Information and education are an essential part of the client experience, and we

are here to provide resources and insights to help keep you advised.

It is once again that most joyous time of year where we step back to take time with our families, reflect on the accomplishments of the year that has passed and we, the authors, have the pleasure of writing another “By the Numbers” article. This year we saw the impact of tariffs, attempted and actual assassinations, hostage releases, space rescues, a Chicago Pope, airplane crashes, wildfires, wild swings in the market, a government shutdown, deportations, protests, and the ever-evolving world of artificial intelligence that made 2025 one for the books. Here are some numbers that help to tell that story: $18.81 Trillion – Dollars invested in ETFs globally. Assets have increased 26.7% year-to-date.1 $878 Billion – Dollar value of Elon Musk’s pay package at Tesla, approved by shareholders in November. In order for Musk to realize the full amount, Tesla market capitalization must rise in value from $1.5 trillion to...

11.08.2023

Regularly reviewing existing estate plans is a good financial practice, and the looming change to the lifetime estate/gift tax exemptions at the end of 2025 makes now an opportune time to review your plans. Two powerful tools in estate planning are time and interest rates. With time, the more you have remaining, the greater the number of estate planning options available to you. With interest rates, the lower the prevailing rates, the more likely investments can achieve excess returns, thus the more attractive many strategies become. The ultra-low interest rates of the past decade were a boon for many estate planning strategies, but the increase in interest rates does not mean the end of effective estate planning opportunities. Indeed, there are a handful of strategies that become even more attractive in a higher interest rate environment. Rising interest rates influence the effectiveness of various estate planning tools. Leveraging these tools...

It seems that Chatbots and Artificial Intelligence are invading every part of modern life. According to recent news reports, over 80% of Fortune 500 companies have adopted one of the new large language AI models.[1] Goldman Sachs estimates that AI adoption could enable a 1.5% increase in labor productivity resulting in an increase of 1.1% per year of Gross Domestic Product (GDP – the total value of all goods and services produced by the economy). Given that our GDP normally averages around 2.5%, a 1.1% addition to our average GDP could represent a 40% increase, significantly impacting corporate earnings and market valuations across the economy.[2] Certainly, AI models can organize, summarize, reconcile, and interpret labeled data beyond human capacity, but can they duplicate the more intangible aspects of human endeavors? These models increasingly mimic human behaviors and beg an intriguing question: are they more than just a better abacus that...

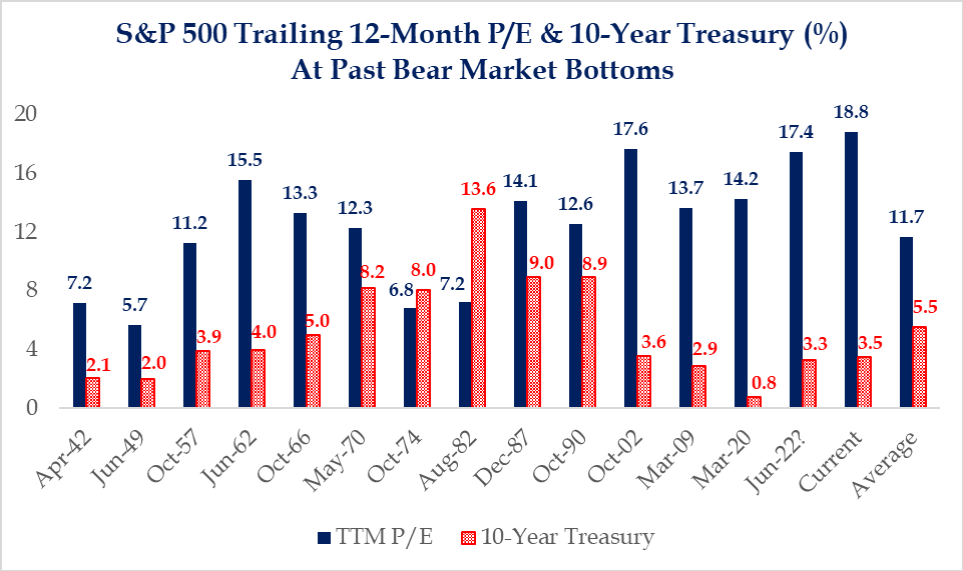

The year 2022 was a bloodbath for both equity and bond markets–the S&P 500 was down 18% and the Bloomberg US Aggregate Bond Index had its worst year ever, down 13%. This year, 2023, began with the US debt ceiling standoff, followed by a banking crisis, and continued rate hikes by the major central banks. The economy seemed like it would get worse before it got better, and the consensus was calling for a near-term recession. However, the stock market quickly shrugged off many of these concerns. Year-to-date as of August 31, the S&P 500 is up approximately 17% and NASDAQ is up approximately 34%. The S&P 500 is officially in a bull market (i.e., up at least 20% from its recent lows in October 2022). With the Federal Reserve and some economists no longer forecasting a recession[1], it makes one wonder what has changed in the last few months....

The cost of a college education is typically the first great expense a young person encounters. According to the Massachusetts Educational Financing Authority (www.mefa.org), an average in-state public college will run roughly $24,000 for the 2023-2024 year and a little more than $100,000 for a four-year degree. Meanwhile, the average private college will cost about $55,000 for a starting freshman and could total more than $230,000 over the course of four years. Herbert Stein, an American economist, famously said, “If something cannot go on forever it will stop.” The growth of college costs will peak at some point and then recede; when that will occur is much more difficult to predict. Until that time, we will address circumstances as they currently are—how to finance this significant expenditure and how to view saving for college as a wealth transfer strategy. For the purposes of this piece, we will assume that our future...

For more than three years, the United States economy has been working through a massive set of disruptions related to the COVID pandemic, the subsequent policy responses, and the second-order effects of those responses including a spike in inflation, interest rate volatility, evolving living and working patterns, and accelerating technological innovation. These disruptions have touched nearly all aspects of our daily lives with significant reverberations throughout the real estate industry. Real estate is inherently cyclical and highly dependent on capital markets and debt for liquidity. Commercial real estate in particular has seen tremendous impacts from these recent disruptive forces. Transaction volume initially dropped and subsequently skyrocketed during the pandemic as stimulus and historically low interest rates drove investors into any assets offering positive yields. As a result, valuations increased as investors drove pricing higher in auction processes. Rents, particularly in the apartment and industrial sectors, increased substantially due to strong...

Little Edward pulls out his 4th grade homework after a long day of practicing spelling and drawing chalk-art flowers. Tonight’s assignment: write a computer program in JavaScript to track his friends’ birthdays. Easy. Edward sits down in front of his PC, opens his Chat GTP app and speaks into the microphone. Thirty seconds later, the program is compiled and on his schools’ share drive, ready for his teacher to grade. If you’ve been listening to the news, apps like ChatGTP, Bard, and Jasper are conversational Artificial Intelligence (AI) programs that are already editing research papers, passing business school exams, creating paintings, and composing music. One simply speaks (or types, for those of us so inclined) our request into the program and in short order the AI produces whatever end result we desire, from writing computer programming language to composing a sonnet. The pace of change in the technology space can...

Frequently misunderstood elements of homeowners’ insurance and structural problems in the homeowners’ insurance industry can create problems for an unwary consumer. Several of the families we work with in California and Florida have received letters from their insurance providers informing them that the companies will no longer provide them with insurance. Additionally, in performing risk reviews for new client families, we often find gaps in coverage related to common misunderstandings. To illustrate how these insurance concerns might arise we dive into the fictional tales of woe of siblings John and Jane Doe, both of whom received such non-renewal letters. John Doe lives in California, the golden state and land of wildfires, mudslides, and earthquakes. John paid high homeowners’ insurance premiums to protect him from these risks and even understood that earthquakes were excluded from most policies and required separate coverage. John had learned that lesson the hard way, having moved...

At the beginning of the new year, we asked colleagues to reflect on the good and the bad of 2022. A diversity of obvious answers came flowing in – pandemic retreats, Ukraine war begins, markets decline. But we also recognized some larger trends were developing that promise to impact the future. Our limited survey revealed challenges, innovations, failures, and accomplishments that are bound to make an impact for years ahead. We wanted to share several of the insights and encourage readers to reflect on their own. Negative Trends in the last year: FEDERAL DEBT HELD BY THE PUBLIC, 1900 TO 2052 Percentage of GDP Positive Trends in the last year: GAME STOP PRICE CHART | 5 YEARS There are many other equally, or more important, trends that can be identified. 2022 was a historic year that will leave its impacts for many years. 2023 promises to present new challenges with...

"There is no official formula that defines a recession. A common rule of thumb is two consecutive quarters of negative gross domestic product. The actual determinants are more intricate."

“If you mix politics with your investment decisions, you are making a big mistake. Each generation of Americans has been, and will continue to be, better off than the previous generation.” - Warren Buffet

"The Federal Reserve, after delaying for more than a year claiming inflation was 'transitory,' has finally embarked on a serious course to bring inflation under control."

"This year, inflation is averaging an annualized 8.3%, the highest in more than 40 years."