Information and education are an essential part of the client experience, and we

are here to provide resources and insights to help keep you advised.

Susan Sofronas, Manchester Capital Management Partner and Managing Director, hosts a presentation and discussion with Amy Cappellazzo, Founding Partner at Art Intelligence Global and former Chairman of Sotheby’s Fine Art Division. During this session they explore key topics for families interested in collecting and investing in art. The discussion covers the current state of the art market, how to access and source art, the methods used to value artwork, and strategies for transferring art across generations.

As we turn the calendar page from September to October in Vermont, we prepare for the changing foliage colors, weekends cheering for our favorite football team, apple picking, hayrides, and of course financial planning. While we carve pumpkins into Jack O’Lanterns, it is important to remember that a strong financial plan is an ongoing cycle much like the changing of the seasons. It can be daunting to think about all one needs to create and maintain a successful plan. Instead of trying to do everything at once, try using the theme of each season to outline the components of your plan. SPRING Spring suggests new beginnings, a fresh start, and planting seeds you hope will flourish and grow into something you will enjoy later. Is there a better time than spring to dust off that budget you have been meaning to balance as part of your New Year’s resolution but somehow...

Manchester Capital Management is proud to announce that Founder and Executive Chair, Ted Cronin, as well as the firm, have been recognized on Barron’s “Top 100 Independent Financial Advisors” list for the 18th consecutive year. Ted ranked 13th among the 100 independent advisors selected from over 15,000 registered investment advisors (RIAs) nationwide. Barron’s rankings are based on a detailed evaluation of assets under management, firm revenue, and the quality of the advisor’s practice. Ted is also featured in Barron’s Hall of Fame, an honor reserved for those who have appeared on the list for more than 10 years. Since its inception over 30 years ago, Manchester Capital Management has been a leader in delivering personalized financial strategies tailored to meet the unique goals of individuals and families. The firm consists of a team of 36 employees all dedicated to fostering a culture of trust, innovation, and integrity. “I would like...

Timing the market, even with a slower-moving asset class like privately-held real estate, is tricky business. It is easy to look back and regret not buying at this time or selling at that time, but pinpointing market shifts while they are happening is easier said than done. Real estate can be particularly tricky since it most frequently involves large, illiquid investments with significant transactional friction on the purchase and sale. Recent developments, specifically the collision of declining supplies and shifting demand in an environment of changing interest rates, create an interesting opportunity. According to Morgan Stanley and Real Capital Analytics, U.S. commercial property prices stopped declining in June 2024, increasing 0.6% after a year and a half of valuation losses.1 Per the chart below, the last time real estate prices fell this much for this long was during the Great Financial Crisis (GFC). Prices bottomed at the beginning of 2010...

Perusing our website, you may have noticed that Manchester Capital has expertise and a track record in acquiring and managing large tracts of land. When clients hear of this, a popular question arises: “Is ranchland a good option for me?” The answer begins with our evaluation of a client’s unique goals. Our introduction to ranchlands began with a family well-suited to the opportunity. The client asked us to find a remote wilderness family retreat with intrinsic values of natural resources, scenic beauty, and a working ranchlands investment component. Over the past 15 years, MCM’s Real Estate Services team has acquired and managed over 120,000 acres of timberland, ranchland, and rural property. We have helped turn our clients’ visions of conservation, into sustainable investments that can be transferred to future generations, by developing strategies to help mitigate the struggles of covering annual carrying costs often associated with owning large tracts of land. ...

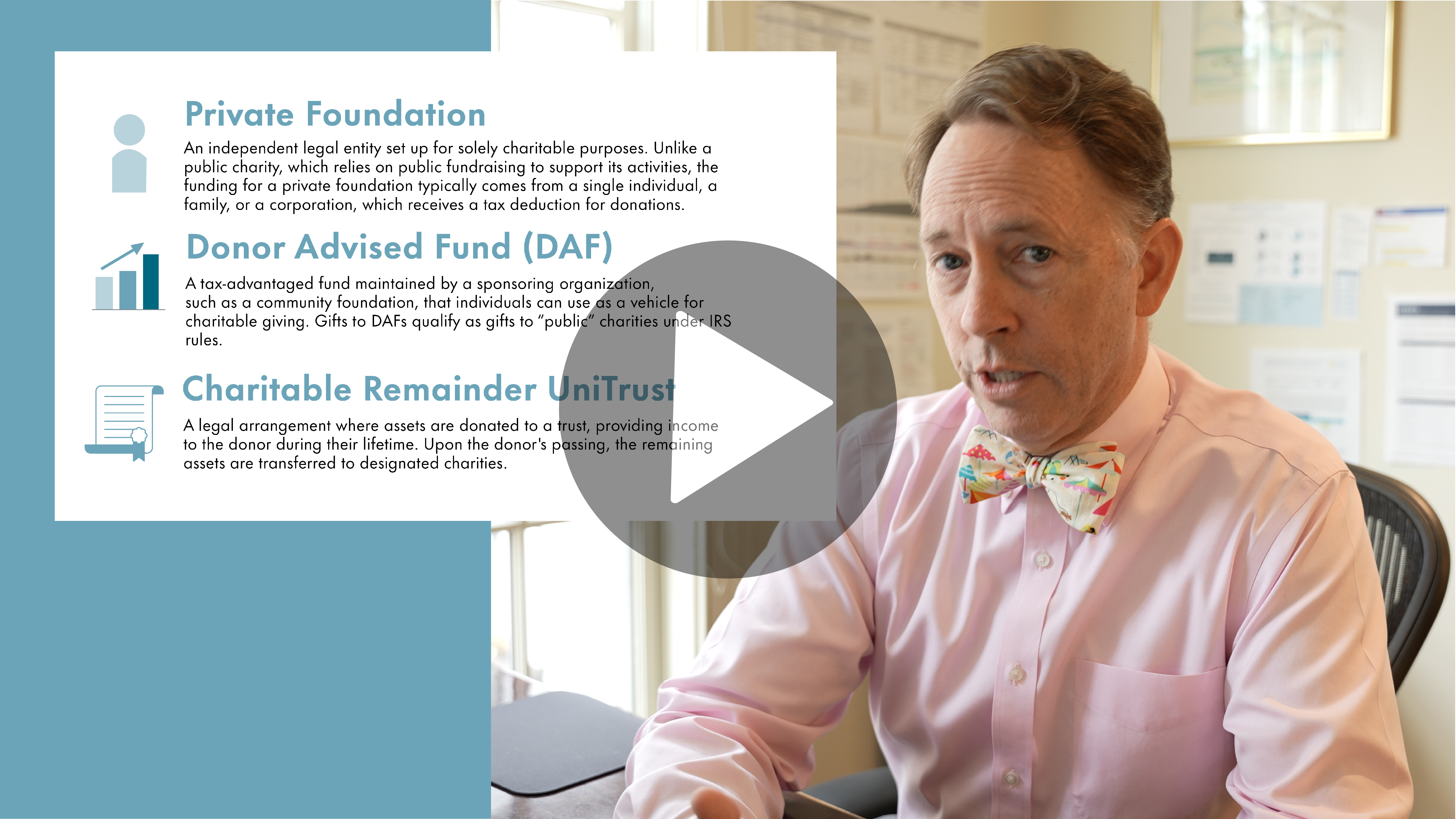

Manchester Capital Management’s Senior Wealth Managers, Brian Vogel and Morgan Roberts discuss how they help wealthy families make informed decisions about charitable giving and select the most suitable charitable giving structures. They assess the benefits of various options with a particular focus on donor-advised funds. Disclosures This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the speaker at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the speaker(s) nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject...

Intuitively, it seems that Presidential elections must affect markets. After all, markets prefer stability and predictability, and Presidential elections introduce the potential for significant change. What will be the policy focus for the next four years? What sectors of the economy will be promoted and supported and which will be targeted? How will the elected President interact with foreign leaders and how will that affect global stability, supply chains, and energy prices? All this uncertainty, particularly when elections are forecast to be close, should lead to greater market volatility. In reality, economics and market performance affect Presidential elections. Consider recessions—of the 46 Presidents who have served, the six presidents who experienced recessions within two years before their re-election all lost. Twelve Presidents who experienced no recession in the two years before their re-election all won.1 Or consider market performance—since 1928, if the S&P 500 has a positive return in the three months leading up to a...

The Federal Reserve finished their latest Federal Open Market Committee (FOMC) meeting on June 12th and as expected, held the benchmark interest rate (the federal funds rate) unchanged at 5.25 – 5.50%. During the press conference after the meeting, Fed Chairman Powell stated, “We are maintaining our restrictive stance of monetary policy in order to keep demand in line with supply and reduce inflationary pressures. We are strongly committed to returning inflation to our 2% goal and supportive of a strong economy that benefits everyone.” Given all the economic and inflation data available, the Fed is now projecting just one rate cut this year, which generally means a modest 0.25% cut to 5.00 – 5.25%. Of course, if inflation eases below 3% and/or unemployment rises above 4%, then the Fed may look to act sooner. When the Fed’s inflation and employment targets are met, their longer-range projection is to ease...

A conversation with Managing Director of Investment Research Bart Earley, CFA and Senior Investment Analyst Lorry Delille, CFA.

Financial planning is just one piece of the puzzle for families of significant wealth when it comes to protecting and preserving their legacy. With a multi-family office lens, we emphasize that there are important considerations beyond asset allocations and managers. While maximizing your portfolio returns, managing investment risk, and taking advantage of tax efficiencies are certainly important, other critical aspects of planning are often overlooked, particularly life care planning and health care planning. As we age, the potential for declining mental and physical capacity becomes an ever-present reality we must confront. Having a comprehensive life care plan in place can ensure you and your loved ones are prepared for any eventualities. A well-structured life care plan should account for your wishes and spell out how you want to be cared for, both medically and personally, should you become incapacitated. This should include considerations such as: Life care planning involves considering...

A consistent request from almost all families Manchester has served over the last thirty years is for guidance on how to talk about money. Both senior and junior generations can be reluctant to start the conversation. They are wary of offending loved ones, injuring egos, revealing details, appearing greedy, exposing ignorance, or feeling neglected. Family money is much more than investments and bank accounts; the emotional importance of this topic is vital to family cohesion. At Manchester we have worked with families large and small that have both great success and enduring struggles. Interestingly, the amount of money involved doesn’t seem to matter. Wealthy families can have challenges identical to families with more modest assets. These can include disagreements between siblings, parents, and children alike. The number of family members also appears irrelevant. Money can connect (or disconnect) family members across cultural differences that arise between different generations. One element of...

A Discussion about the Technologies Driving the New Sustainable Energy Solution