Information and education are an essential part of the client experience, and we

are here to provide resources and insights to help keep you advised.

"The Federal Reserve, after delaying for more than a year claiming inflation was 'transitory,' has finally embarked on a serious course to bring inflation under control."

"This year, inflation is averaging an annualized 8.3%, the highest in more than 40 years."

"As the West imposes sanctions on Russia—the world’s number three oil producer and number two natural gas producer—many countries are trying to cope with a sudden decrease in energy supply that has caused energy prices to spike dramatically. Unfortunately, there are no easy answers."

"Transferring wealth during periods of depressed asset values, like coiling a spring, allows for the passing of assets with the potential to expand when the market recovers (as markets have historically always done)."

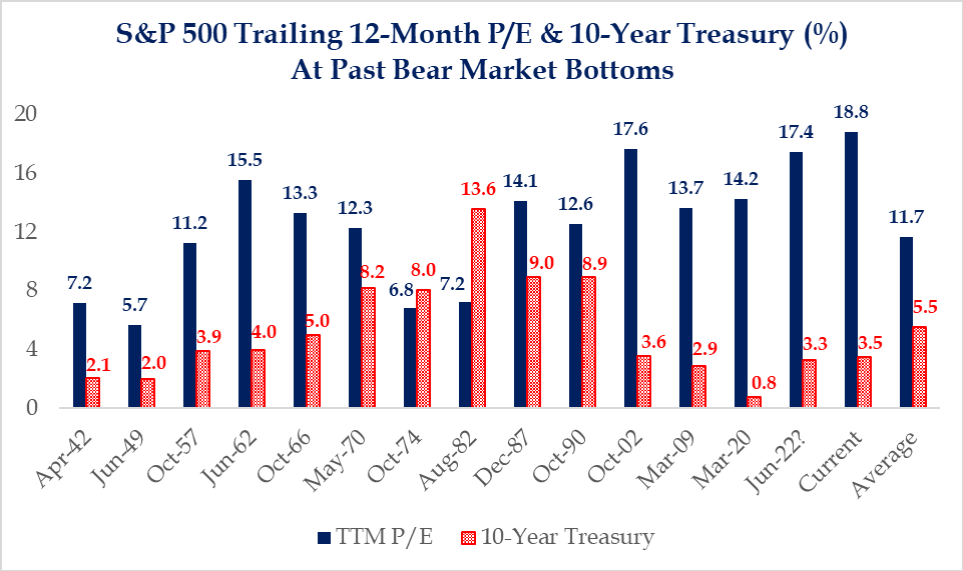

"Although the current market correction is unsettling for investors, it also presents opportunities for long-term investors who can stay invested and adjust as the cycle changes."

"No matter the asset class, returns will be influenced and impacted by a multitude of factors. Some are within an investor’s control, while many are not. Commercial real estate is no different."

"Stocks, bonds, real estate, and hedge funds all have negative year-to-date returns. Even cash is losing purchasing power with inflation running at 7.9%. So, what is an investor to do?"

"The most significant effect Americans and many Europeans will feel from Russia’s actions are rising energy prices."