continually and without notice of any kind and may no longer be true after any date indicated. Any forward-looking predictions or statements speak only as of the date they are made, and the author and Manchester Capital assume no duty to and do not undertake to update forward-looking predictions or statements. Forward-looking predictions or statements are subject to numerous assumptions, risks and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward- looking predictions or statements. As with any investment, there is the risk of loss.

Today’s most dangerous cyber threats don’t come from hackers breaking into systems- they come from someone convincing you to open the door for...

As investment stewards, we at Manchester Capital seek to preserve, protect, and grow client assets given the prevailing market, economic, and...

The recent swoon in the market could be attributed to confusion and uncertainty around the United States' new tariff and trade policy. The Trump...