Information and education are an essential part of the client experience, and we

are here to provide resources and insights to help keep you advised.

"There is no official formula that defines a recession. A common rule of thumb is two consecutive quarters of negative gross domestic product. The actual determinants are more intricate."

“If you mix politics with your investment decisions, you are making a big mistake. Each generation of Americans has been, and will continue to be, better off than the previous generation.” - Warren Buffet

"The Federal Reserve, after delaying for more than a year claiming inflation was 'transitory,' has finally embarked on a serious course to bring inflation under control."

Founder, Ted Cronin and the Manchester Capital team have been ranked 8th in Barron’s prestigious annual ranking of “Top 100 Independent Financial Advisors” for 2022. This is the 16th consecutive year Ted has been recognized among the top 100 Independent Financial Advisors by Barron’s. “I am proud to be part of the Manchester team, and this recognition is a tribute to our wonderful clients and our dedicated employees, who remain committed to helping our client families preserve their wealth, culture, and values for generations to come.” – Ted Cronin According to Barron’s, the ranking reflects the volume of assets overseen by the advisor and their team, revenues generated for their firm, and the quality of the advisor’s practice. Read full article on barrons.com › For more details about Barron’s ranking process go to Barron’s Methodology for Ranking Financial Advisors | Barron’s (barrons.com).

"This year, inflation is averaging an annualized 8.3%, the highest in more than 40 years."

"As the West imposes sanctions on Russia—the world’s number three oil producer and number two natural gas producer—many countries are trying to cope with a sudden decrease in energy supply that has caused energy prices to spike dramatically. Unfortunately, there are no easy answers."

"Transferring wealth during periods of depressed asset values, like coiling a spring, allows for the passing of assets with the potential to expand when the market recovers (as markets have historically always done)."

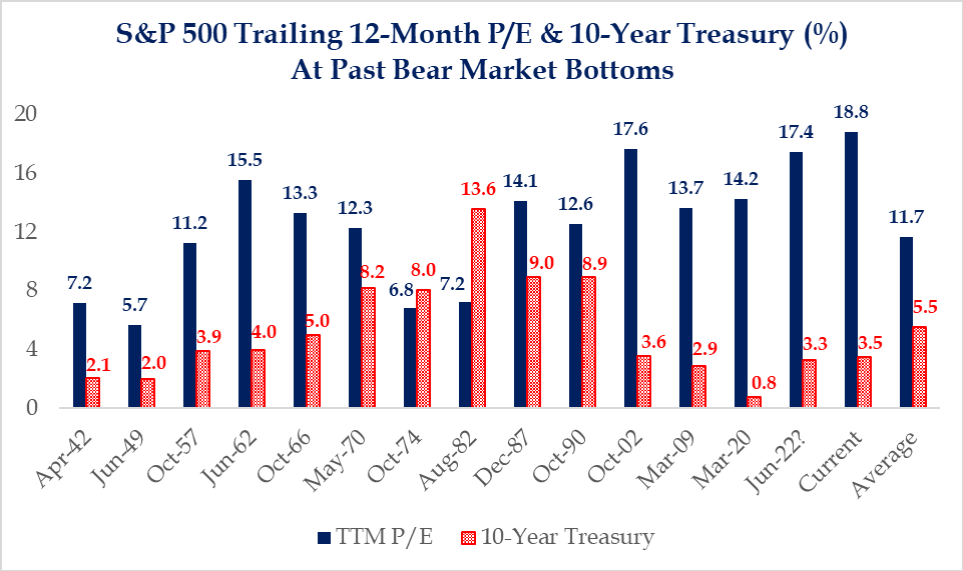

"Although the current market correction is unsettling for investors, it also presents opportunities for long-term investors who can stay invested and adjust as the cycle changes."

"No matter the asset class, returns will be influenced and impacted by a multitude of factors. Some are within an investor’s control, while many are not. Commercial real estate is no different."

"Stocks, bonds, real estate, and hedge funds all have negative year-to-date returns. Even cash is losing purchasing power with inflation running at 7.9%. So, what is an investor to do?"

"The most significant effect Americans and many Europeans will feel from Russia’s actions are rising energy prices."

"In January, we faced more significant declines in stock market indices. We have witnessed record highs, one after another followed by several weeks of multiple declines as investors focus on the new conditions presented by 2022."