Information and education are an essential part of the client experience, and we

are here to provide resources and insights to help keep you advised.

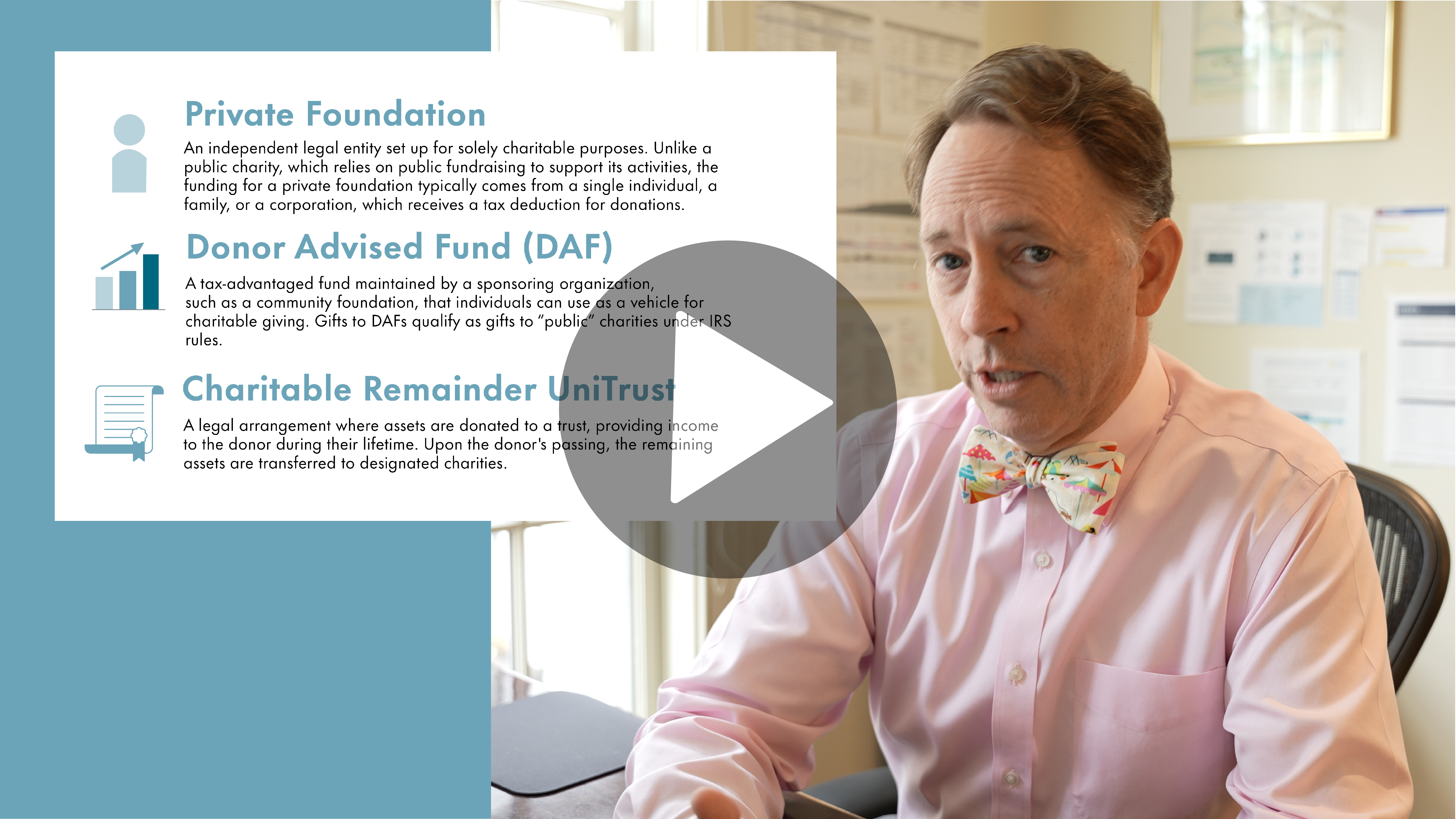

Manchester Capital Management’s Senior Wealth Managers, Brian Vogel and Morgan Roberts discuss how they help wealthy families make informed decisions about charitable giving and select the most suitable charitable giving structures. They assess the benefits of various options with a particular focus on donor-advised funds. Disclosures This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the speaker at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the speaker(s) nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject...

07.17.2024

Manchester Capital Management’s Senior Wealth Managers, Brian Vogel and Morgan Roberts discuss how they help wealthy families make informed decisions about charitable giving and select the most suitable charitable giving structures. They assess the benefits of various options with a particular focus on donor-advised funds. Disclosures This material is solely for informational purposes and shall not constitute a recommendation or offer to sell or a solicitation to buy securities. The opinions expressed herein represent the current, good faith views of the speaker at the time of publication and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented herein has been developed internally and/or obtained from sources believed to be reliable; however, neither the speaker(s) nor Manchester Capital Management guarantee the accuracy, adequacy or completeness of such information. Predictions, opinions, and other information contained in this article are subject...

Intuitively, it seems that Presidential elections must affect markets. After all, markets prefer stability and predictability, and Presidential elections introduce the potential for significant change. What will be the policy focus for the next four years? What sectors of the economy will be promoted and supported and which will be targeted? How will the elected President interact with foreign leaders and how will that affect global stability, supply chains, and energy prices? All this uncertainty, particularly when elections are forecast to be close, should lead to greater market volatility. In reality, economics and market performance affect Presidential elections. Consider recessions—of the 46 Presidents who have served, the six presidents who experienced recessions within two years before their re-election all lost. Twelve Presidents who experienced no recession in the two years before their re-election all won.1 Or consider market performance—since 1928, if the S&P 500 has a positive return in the three months leading up to a...

The Federal Reserve finished their latest Federal Open Market Committee (FOMC) meeting on June 12th and as expected, held the benchmark interest rate (the federal funds rate) unchanged at 5.25 – 5.50%. During the press conference after the meeting, Fed Chairman Powell stated, “We are maintaining our restrictive stance of monetary policy in order to keep demand in line with supply and reduce inflationary pressures. We are strongly committed to returning inflation to our 2% goal and supportive of a strong economy that benefits everyone.” Given all the economic and inflation data available, the Fed is now projecting just one rate cut this year, which generally means a modest 0.25% cut to 5.00 – 5.25%. Of course, if inflation eases below 3% and/or unemployment rises above 4%, then the Fed may look to act sooner. When the Fed’s inflation and employment targets are met, their longer-range projection is to ease...

MCM Managing Director Christine Kaming Tomas facilitates a conversation with Managing Director of Investment Research Bart Earley, CFA and Senior Investment Analyst Lorry Delille, CFA.

Financial planning is just one piece of the puzzle for families of significant wealth when it comes to protecting and preserving their legacy. With a multi-family office lens, we emphasize that there are important considerations beyond asset allocations and managers. While maximizing your portfolio returns, managing investment risk, and taking advantage of tax efficiencies are certainly important, other critical aspects of planning are often overlooked, particularly life care planning and health care planning. As we age, the potential for declining mental and physical capacity becomes an ever-present reality we must confront. Having a comprehensive life care plan in place can ensure you and your loved ones are prepared for any eventualities. A well-structured life care plan should account for your wishes and spell out how you want to be cared for, both medically and personally, should you become incapacitated. This should include considerations such as: Life care planning involves considering...

A consistent request from almost all families Manchester has served over the last thirty years is for guidance on how to talk about money. Both senior and junior generations can be reluctant to start the conversation. They are wary of offending loved ones, injuring egos, revealing details, appearing greedy, exposing ignorance, or feeling neglected. Family money is much more than investments and bank accounts; the emotional importance of this topic is vital to family cohesion. At Manchester we have worked with families large and small that have both great success and enduring struggles. Interestingly, the amount of money involved doesn’t seem to matter. Wealthy families can have challenges identical to families with more modest assets. These can include disagreements between siblings, parents, and children alike. The number of family members also appears irrelevant. Money can connect (or disconnect) family members across cultural differences that arise between different generations. One element of...

A Discussion about the Technologies Driving the New Sustainable Energy Solution

Investing is more than a financial exercise. The most seasoned investor feels a twinge of fear and concern when volatile markets react negatively to sudden economic shocks. Those cool-headed decisions based on a sound investment policy offer little comfort when there are sudden declines. Why do we become prisoners of our emotions subject to making the wrong choices at the wrong time? There are evolutionary reasons for our behavior. The science of “Behavioral Finance” has shown that we are the product of inherent emotional biases in our core genetic code. We fear losses significantly more than we value gains. A loss aversion bias likely developed during human evolution as a survival mechanism, deeply rooted in the way our ancestors needed to make decisions under conditions of uncertainty and scarcity. Early humans faced an environment where resources such as food, shelter, and water were not only scarce but also crucial for...

Manchester Capital’s Managing Director, Christine Kaming Tomas, sat down with Sam Gyimah, Geopolitics of Business podcast host and former UK Minister for Science Innovation and Higher Education, to discuss the geopolitics of business and investment. Sam draws on his background as UK MP, Minister, banker, entrepreneur, and board member of Goldman Sachs International, Cambridge University Endowment, and Oxford Innovation. Find Sam’s podcast here: The Geopolitics of Business.

As we analyze the global situation in early 2024, a mosaic of complex geopolitical events unfolds, each with potential ramifications for the global economy and investors. Do these events rise to the level of “breaking the glass” and pulling the fire alarm? The intensification of conflicts in the Middle East, notably the escalated attacks by Iran-backed Houthi rebels in the Red Sea and the Iranian Islamic Revolutionary Guard Corps’ operations in Iraq and Syria, pose a significant threat to regional stability. The recent death of three American soldiers in Jordan caused by a rebel drone raise the stakes of an expanding war in the Middle East. These actions, coupled with Israel’s countermeasures against Hamas and operations in Lebanon, illustrate the intricate dance of power and retaliation that is playing out. Meanwhile, the political landscape in East Asia is equally turbulent. Taiwan’s election with a new pro-independence President contrast with an...

[MONTECITO, CA, January 10, 2024] — Manchester Capital Management LLC, a leading private family wealth office in the United States, is delighted to announce the appointment of Susan W. Sofronas as a Partner working out of the firm’s Montecito, CA office. Susan will add strategic leadership to Manchester Capital’s capabilities and reinforce its unwavering dedication to providing outstanding, bespoke wealth management solutions. Susan has an outstanding record of advising some of the most sophisticated and affluent families and she brings a wealth of knowledge and expertise that align perfectly with our vision for continued client success. Her career reflects a demonstrated track record of leading and advising complex families in achieving their wealth goals, coordinating family and business matters, and guiding multigenerational families in successfully shaping their legacies. Susan’s insights on assisting women in wealth management have been featured across diverse financial platforms. Renowned for her strategic acumen, Susan has earned...

If you Google “Where is the best place to hide a dead body?” the first search result, from theleverageway.com, claims the best place is “page 2 of Google search results.” According to the site, “Studies have shown that about 91.5% of search engine click-throughs occur on the first page of search results.” This response to the enquiry inadvertently reveals multiple dilemmas faced by modern information consumers, the most critical of which is, what can be trusted? In simpler, more naïve times, finding the answer to “Where is the best place to hide a dead body?” would involve some legwork on our part. We might survey friends and colleagues to get their thoughts. We might discuss past “difficult cases” with a coroner. We might drive to a lake or forest to check out possibilities. A trip to a nearby library might be in order to consult chemistry books about chemicals capable of...